EUR/JPY Price Analysis: Gains momentum after Fed minutes release, traders eye 163.00

Source Fxstreet

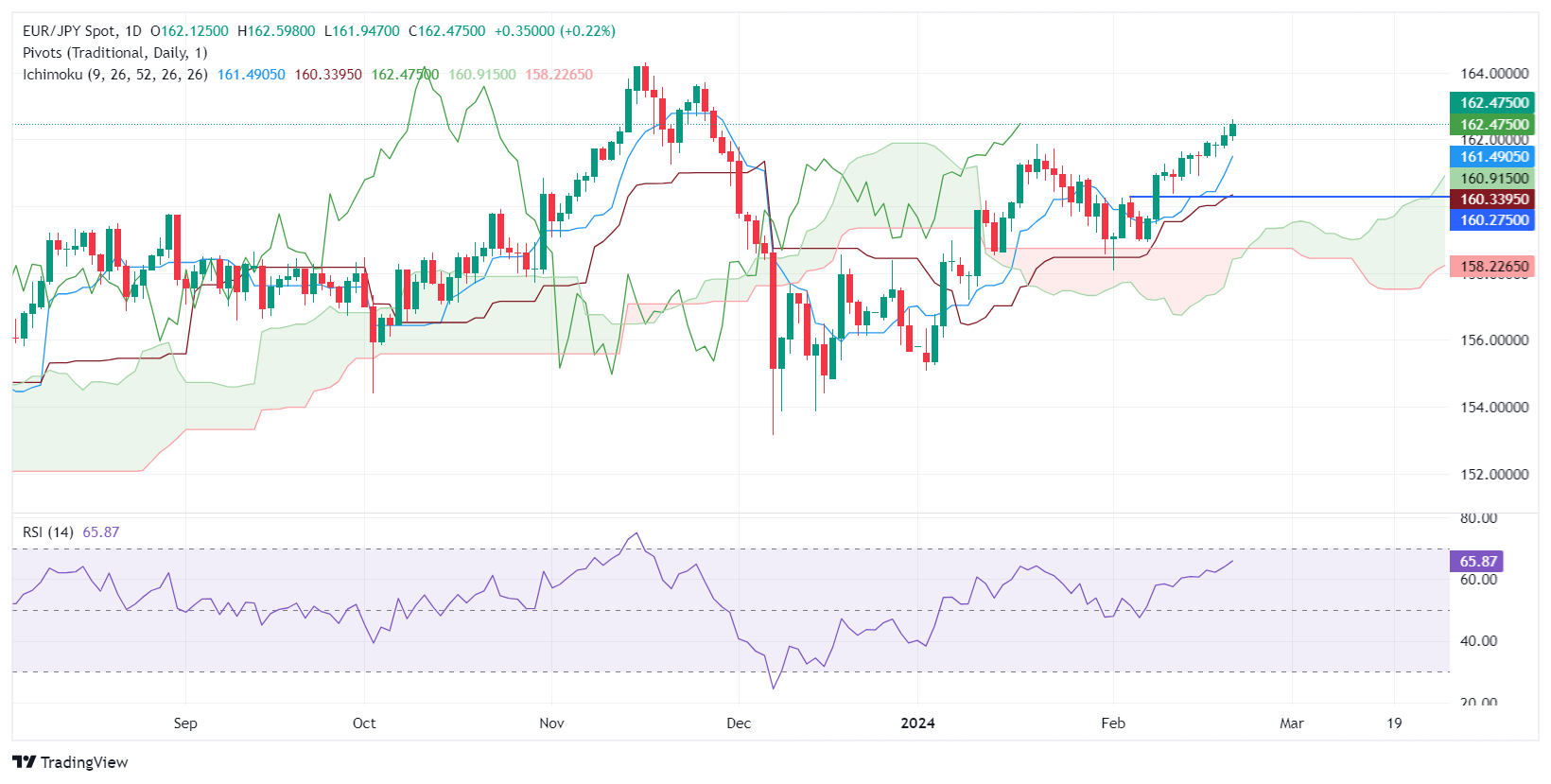

- EUR/JPY ascends to 162.47, marking a continuous rise influenced by recent Fed monetary policy insights.

- Technical analysis points to key resistance levels, with 163.00 and 163.72 as immediate targets.

- Potential pullback could see support tests at 161.48 and 160.91, depending on market dynamics.

The Euro extended its gains for the second straight day against the Japanese Yen and is up by 0.22% as the EUR/JPY trades at 162.47 late during the North American session.

The release of the latest Federal Reserve (Fed) minutes sponsored a leg-up in the EUR/JPY as the EUR/USD edged slightly up. From a technical standpoint, the pair is trading at year-to-date (YTD) highs, aiming to extend its gains. The first resistance would be the 163.00 figure, followed by the November 27 high at 163.72. A further upside is seen at 164.00, followed by last year’s high at 164.31.

On the flip side, if the pair drops below 162.00, that would pave the way to test the Tenkan-Sen at 161.48 before slumping toward the Senkou Span A at 160.91.

EUR/JPY Price Action – Daily Chart

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

Once again, the price of Ethereum (ETH) has risen above $3,900. This bounce has hinted at a further price increase for the altcoin before the end of the year.

Pi Network Price Annual Forecast: PI Heads Into a Volatile 2026 as Utility Questions Collide With Big UnlocksPi Network heads into 2026 after a 90%+ 2025 drawdown from $3.00, with 17.5 million KYC users and a smart-contract-focused Stellar v23 upgrade offering upside potential, but 1.21 billion tokens unlocking and heavy exchange deposits (437 million PI) keeping supply pressure and trust risks firmly in focus.

Pi Network heads into 2026 after a 90%+ 2025 drawdown from $3.00, with 17.5 million KYC users and a smart-contract-focused Stellar v23 upgrade offering upside potential, but 1.21 billion tokens unlocking and heavy exchange deposits (437 million PI) keeping supply pressure and trust risks firmly in focus.

West Texas Intermediate (WTI) US Crude Oil prices attract fresh buyers on Wednesday and climb back closer to the highest level since January 2025, touched the previous day.

Related Instrument