USD/JPY Price Forecast: Surges past 154.50 post hot CPI

- USD/JPY jumps over 1%, breaking 153.00 and 154.00 resistance levels.

- Hot US inflation fuels Treasury yield surge, boosting dollar strength.

- Technical outlook: Bulls eye 155.26, but key support lies at 153.00.

The USD/JPY rallied sharply on Wednesday after a hot US inflation report spurred a jump in the US 10-year Treasury yield, closely correlated with the major. Hence, the pair aimed higher, clearing the 153.00 and 154.00 figures on their way toward current spot prices, near 154.50.

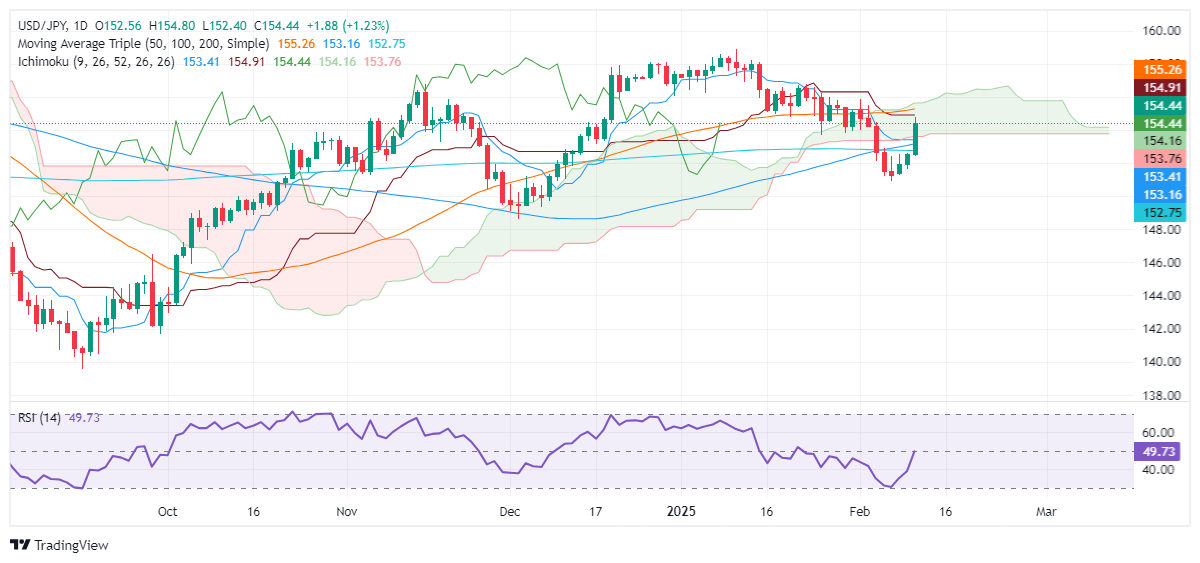

USD/JPY Price Forecast: Technical outlook

The USD/JPY enjoyed an over 1% rally on Wednesday after clearing the 200-day Simple Moving Average (SMA) at 152.76, opening the door for further upside. Despite this, the pair found stir resistance at the Kijun-sen at 154.90 before consolidating near the 154.50 area,

Despite this, the pair is neutral to downward biased after registering a successive series of lower highs and lower lows. If bulls want to regain control, the USD/JPY must clear the 50-day SMA at 155.26, followed by the latest cycle high of 155.89.

On the other hand, a drop below 154.00 would expose the Senkou Span B at 153.76, followed by the 153.00 figure and the 200-day SMA at 152.76.

USD/JPY Price Chart – Daily

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | 0.03% | 0.00% | 0.03% | 0.06% | 0.05% | 0.03% | |

| EUR | -0.05% | -0.02% | -0.05% | -0.02% | -0.01% | 0.00% | -0.02% | |

| GBP | -0.03% | 0.02% | -0.04% | 0.00% | 0.03% | 0.02% | -0.00% | |

| JPY | 0.00% | 0.05% | 0.04% | 0.03% | 0.06% | 0.05% | 0.03% | |

| CAD | -0.03% | 0.02% | -0.00% | -0.03% | 0.02% | 0.02% | -0.00% | |

| AUD | -0.06% | 0.01% | -0.03% | -0.06% | -0.02% | -0.01% | -0.03% | |

| NZD | -0.05% | -0.01% | -0.02% | -0.05% | -0.02% | 0.00% | -0.02% | |

| CHF | -0.03% | 0.02% | 0.00% | -0.03% | 0.00% | 0.03% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).