NZD/JPY Price Analysis: Bearish momentum intensifies, threatening 91.00

- NZD/JPY extends downtrend, breaking below key support.

- Technical indicators suggest further downside potential.

- The overall picture sees the pair stuck in a side-ways trading channel.

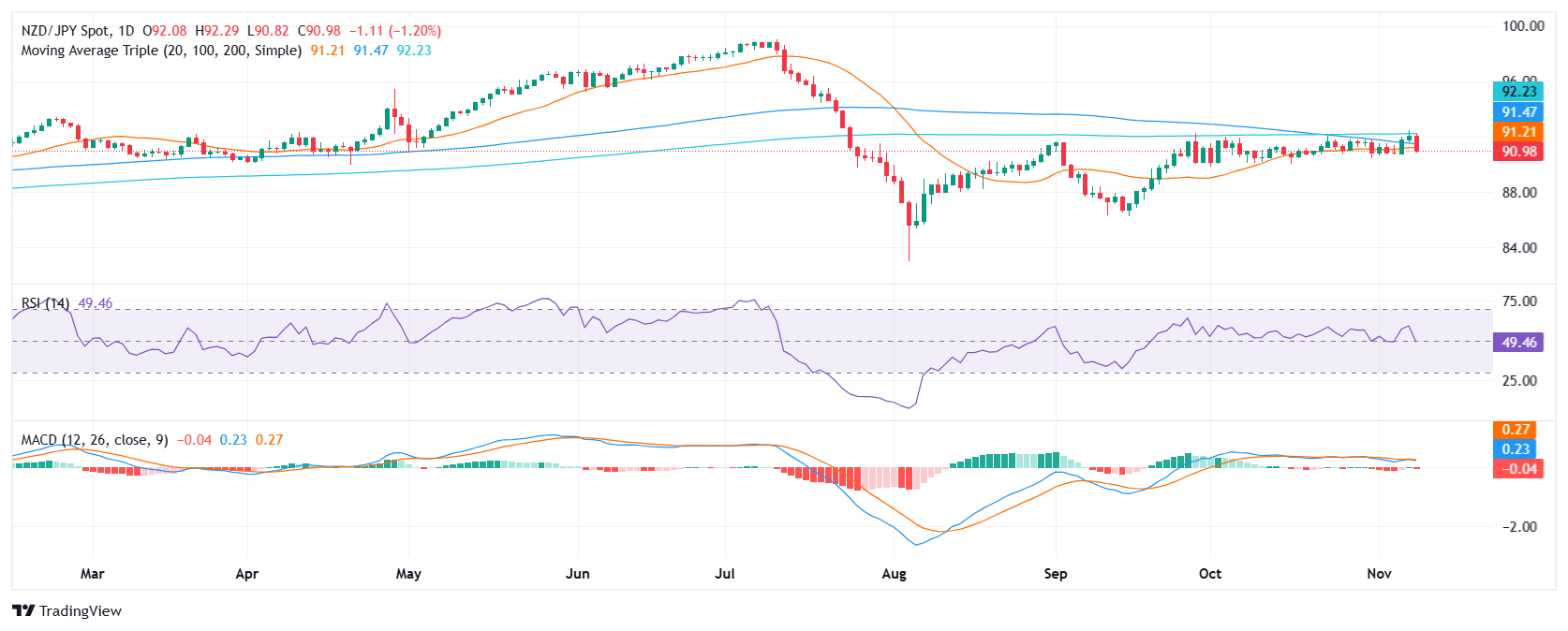

In Friday's session, the NZD/JPY declined by 1.20% to 91.00, continuing its bearish momentum. This break below the crucial 91.00 support level and the convergence of the 20 and 100-day Simple Moving Averages (SMAs) further confirms the strength of the selling pressure.

The analysis of technical indicators reveals a bearish outlook. The Relative Strength Index (RSI) has fallen into the negative territory and is declining sharply, indicating increasing selling pressure. The Moving Average Convergence Divergence (MACD) is also indicating rising selling momentum, as the histogram is red and rising.

Based on these observations, the NZD/JPY pair is expected to continue its downward trajectory. The initial support level to watch is 90.80, followed by 90.50 and then 90.30. On the upside, the first resistance level is 91.50, followed by 91.80 and 92.00.

NZD/JPY daily chart