Forex Today: US Dollar extends recovery ahead of FOMC Minutes

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Wednesday, May 28:

The US Dollar (USD) stays resilient against its rivals to start the European session on Wednesday. April Unemployment Rate data from Germany will be featured in the European economic calendar. In the second half of the day, the US Treasury will hold a 5-year note auction and the Federal Reserve (Fed) will publish the minutes of its May policy meeting.

US Dollar PRICE This week

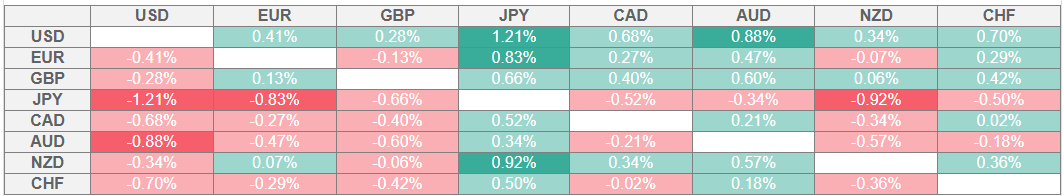

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

In the early Asian session on Wednesday, the Reserve Bank of New Zealand (RBNZ) announced that it cut the policy rate by 25 basis points (bps) to 3.25%. This decision came in line with the market expectation. The RBNZ revised the policy rate projection for September 2025 lower to 3.12% from 3.23%. RBNZ acting Governor Christian Hawkesby said in the press conference that the message that they want to deliver is that they are not pre-programmed on policy moves and noted that inflation is within their target range. After losing nearly 0.9% on Tuesday, NZD/USD edged slightly higher following the RBNZ event and was last seen rising more than 0.2% on the day above 0.5950.

The USD Index gained about 0.6% on Tuesday as the action in bond and stock markets reflected an improving sentiment around the US economy. The benchmark 10-year US yield declined more than 1% on the day, reflecting healthy demand, while the S&P 500 Index gained more than 2%. The USD Index stays in positive territory above 99.50 in the European morning.

Reuters reported on Tuesday that Japan's Ministry of Finance is planning to adjust the composition of its bond issuance plan by reducing the issuance of super-long bonds for the current fiscal year ending in March 2026. In the meantime, Bank of Japan (BoJ) Governor Kazuo Ueda repeated on Wednesday that ongoing tariff negotiations between the United States and Japan create uncertainty. After rising more than 1% on Tuesday, USD/JPY fluctuates in a tight channel above 144.00 in the European session on Wednesday.

EUR/USD lost about 0.5% on Tuesday and erased the gains it registered to start the week. The pair stays under modest bearish pressure and declines toward 1.1300 early Wednesday.

GBP/USD stays on the back foot and trades below 1.3500 after closing in negative territory on Tuesday.

The upbeat market mood made it difficult for Gold to find demand on Tuesday. Following a more than 1% loss, Gold seems to have stabilized slightly above $3,300 in the European session on Wednesday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.