US Stocks, Bonds, and Dollar Face Triple Whammy, Yet Bitcoin Soars Against the Trend!

- 270,000 People Instantly Liquidated. Crypto Earthquake, Just Because This Person Might Take Over the Fed?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Bitcoin No Longer Digital Gold? Gold and Silver Token Market Cap Hits Record $6 Billion

Trump blasts Powell, causing a sell-off in US stocks, bonds, and the dollar. Bitcoin, however, surges to around $90,000. Can it break this resistance level?

On Tuesday, safe-haven funds flowed back into the crypto market. Bitcoin (BTC) continued its rebound, nearing the $90,000 resistance. It peaked at $88,877, marking a new high since March 25.

Bitcoin Price Trend Chart, Source: TradingView.

Recently, President Trump has relentlessly attacked and threatened to fire Federal Reserve Chair Powell. He labeled Powell a "major loser" and demanded immediate rate cuts. Trump warned, "If I let him go, he will be gone soon, believe me."

Trump's actions have heightened concerns about the US economy and the independence of the Fed. Investors sold off US assets, leading to a dramatic drop in stocks, bonds, and the dollar. On April 21, all three major US stock indexes fell over 2%. The dollar index dropped to around 97, a three-year low. The yields on 10-year and 30-year US Treasuries rose by over 7 basis points.

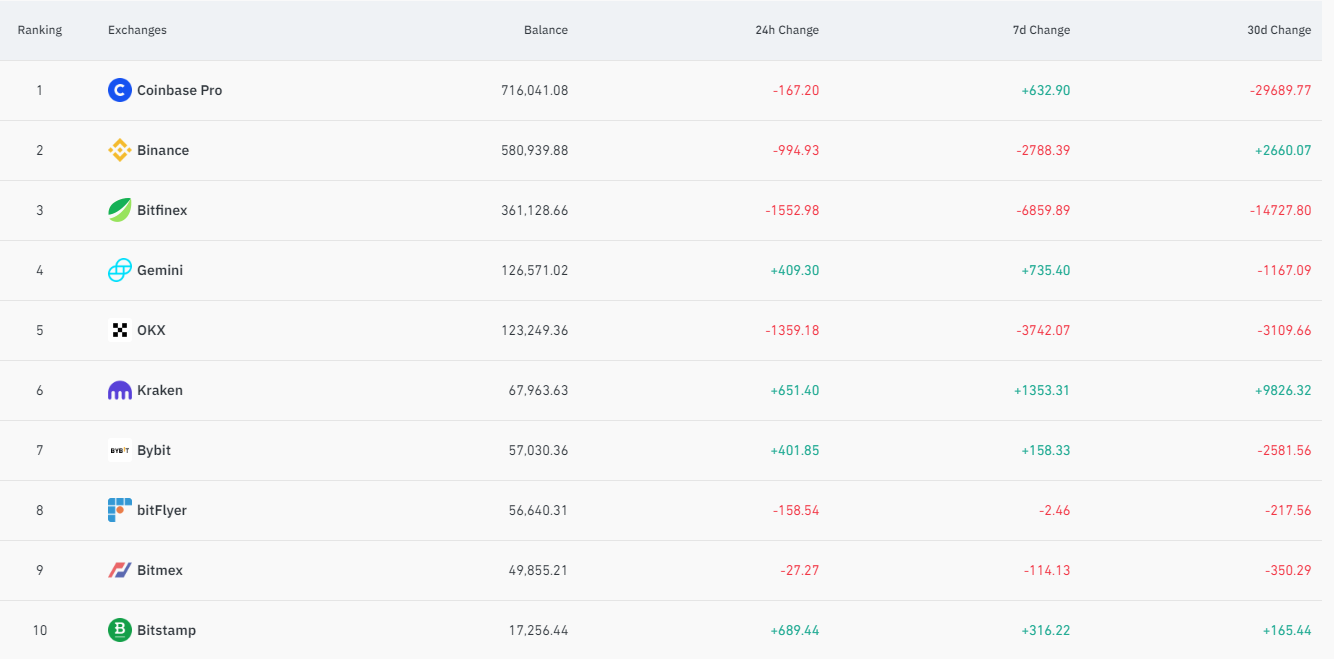

Currently, several indicators show that hot money is flowing into Bitcoin, potentially driving its price higher. The Value Days Destroyed (VDD) metric has returned to 2022 lows, suggesting that whales are accumulating Bitcoin. Additionally, Bitcoin balances on exchanges have steadily declined over the past month, indicating reduced selling pressure.

Top Ten Exchanges' Bitcoin Balances, Source: Coinglass.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.