USD/JPY Price Forecast: Clears 150.00 underpinned by US yields surge

- USD/JPY rallies over 0.8% as US yields jump and risk sentiment improves.

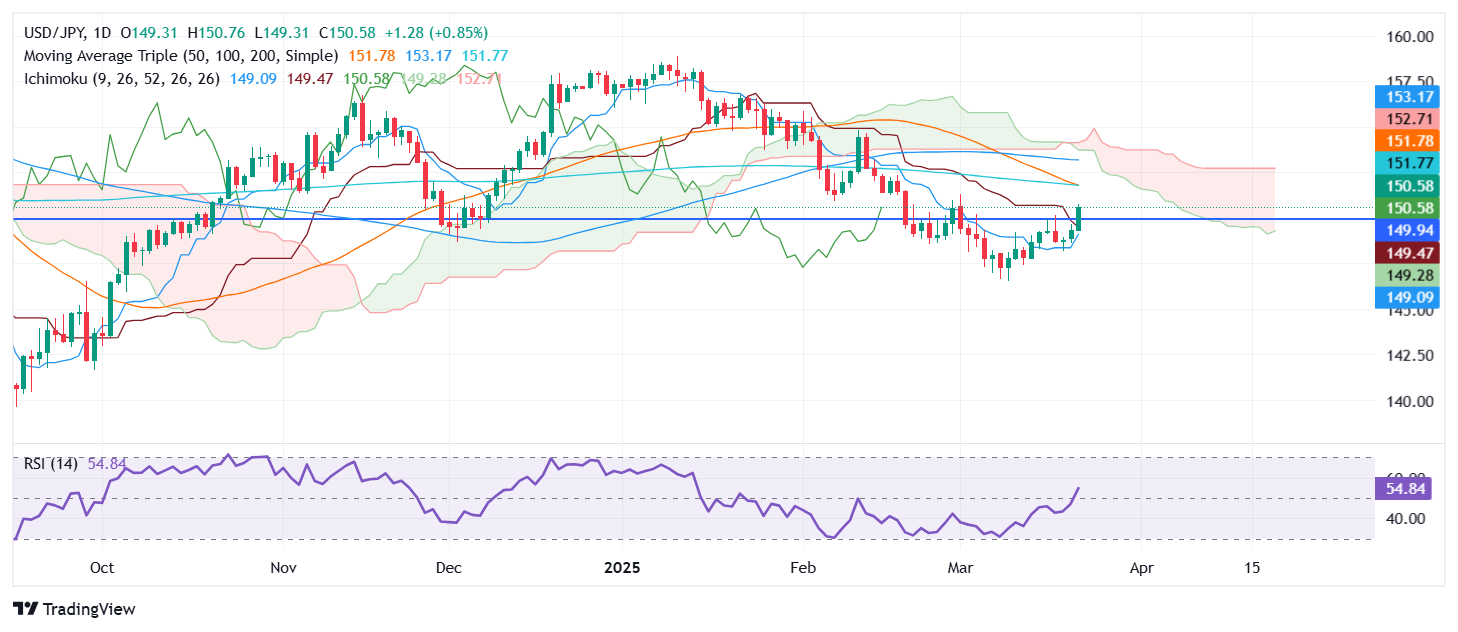

- Price clears 150.00 and Kijun-Sen, RSI momentum favors further upside for bulls.

- 151.80–152.70 range now key resistance; failure to hold 150 risks deeper pullback.

The USD/JPY pair surged on Monday and climbed above the 150.00 mark for the first time since early March as tariff fears faded and US Treasury bond yields skyrocketed, pushing the major for over 0.81%.

USD/JPY Price Forecast: Technical outlook

The USD/JPY cleared key resistance levels on Monday: first, the Kijun-Sen at 149.47, followed by the 150.00 figure. Buyers are gathering momentum, as depicted by the Relative Strength Index (RSI) punching through the 50 neutral line, suggesting that bulls could push prices past key strong resistance levels.

The 200-day and 50-day Simple Moving Averages (SMAs) confluence, at 151.79/82, respectively, emerges as a crucial ceiling and could be tested in the near term. If surpassed, the next significant resistance level would be the Senkou Span B, at 152.71.

Conversely, if USD/JPY retreats below 150.00, immediate support would be the Kijun-Sen and the Senkou Span A at 149.28. A breach of the latter will expose the Tenkan-Sen at 149.08.

USD/JPY Price Chart – Daily

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.15% | -0.04% | 0.84% | -0.24% | -0.15% | 0.16% | 0.02% | |

| EUR | -0.15% | -0.30% | 0.18% | -0.34% | -0.33% | 0.05% | -0.09% | |

| GBP | 0.04% | 0.30% | 0.88% | -0.68% | -0.06% | 0.36% | 0.10% | |

| JPY | -0.84% | -0.18% | -0.88% | -1.08% | -1.01% | -0.65% | -0.83% | |

| CAD | 0.24% | 0.34% | 0.68% | 1.08% | 0.14% | 0.41% | 0.26% | |

| AUD | 0.15% | 0.33% | 0.06% | 1.01% | -0.14% | 0.39% | 0.23% | |

| NZD | -0.16% | -0.05% | -0.36% | 0.65% | -0.41% | -0.39% | -0.08% | |

| CHF | -0.02% | 0.09% | -0.10% | 0.83% | -0.26% | -0.23% | 0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).