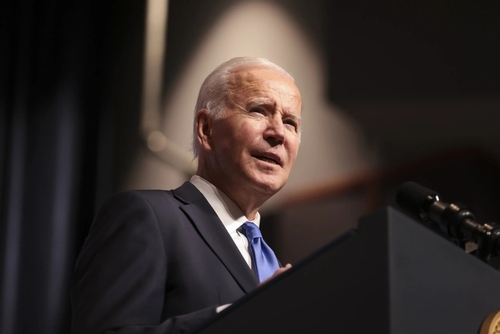

Analysts weigh in on Biden dropping out of White House race

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- Bitcoin Price Surges To $90,000. U.S. Arrests Venezuela's President, Triggers Bull Frenzy

- After Upheaval in the World’s Largest Oil Reserve Holder, Who Will Emerge as the Biggest Winner in Venezuela’s Oil Market?

- U.S. to freeze and take control of Venezuela's Bitcoin holdings after Maduro capture

- Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

- Silver Price Forecast: XAG/USD bulls look to build on momentum beyond $79.00

President Joe Biden has ended his re-election campaign and endorsed Vice President Kamala Harris as the Democratic candidate for the 2024 presidential race.

Biden announced his decision in a written statement on Sunday, calling it the "greatest honour" to serve as president but stating that his withdrawal is "in the best interest of my party and the country."

The announcement concludes a turbulent period in U.S. politics that began with Biden's lackluster debate performance against Donald Trump on June 27. Despite stepping down from the race, Biden will remain president until January.

Kamala Harris, 59, expressed her gratitude for Biden's endorsement, saying she feels "honored" and committed to "earn and win this nomination" to unite the country against Trump.

Although Harris has received support from many prominent figures within the Democratic Party, her official nomination may not be confirmed until the Democratic National Convention in August.

Meanwhile, a resurgent Trump has taken the lead in the polls and was confirmed as the Republican nominee at the party's convention in Milwaukee this week, just five days after surviving an assassination attempt.

Analysts share thoughts on Biden’s withdrawal

Citi: “So far, we have seen election odds tightening, marginally, but await more polling in coming weeks. The net impact will be to inject more variance into the election which had been trending towards Republicans. That trend gave us a window into markets’ election pricing. Steepeners, small-caps, and banks were consistent outperformers. Crypto benefited from Trump fundraising. Market moves have been muted at time of writing, but were consistent with a small unwind of “Trump trades” with small-cap futures underperforming, a light curve-flattening. Crypto has risen slightly. Even if the race tightens, we expect the market to continue to price a meaningful risk premium to a red-wave scenario.”

RBC Capital Markets: “Along with the path of interest rates and the duration of datacenter/AI investments, investors are starting to weigh the potential impact of the upcoming US presidential election on earnings outlooks. Without opining on the potential election outcome, our analysis indicates that the Multi- Industry sector on average appears best positioned to benefit under a Trump administration, particularly from signaling of lower, or at least not higher, corporate tax rates.”

BTIG: “The Democratic convention in Chicago does not kick off for another 29 days and we are acutely aware of how much can change in that amount of time. Biden’s exit resets the presidential election, and it ramps the uncertainty in the near term, but our foundational view remains the same as we continue to believe it will be a close race and we maintain our view that Trump is the slight favorite.”

UBS: “Our base case that the S&P 500 ends the year around 5,900, modestly higher than the current 5,505, would hold in most political scenarios— barring a Democratic sweep of power that leads to higher corporate taxes, or a scenario in which former President Trump imposes trade tariffs that are as high as proposed in his campaign speeches. We consider either outcome unlikely at present. In addition, we believe the positive outlook for top US tech companies is likely to more than offset political uncertainty.”

Raymond James: “The path forward is uncertain as these are arguably unprecedented times in the modern era. Democratic delegates will now choose the Democratic presidential and vice presidential nominees to face off against former President Trump. We are not revising our election odds at this stage as our base case is VP Harris will be the Democratic nominee and currently view her as having about the same odds against Trump as Biden did.”

TD Cowen: “President Biden on Sunday announced he would not seek re-election in November. Biden endorsed Kamala Harris for the nomination, though other Democrats want an open process. We view this decision as resetting the election, which makes a Trump victory less certain. It is why we view this as boosting risk for financials and crypto though it may be positive for housing.”

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.