FTSE 100 down; employment better than expected; earnings data mixed

Investing.com – U.K. equities started mixed on Tuesday, with losses in majority of sectors. Top losers were Food & Drug Retailers, Household Goods, Industrial Metals & Mining and Electronic & Electrical Equipment. Mining, Personal Goods, Aerospace & Defense and Gas Water & Multiutilities sectors were up.

At the market open in London, the FTSE 100 Index fell 0.48%. The FTSE 250 Index and the FTSE 350 Index also declined. The FTSE 250 dropped 0.07%, while the FTSE 350 was down by 0.60%.

Top Gainers:

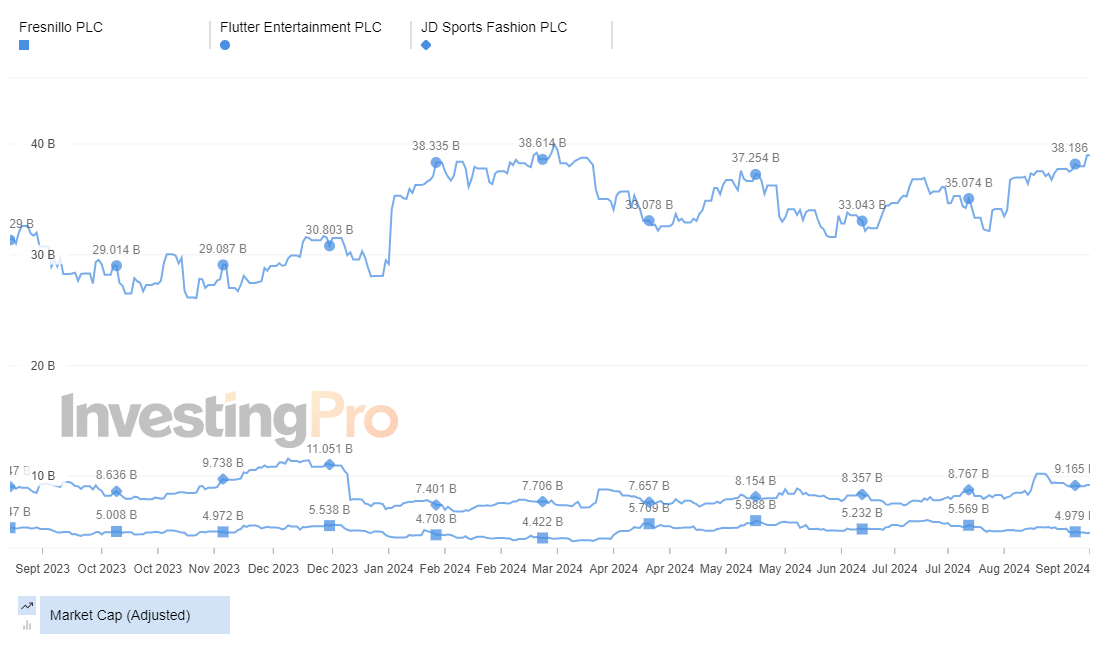

Fresnillo (LON:FRES): Climbed 2.12% or 10.72 points to 515.22.

Flutter (LON:FLTRF) Entertainment: Rose 0.69% or 115.0 points to 16,765.0.

JD Sports Fashion (LON:JD): Increased 0.63% or 0.85 points to 136.70.

Top Losers:

AstraZeneca (LON:AZN): Dropped 5.52% or 702.0 points to 12,010.0.

Hikma Pharma (LON:HIK): Declined 1.77% or 34.36 points to 1,909.65.

ConvaTec (LON:CTEC) Group: Fell 1.37% or 3.20 points to 230.40.

In Commodities Trading:

- Gold Futures for December delivery climbed 0.90 points to 2,533.60 a troy ounce.

- Crude Oil for October delivery dropped 0.43 points to 68.28 a barrel.

- November Brent Oil Contract fell 0.56% or 0.40 points to 71.44 a barrel.

Currency Markets:

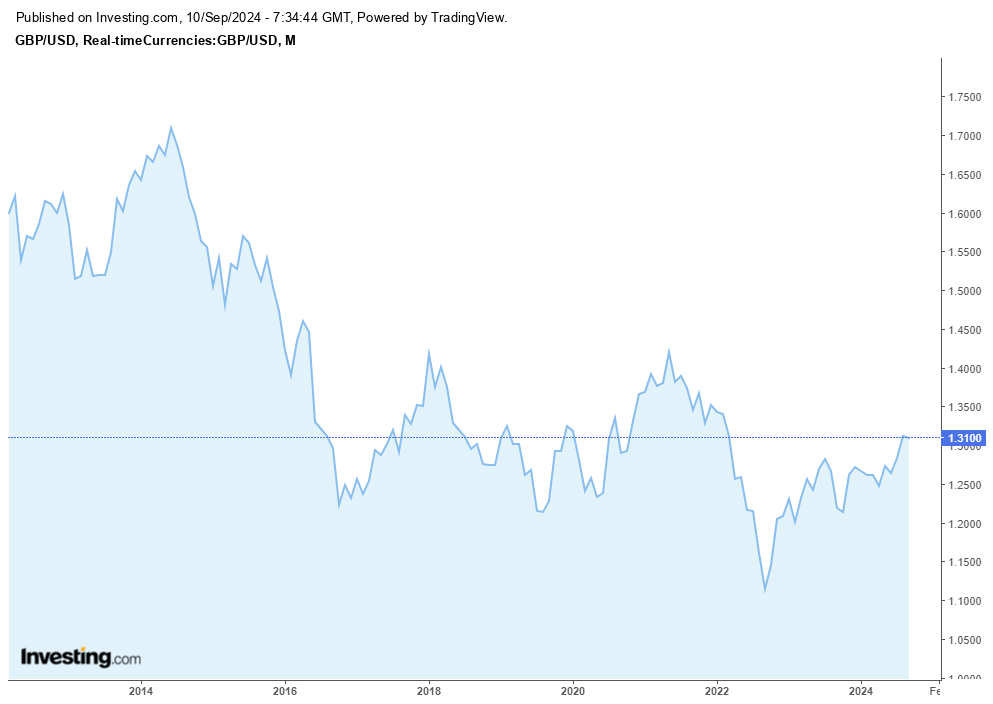

- GBP/USD is still struggling to stay above 1.31 line.

- EUR/GBP is at 0.84.

- The US Dollar Index Futures was up 0.07% at 101.584.

Main Economic Events:

Today's main economic event in the United Kingdom are the earnings reports and the employment data. Employment change surpassed the forecasts.