USD/JPY Price Analysis: Flatlines amid subdued session, hovers around 156.90

- USD/JPY down slightly by 0.08% at 156.87, amid low-volume trading due to US Memorial Day.

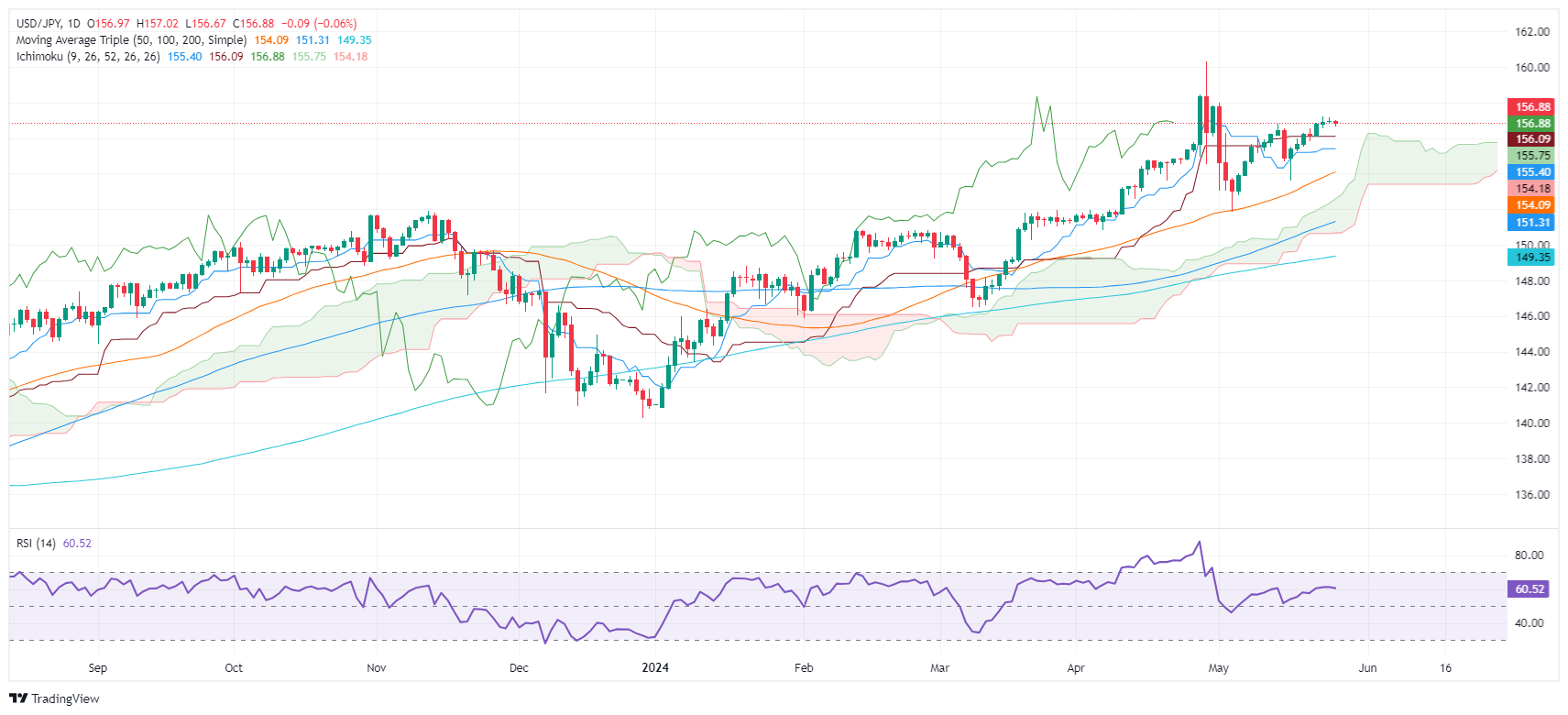

- Technicals show an upward trend, with prices above the Ichimoku Cloud, Tenkan-Sen, and Kijun-Sen.

- Resistance at 157.00, followed by April 26 high of 158.44 and YTD high of 160.32.

- Support levels include Tenkan-Sen at 156.05, Senkou Span A at 155.72, Kijun-Sen at 155.39, and 50-DMA at 154.08.

The USD/JPY trade subdued amid low-volume trading on Monday. courtesy of the observance of Memorial Day, as Wall Street remained closed. The major trades at 156.87, registering modest losses of 0.08%.

USD/JPY Price Analysis: Technical outlook

From a technical perspective, the USD/JPY is upward biased, as evidenced by successive series of higher highs and lows and price action standing above the Ichimoku Cloud (Kumo). Additionally, the spot price is also above the Tenkan and Kijun-Sen, a further indication of bulls’ strength. Yet intervention threats by Japanese authorities kept buyers at bay instead of committing to open fresh long positions.

However, if USD/JPY clears the 157.00 figure, further gains lie overhead. The next resistance would be the April 26 high at 158.44, followed by the year-to-date (YTD) high at 160.32.

Conversely, if it stumbles below the confluence of the Tenkan-Sen at 156.05, that will sponsor a leg down. Next key support levels emerge at the Senkou Span A at 155.72, followed by the Kijun-Sen at 155.39, ahead of the 50-day moving average (DMA) at 154.08.

USD/JPY Price Action – Daily Chart