- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Wednesday, May 7:

The US Dollar (USD) struggles to stay resilient against its rivals as market attention turns to the Federal Reserve's (Fed) monetary policy announcements and Fed Chairman Jerome Powell's press conference later in the American session. During the European trading hours, Eurostat will publish Retail Sales data for March.

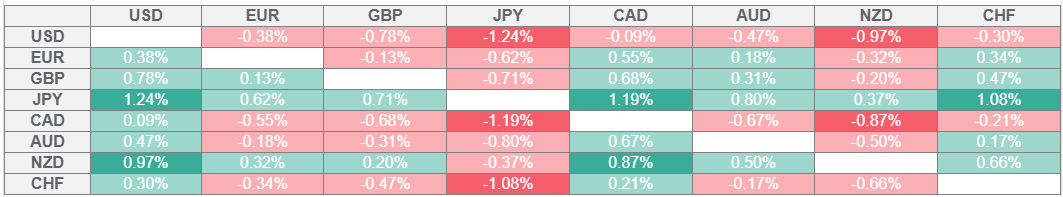

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index, which tracks the USD's performance against a basket of six major currencies, closed in negative territory for the third consecutive trading day on Tuesday. Early Wednesday, the USD Index fluctuates in a narrow channel below 99.50. Later in the day, the Fed is widely anticipated to keep the interest rate unchanged at 4.25%-4.5%. Market participants will pay close attention to Powell's comments on the inflation and growth outlook.

Meanwhile, US stock index futures were last seen rising about 0.4% on the day, after Wall Street's main indexes registered large losses on Tuesday. US Deputy Treasury Secretary Michael Faulkender said late Tuesday that despite ongoing market tensions and investor concerns about US economic stability, demand for US Treasuries and USD remain high.

During the Asian trading hours, People's Bank of China (PBOC) Governor Pan Gosheng announced that they've decided to cut the Reserve Requirement Ratio (RRR) and the policy rate by 50 basis points (bps) and 10 bps, respectively, following a meeting with the China Securities Regulatory Commission and the National Financial Regulatory Authority. AUD/USD advanced to a fresh 2025-high above 0.6500 following this development before retreating below this level by the European session.

Gold built on Monday's impressive gains and rose nearly 3% on Tuesday to touch a fresh two-week high above $3,430. XAU/USD corrects lower midweek and trades below $3,400, losing more than 1% on the day. In addition to the escalating geopolitical tensions in the Middle East, India-Pakistan conflict helped the precious metal rose sharply in the first half of the week.

EUR/USD benefited from the broad USD weakness and rose nearly 0.5% on Tuesday. The pair moves sideways above 1.1350 in the European session on Wednesday.

GBP/USD gathered bullish momentum and climbed above 1.3400 on Tuesday. The pair edges lower early Wednesday but holds above 1.3350. The Bank of England will announce policy decisions on Thursday.

After losing nearly 1% on Monday, USD/JPY continued to push lower and fell about another 1% on Tuesday. The pair stages a rebound early Wednesday and trades near 143.00. In the Asian session on Thursday, the Bank of Japan will publish Monetary Policy Meeting Minutes.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.