Gold price hits record high as Trump tariffs trigger trade war fears

- XAU/USD jumps over 1% as global tensions mount, stocks slide, and US Dollar weakens.

- Trump’s 25% auto tariffs spark trade war jitters, driving safe-haven demand for Gold to new all-time highs.

- Risk appetite crumbles as Wall Street dips and DXY reverses.

- Traders await US Core PCE inflation amid firm jobs data and 64.5 bps of Fed cuts priced for 2025.

Gold price uptrend continued on Thursday with the yellow metal hitting a new record high of $3,059 amid uncertainty over trade policies enacted by US President Donald Trump, which escalated the trade war by imposing tariffs on automobiles. The XAU/USD trades at $3,051, up more than 1%.

Tariffs continue to drive price action, following Trump's announcement of 25% duties on cars and automotive parts not manufactured in the United States (US). As uncertainty rises, Bullion traders bought the precious metal, which extended its gains past $3,050.

Consequently, risk appetite deteriorated with Wall Street trading in the red. The Greenback is also feeling the pain as the US Dollar Index (DXY), which measures the performance of the buck against a basket of six currencies, makes a U-turn, dropping 0.33% to 104.31.

This sparked reactions from global governments with Canada and the European Union (EU) threatening to retaliate against Trump’s actions.

The US labor market remains firm, following the unemployment claims report for the last week, while the economy remains strong after the release of Gross Domestic Product (GDP) data for the last quarter of 2024. Housing data improved but confirmed the slowdown in the housing market.

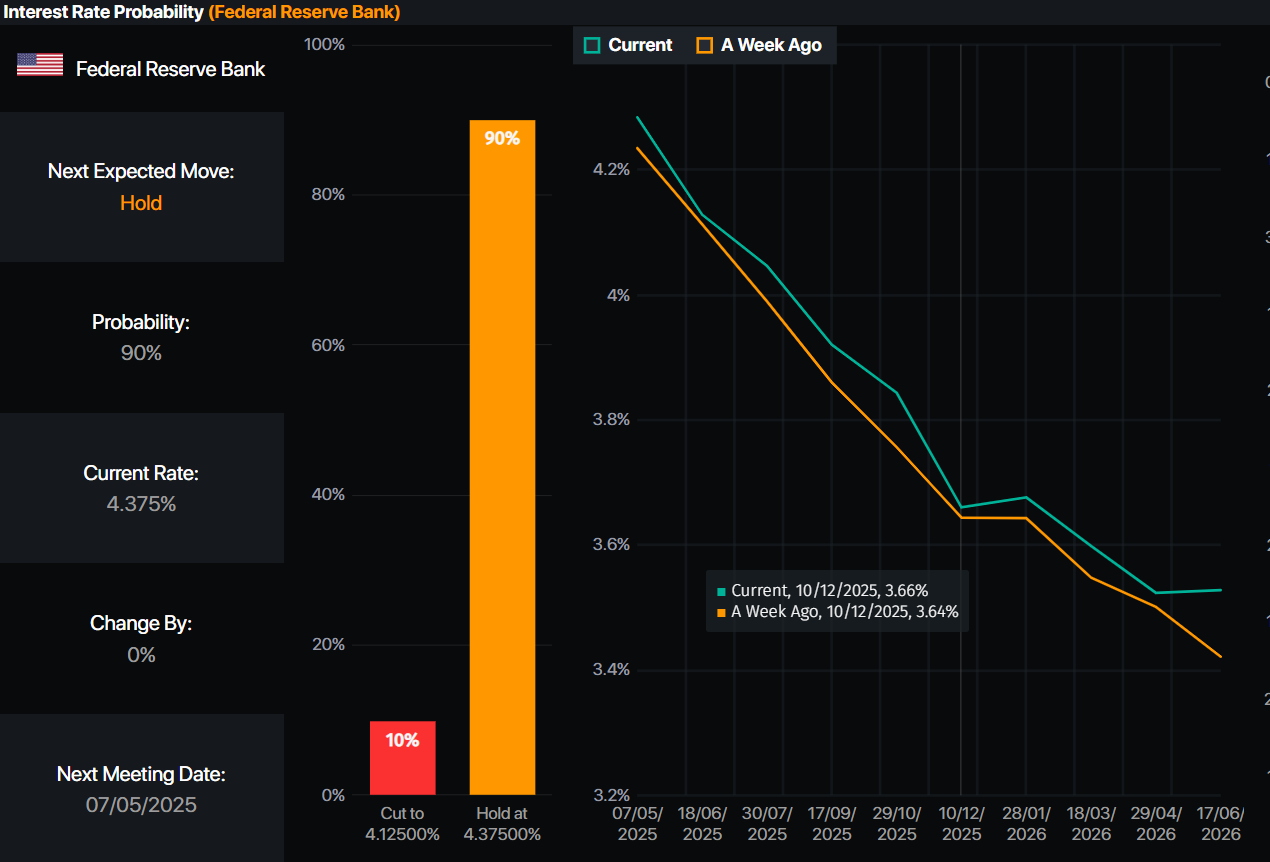

Meanwhile, money markets have priced in 64.5 basis points of Fed easing in 2025, according to Prime Market Terminal interest rate probabilities.

Source: Prime Market Terminal

Aside from this, traders' focus shifts to the announcement of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold price trades firm near $3,000, unfazed by Trump’s comments

- The US 10-year T-note yield is almost flat, up one basis point at 4.371%. US real yields edge down one bps to 1.979%, according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- US Initial Jobless Claims for the week ending March 22 rose to 224K, slightly below expectations of 225K, signaling continued strength in the labor market.

- The final reading of Q4 2024 GDP came in at 2.3% QoQ, up from the previous estimate of 1.9%, though just below the forecast of 2.4%.

- Pending Home Sales declined 3.6% YoY in February, marking an improvement from January’s steeper 5.2% drop, suggesting a modest recovery in housing activity.

XAU/USD technical outlook: Gold price rallies past $3,050

Gold price registered a new all-time high (ATH) of $3,059 as Trump provided the awaited catalyst before the release of PCE inflation figures on Friday. As the yellow metal reaches a new milestone, it sees that buyers are stepping in, putting a test of $3,100 in the near term back on the table.

The Relative Strength Index (RSI) suggests that buyers are gathering steam with the index turning overbought. Nevertheless, traders should be aware that in aggressive movements, the most extreme level would be 80.

The next resistance for XAU/USD would be $3,059. A breach of the latter will result in a $3,100 exposure. Conversely, Gold’s first support is $3,050. Once cleared, the next stop would be $3,000, followed by the February 24 swing high at $2,956, then the $2,900 mark and the 50-day Simple Moving Average (SMA) at $2,887.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.