FTSE 100 opens with gains; shares rise

Source Investing

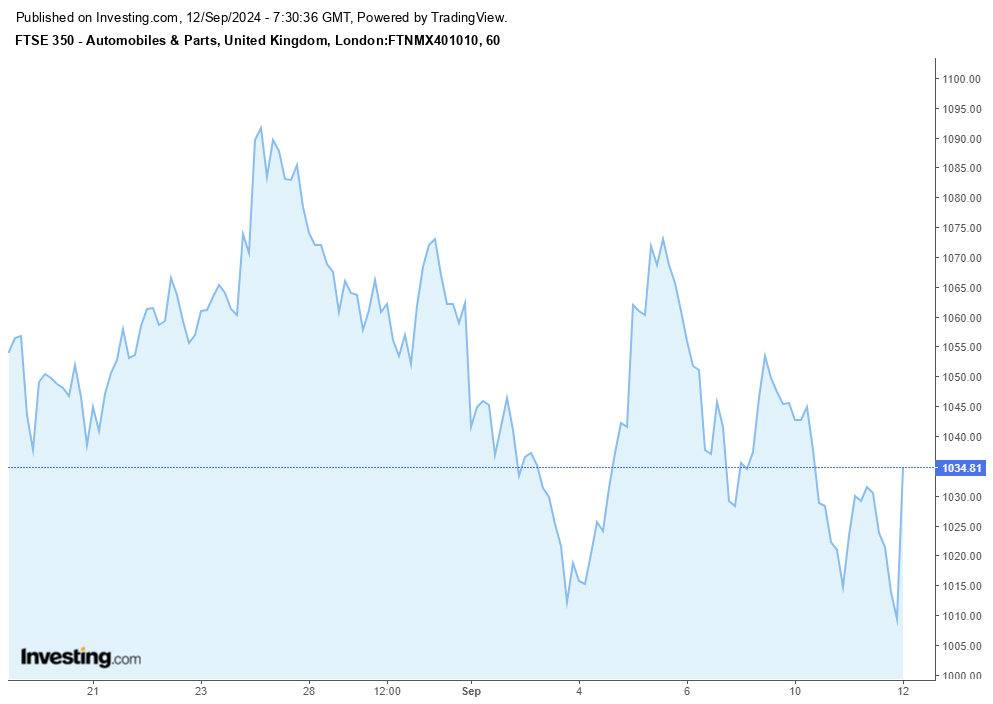

Investing.com – U.K. equities started with gains in all sectors on Thursday. The top risers are Automobiles & Parts, Beverages, Industrial Metals & Mining and Personal Goods.

At the market open in London, the FTSE 100 Index climbed 1.09%. The FTSE 250 Index and the FTSE 350 Index also rose. The FTSE 250 increased 0.74%, while the FTSE 350 was up by 1.19%.

Top Gainers:

- Antofagasta (LON:ANTO): Climbed 2.67% or 45.00 points to 1,731.00

- Scottish Mortgage (LON:SMT): Rose 3.08% or 24.47 points to 818.87

- Intermediate Capital (LON:ICGIN): Increased 3.07% or 66.00 points to 2,218.00

Top Losers:

- M&G PLC (LON:MNG): Dropped 2.34% or 4.90 points to 204.20

- British American Tobacco (LON:BATS): Declined 0.40% or 12.0 points to 2,972.0

- Severn Trent (LON:SVT): Fell 0.30% or 8.0 points to 2,682.0

In Commodities Trading:

- Gold Futures for December delivery climbed 0.15 points to 2,542.55 a troy ounce.

- Crude Oil for October delivery rose 0.85 points to 68.16 a barrel.

- November Brent Oil Contract increased 1.32% or 0.93 points to 71.54 a barrel.

Currency Markets:

- GBP/USD is traded at 1.3045.

- EUR/GBP is at 0.84.

- The US Dollar Index Futures was up 0.15% at 101.807.

Main Economic Events:

Today's economic calendar is calm today with only BoE’s Breeden speaks and IPSOS PCSI data coming.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

Once again, the price of Ethereum (ETH) has risen above $3,900. This bounce has hinted at a further price increase for the altcoin before the end of the year.

Pi Network Price Annual Forecast: PI Heads Into a Volatile 2026 as Utility Questions Collide With Big UnlocksPi Network heads into 2026 after a 90%+ 2025 drawdown from $3.00, with 17.5 million KYC users and a smart-contract-focused Stellar v23 upgrade offering upside potential, but 1.21 billion tokens unlocking and heavy exchange deposits (437 million PI) keeping supply pressure and trust risks firmly in focus.

Pi Network heads into 2026 after a 90%+ 2025 drawdown from $3.00, with 17.5 million KYC users and a smart-contract-focused Stellar v23 upgrade offering upside potential, but 1.21 billion tokens unlocking and heavy exchange deposits (437 million PI) keeping supply pressure and trust risks firmly in focus.

ECB Policy Outlook for 2026: What It Could Mean for the Euro’s Next MoveWith the ECB likely holding rates steady at 2.15% and the Fed potentially extending cuts into 2026, EUR/USD may test 1.20 if Eurozone growth proves resilient, but weaker growth and an ECB pivot could pull the pair back toward 1.13 and potentially 1.10.

With the ECB likely holding rates steady at 2.15% and the Fed potentially extending cuts into 2026, EUR/USD may test 1.20 if Eurozone growth proves resilient, but weaker growth and an ECB pivot could pull the pair back toward 1.13 and potentially 1.10.

My Top 5 Stock Market Predictions for 2026Five 2026 market predictions written in a native, news-style voice: AI’s winners and losers, broader sector leadership, dividend demand, valuation cooling as the Shiller CAPE sits at 39 (Dec. 31, 2025), and quantum-computing bursts—while keeping all original facts and numbers unchanged.

Five 2026 market predictions written in a native, news-style voice: AI’s winners and losers, broader sector leadership, dividend demand, valuation cooling as the Shiller CAPE sits at 39 (Dec. 31, 2025), and quantum-computing bursts—while keeping all original facts and numbers unchanged.

WTI recovers to near $86.50 as Strait of Hormuz remains closedWest Texas Intermediate (WTI), the US crude oil benchmark, is trading around $86.40 during the early Asian trading hours on Tuesday. The WTI price faces extreme volatility following a massive spike to nearly $120 per barrel in the previous session.

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $86.40 during the early Asian trading hours on Tuesday. The WTI price faces extreme volatility following a massive spike to nearly $120 per barrel in the previous session.