FTSE 100 opens with gains; shares rise

Source Investing

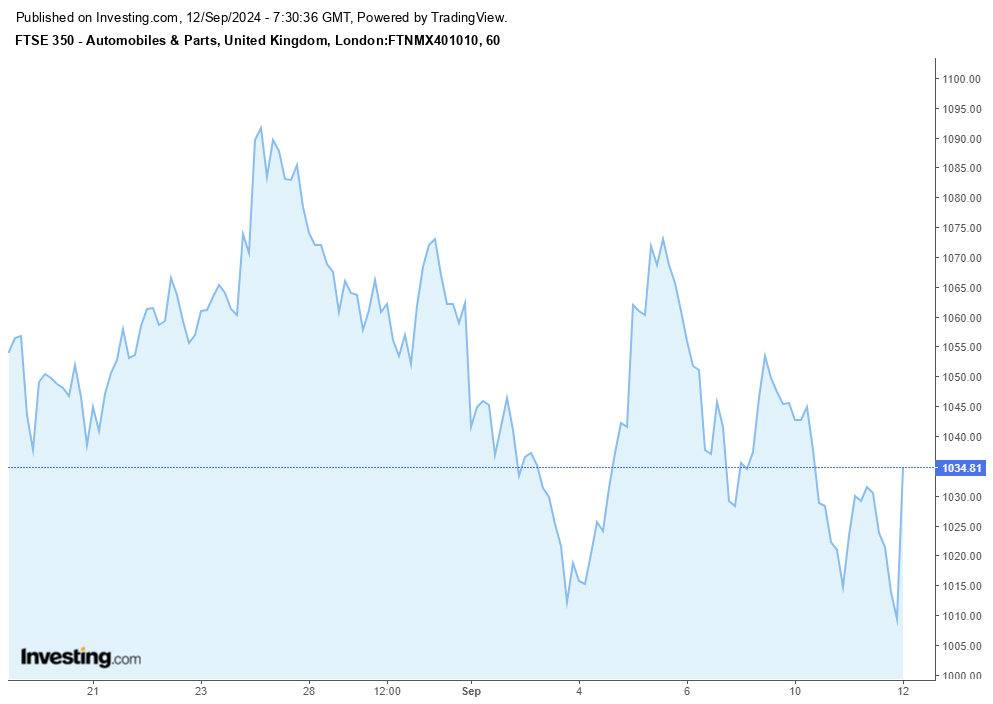

Investing.com – U.K. equities started with gains in all sectors on Thursday. The top risers are Automobiles & Parts, Beverages, Industrial Metals & Mining and Personal Goods.

At the market open in London, the FTSE 100 Index climbed 1.09%. The FTSE 250 Index and the FTSE 350 Index also rose. The FTSE 250 increased 0.74%, while the FTSE 350 was up by 1.19%.

Top Gainers:

- Antofagasta (LON:ANTO): Climbed 2.67% or 45.00 points to 1,731.00

- Scottish Mortgage (LON:SMT): Rose 3.08% or 24.47 points to 818.87

- Intermediate Capital (LON:ICGIN): Increased 3.07% or 66.00 points to 2,218.00

Top Losers:

- M&G PLC (LON:MNG): Dropped 2.34% or 4.90 points to 204.20

- British American Tobacco (LON:BATS): Declined 0.40% or 12.0 points to 2,972.0

- Severn Trent (LON:SVT): Fell 0.30% or 8.0 points to 2,682.0

In Commodities Trading:

- Gold Futures for December delivery climbed 0.15 points to 2,542.55 a troy ounce.

- Crude Oil for October delivery rose 0.85 points to 68.16 a barrel.

- November Brent Oil Contract increased 1.32% or 0.93 points to 71.54 a barrel.

Currency Markets:

- GBP/USD is traded at 1.3045.

- EUR/GBP is at 0.84.

- The US Dollar Index Futures was up 0.15% at 101.807.

Main Economic Events:

Today's economic calendar is calm today with only BoE’s Breeden speaks and IPSOS PCSI data coming.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

West Texas Intermediate (WTI) US Crude Oil prices attract fresh buyers on Wednesday and climb back closer to the highest level since January 2025, touched the previous day.

Silver Price Forecast: XAG/USD rises to near $85.00 as Middle East war intensifiesSilver price (XAG/USD) recovers over 3% during the Asian hours on Wednesday, hovering around $85.20 per troy ounce after plunging more than 12% over the previous two sessions. The precious metal draws safe-haven demand as geopolitical conflict in the Middle East intensifies.

Silver price (XAG/USD) recovers over 3% during the Asian hours on Wednesday, hovering around $85.20 per troy ounce after plunging more than 12% over the previous two sessions. The precious metal draws safe-haven demand as geopolitical conflict in the Middle East intensifies.

AUD/USD extends its losses for the second successive session, trading around 0.7010 during the Asian hours on Wednesday. The pair remains under pressure following the release of Australian Gross Domestic Product (GDP) data.

Single-Day Prices Surge Another 32%. How Severe Is the Volatility Challenge in Europe’s Natural Gas Market?TradingKey - On March 3 local time, European natural gas futures surged for the second consecutive trading day, driven by the production halt at QatarEnergy's core facilities. European benchmark natur

TradingKey - On March 3 local time, European natural gas futures surged for the second consecutive trading day, driven by the production halt at QatarEnergy's core facilities. European benchmark natur