Banxico cuts rates by 50 bps to 9.50% as expected

- Banxico's 50-bps rate cut reflects a cautiously optimistic inflation forecast, with a possible additional cut discussed.

- Deputy Governor Jonathan Heath favored a more conservative 25-bps cut, highlighting internal differences.

- The Central Bank notes significant MXN volatility in response to US-Mexico tariff negotiations.

The Banco de Mexico (Banxico) lowered interest rates by 50 basis points (bps) as expected by analysts, though the decision was not unanimous as Deputy Governor Jonathan Heath voted for a 25-bps rate cut.

Banxico cuts on a split decision

Banxico’s monetary policy statement revealed that the central bank could continue calibrating monetary policy and consider an additional 50 bps cut in subsequent meetings. According to the board, the inflationary environment would allow the bank to continue easing policy, albeit maintaining a restrictive stance.

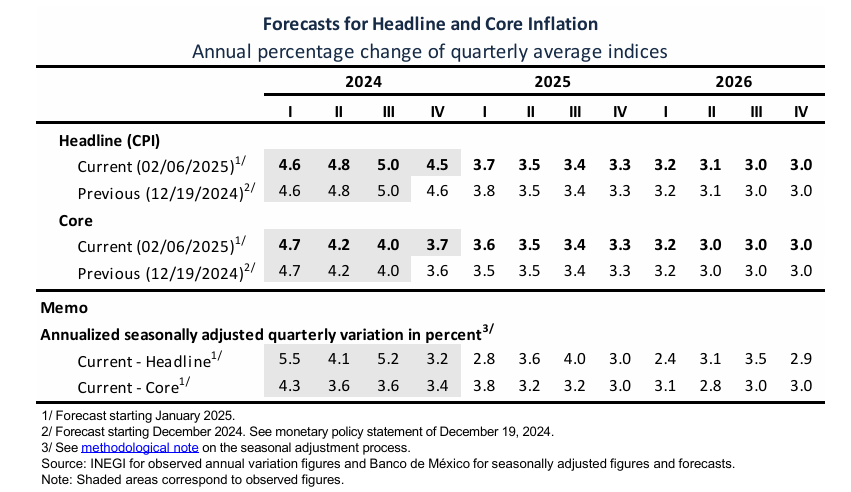

The Mexican Institution Governing Council added that headline inflation is projected to converge to Banxico’s 3% goal in Q3 2026. According to recent statements, the board sees inflation risks remaining skewed to the upside.

Regarding tariffs, the board acknowledged that the Mexican Peso depreciated significantly and reverted once the US and Mexico agreed to pause tariffs.

Forecasts for Inflation

Source: Banxico

USD/MXN Reaction to Banxico’s Decision

The USD/MXN has recovered some ground after reaching a daily low of 20.41 ahead of the decision, with the exchange range meandering within the 20.45 – 20.55 range. The first key resistance level eyed by traders would be the February 5 high of 20.71, which once cleared could pave the way to test the January 17 high of 20.90. On the downside, if sellers push the exchange rate below the 50-day SMA at 20.41, they could drive it towards the 100-day SMA at 20.22.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.