Mexican Peso gains as inflation surprises, but US risks persist

- Solid March retail sales and Q1 GDP ease recession fears, reinforcing support for MXN.

- Stronger-than-expected price data prompts markets to dial back expectations for near-term rate reductions.

- Trump’s “One Big Beautiful Bill” raises deficit concerns, dampening investor confidence in the Greenback.

The Mexican Peso (MXN) is gaining traction against the US Dollar (USD) on Thursday, supported by a hotter-than-expected mid-May inflation reading. The data has prompted investors to reconsider the timeline for further interest rate cuts by Banxico, leading to increased demand for the Peso and pushing USD/MXN below its 20-day Simple Moving Average (SMA) to trade near 19.3096 at the time of writing.

At the same time, developments in the United States continue to exert significant influence over the pair’s short-term trajectory. Despite inflation gradually aligning with the Federal Reserve’s 2% target, a weaker US Dollar has emerged due to broader concerns, namely, a credit rating downgrade, deteriorating sentiment, and the passage of President Donald Trump’s “One Big Beautiful Bill.”

Together, these developments are weighing on the US Dollar and reinforcing MXN strength, particularly as Mexican monetary policy appears more data-dependent than dovish for now.

Mexican Peso daily digest: US fiscal concerns and Mexican data resilience steer USD/MXN sentiment

- As the US Dollar (USD) continues to shape broader market dynamics, shifts in sentiment, driven by fiscal policy, economic data, and Fed guidance, remain critical to the trajectory of USD/MXN.

- This week, sentiment surrounding the Greenback took another hit following the House of Representatives’ approval of President Donald Trump’s “One Big Beautiful Bill,” a controversial extension of the 2017 Tax Cuts and Jobs Act.

- The bill, which decreases funding for programs such as Medicare and food stamps, while reducing taxes on overtime, tips, and additional income, has sparked concern that low- and middle-income Americans may bear the brunt of the changes.

- While short-term growth could benefit, the package is projected to significantly widen the US federal deficit over the next decade, raising red flags about the long-term sustainability of US government debt.

- As debt levels rise, so too does the cost of servicing that debt, especially under a high-interest rate environment.

- To maintain investor demand, the US must offer higher yields, inadvertently increasing perceived credit risk and weakening confidence in the Dollar. This has led some investors to seek refuge in alternative currencies, including the Mexican Peso (MXN).

- Meanwhile, this week’s release of March retail sales and Thursday’s Growth Domestic Product (GDP) print have helped ease concerns over Mexico’s economic health, further supporting MXN strength.

- In summary, USD/MXN remains highly sensitive to any economic releases or policy shifts that alter growth, inflation, or monetary policy expectations in either country.

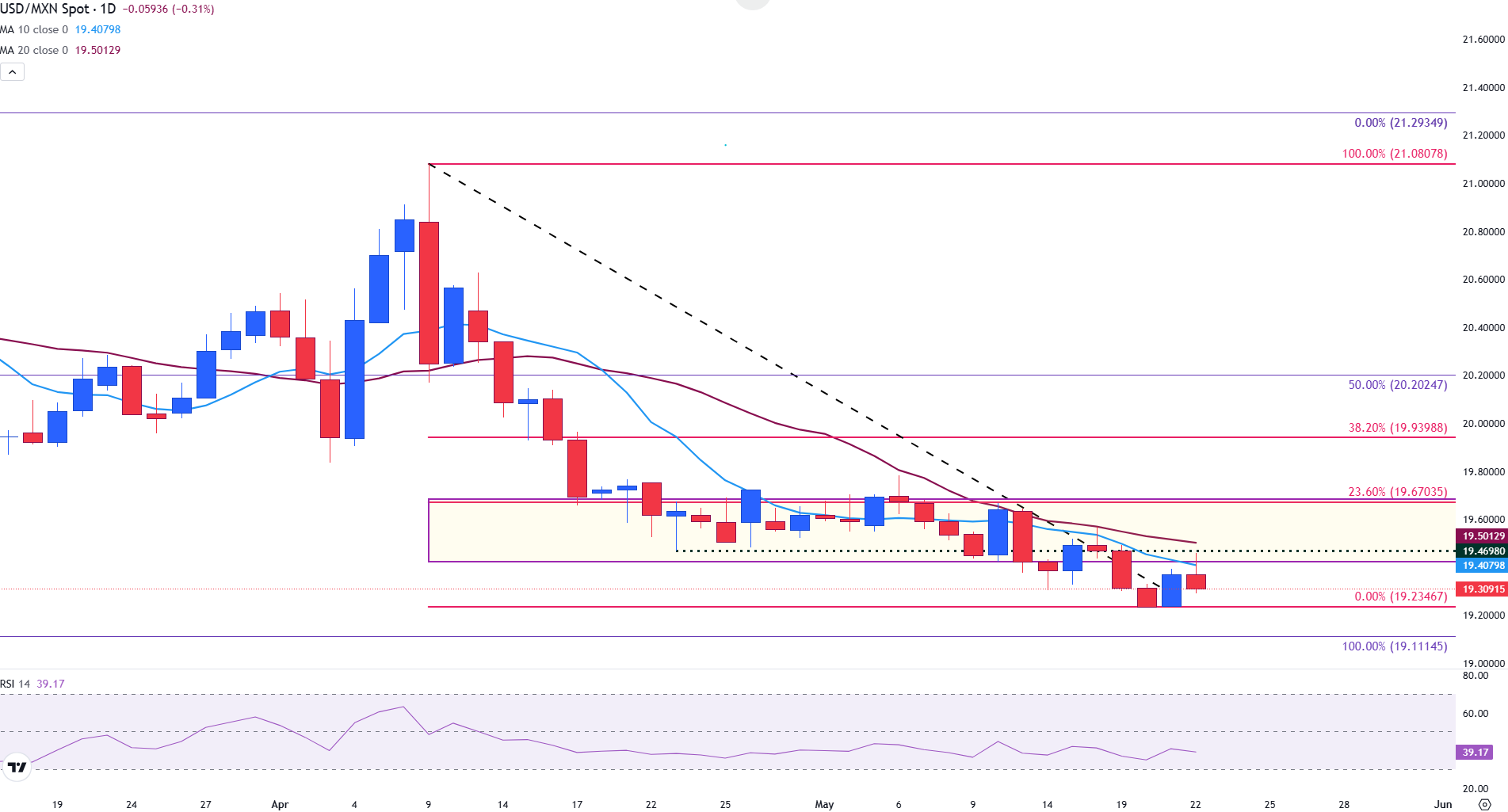

Mexican Peso technical analysis: USD/MXN risks deeper losses below 19.30 as bearish pressure builds

USD/MXN has extended its downside move after failing to hold above the 10-day Simple Moving Average (SMA), now acting as near-term resistance around 19.4080.

The pair is trading around 19.3096, with bearish momentum building. A decisive close below 19.30 could expose deeper support at the early May low of 19.11, followed by the October 2024 swing low at 19.00.

The Relative Strength Index (RSI) has crossed into neutral-bearish territory, indicating potential for further losses unless bulls reclaim control above the 10-day and 20-day SMA at 19.46.

Short-term bias favors further downside below that level.

However, if bears gain traction below 19.300, the May low near 19.235 and a continuation of USD weakness may allow sellers to push prices toward the October low of 19.111.

Meanwhile, the Relative Strength Index (RSI) indicator remains below the neutral zone of 50.

Since the 30 mark is considered a potential oversold territory, the bearish trend currently remains intact.

If prices fall below 19.20, it could open the door to the October low of around 19.11, paving the way towards the 19.00 mark.

On the other hand, if USD strength resurges and prices rise above the descending trendline, USD/XN could see a retest of the April low near 19.47, bringing the 20-day SMA into play at 19.53.

USD/MXN daily chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.