USD/CAD declines for second day after Kamala comeback

- USD/CAD falls as the US Dollar weakens following a late-stage comeback by Kamala Harris in Republican safe-State Iowa.

- A Harris win would be negative for USD whilst a Trump victory would strengthen the Dollar, say analysts.

- The Canadian Dollar labors under a black cloud of fundamentals including a weak economy and falling Oil prices.

USD/CAD trades down by about three-tenths of a percent in the 1.3860s on the day of the US presidential election. This comes as the US Dollar (USD) weakens after a late surge in the polls for Democrat nominee Kamala Harris puts the election on a knife edge. Last week former President Donald Trump was ahead, albeit by a small margin.

The prior expectation that Trump will win contributed to pushing the USD/CAD to a new high for the year of 1.3959 on November 1, however, Harris’ late showing in the usually safe Republican State of Iowa – according the reputedly accurate Ann Selzer poll – has led to a sell-off in the USD and the Loonie pair on Monday and Tuesday.

USD/CAD Daily Chart

Markets are forecasting that a Harris win will be negative for the US Dollar whilst a victory for Donald Trump will have the oposite impact. Trump’s threats of putting tariffs on foreign imports and his inflationary tax cuts are the two main reasons – under Harris there would be no risk of tariffs.

The prediction model of the highly-rated election website 538.com is showing a 50% probability of Vice President Harris winning whilst former President Donald Trump has a 49% chance of victory. The model gives a 1% chance of there being no overall winner.

The election uncertainty combined with the proximity of the Federal Reserve (Fed) November 6-7 meeting is putting further pressure on USD/CAD. Some analysts are speculating that the Fed may opt to make a double-dose 50 basis points (bps) (0.50%) interest rate cut simply in order to calm markets, if it is unclear who has won the election.

“If markets spin out of control, the FOMC may opt for a 50 bps cut as a circuit breaker,” says Philip Marey, Senior US Strategist, at Rabobank.

His views are not backed by market-based gauges of Fed policy, however, with swap rates showing zero chance of a 50 bps cut but a roughly 95% chance of a 25 bps cut instead – and 5% probability of no cut – according to the CME FedWatch tool.

Nor does the huge miss suffered in the October US Nonfarm Payrolls (NFP) report, which showed only 12,000 new employees in the US in the month, compared to 223,000 in September and well below expectations of 113,000, increase the odds of a 50 bps cut, according to some analysts. The weak employment gains were put down to the temporary effect of Hurricane’s Helene and Milton.

“October’s distorted payrolls print probably won’t change the outlook for the Fed, which we expect to cut by 25 bps next week,” said Joe Maher, Assistant Economist, Capital Economics in a note on Friday.

Trading under a cloud

The Canadian Dollar, meanwhile, continues to operate under a cloud of negative fundamentals which may limit downside for USD/CAD.

The Bank of Canada (BoC) has been one of the most aggressive major central banks when it comes to cutting interest rates this year, having cut the bank’s cash rate from 5.00% in May 2024 to 3.75% currently. This includes a double-dose 50 bps (0.50%) cut in October. Lower interest rates are usually negative for a currency as they reduce foreign capital inflows.

Markets are further betting the BoC might cut by another 50 bps at its meeting in December due to overall weak fundamentals, particularly if employment data continues to show a decline.

“We think Friday’s Canadian employment report should tell a familiar story – that the labor market has continued to weaken in October amid slowing hiring demand,” says Nathan Janzen, Assistant Chief Economist at RBC in a recent note.

A further source of weakness for CAD is the steep sell-off in Crude Oil, which is only just rebounding from the mid-$60s per barrel (WTI Crude) and entering the $70 region. Oil is Canada’s largest export so Oil prices can impact gross demand for its currency.

Green shoots through the ice

Not all is doom and gloom, however, and there are signs of green shoots in the Canadian economy which the more optimistic argue might lead the BoC to relax its stance to future easing.

Most recently, the S&P Global Canada Manufacturing PMI rose to 51.1 in October from 50.4 in the previous month, “the second consecutive expansion in Canadian factory activity after 17 consecutive monthly contractions,” according to Trading Economics.

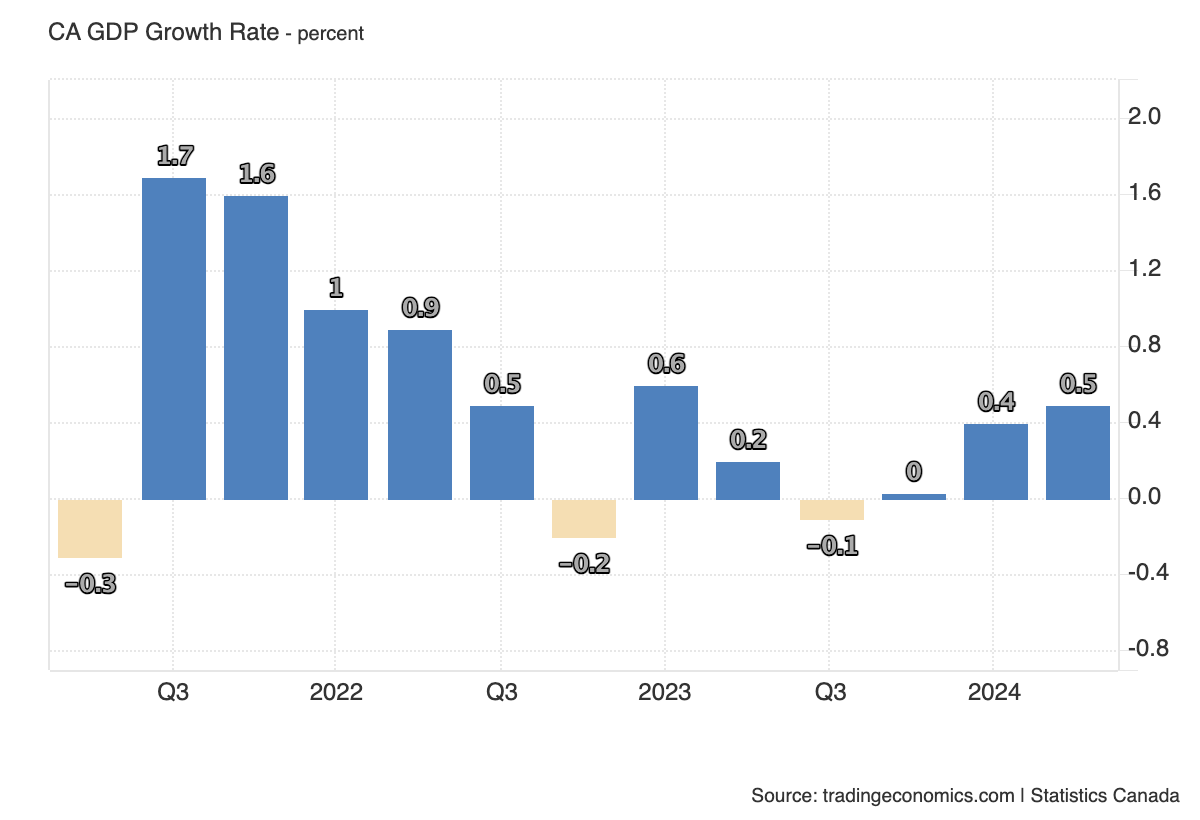

In addition, Canadian GDP looks to have lifted from its nadir at the end of 2023 when Canada almost fell into a recession. In the second quarter of 2024 the Canadian economy grew by 0.5% compared to the previous quarter, up from 0.4% in Q1.

That said, not all analysts are optimistic about the outlook for the economy. National Bank of Canada foresees even more weakness for the Canadian Dollar as GDP slows due to a marked decline in Canadian population growth.

“According to the latest targets, population growth is now projected to decline for two consecutive years – a first in modern history. If this unprecedented shift is implemented swiftly, it will likely dampen GDP growth in the coming quarters,” says National Bank’s Strategist Stéfane Marion.

The reduced GDP growth compared to the US moreover is likely to lead to a divergence in central bank policy between the two nations. Whereas the Fed might take a more cautious approach to cutting interest rates, the BoC could be forced to continue slashing them. Such a scenario would drive USD/CAD higher, with Marion revising up her target for pair from 1.41 in November 2024 to 1.45.

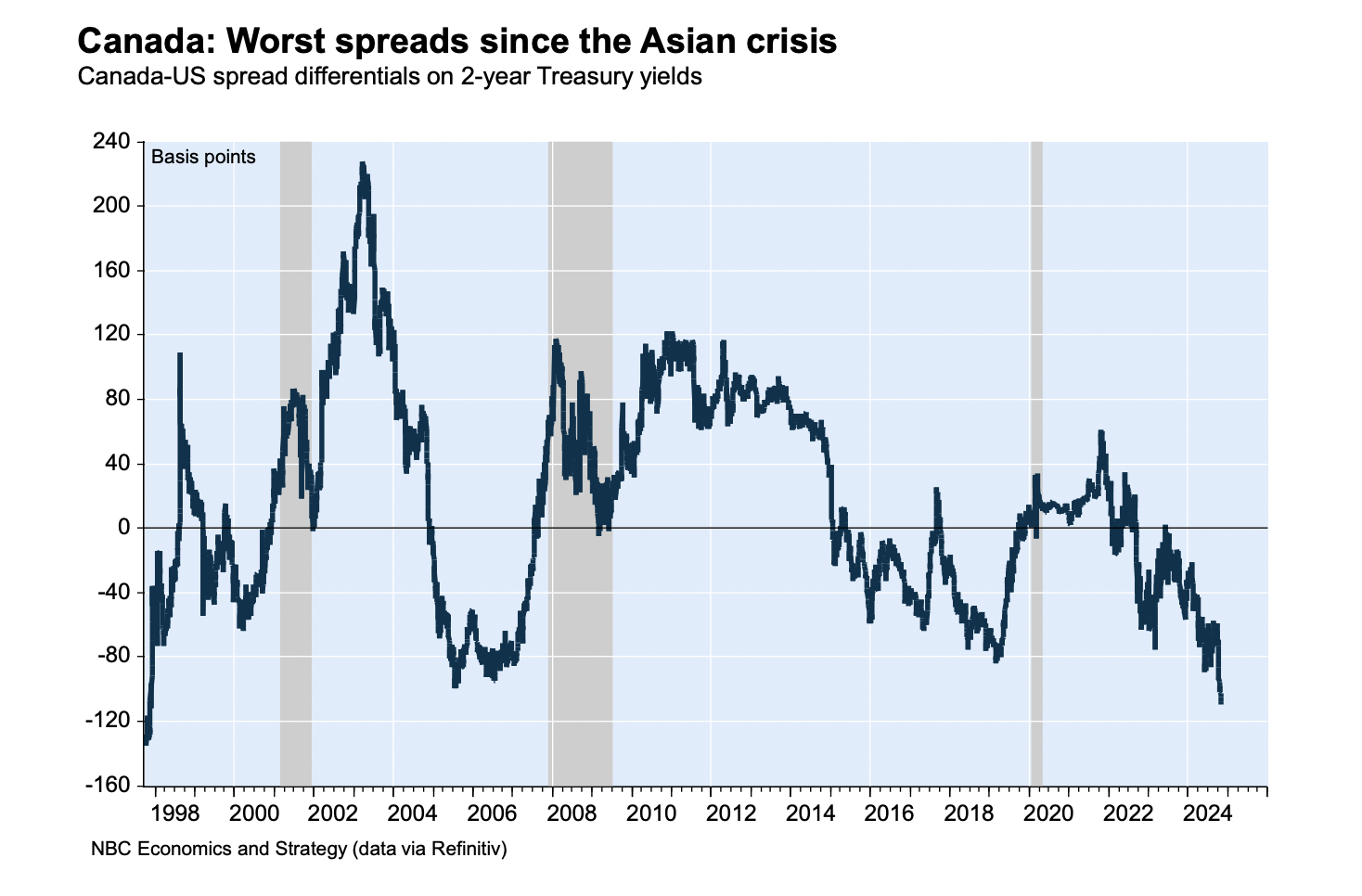

Swap spreads between US and Canadian government bonds – often seen as a proxy for the exchange rate – are already at a low not seen since the Asian financial crisis in the 1990s, says the strategist.

“While the U.S. economy is operating in a state of excess demand, Canada is grappling with excess capacity,” Marion notes. “As today’s Hot Chart shows, this unusual development supports a significant divergence in monetary policy, now reflected in the widest spreads on 2-year Treasury yields between Canada and the U.S. since the 1997-98 Asian crisis—a key driver of the exchange rate.”