Forex Today: US Dollar retreats after NFP-inspired rally

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Friday, July 4:

Markets stay relatively quiet early Friday and the US Dollar (USD) Index retreats after posting gains for two consecutive days. May Producer Price Index (PPI) for the Eurozone will be the only data featured in the European economic calendar. Financial markets in the US will remain closed in observance of the July 4 holiday, paving the way for subdued action heading into the weekend.

US Dollar PRICE This week

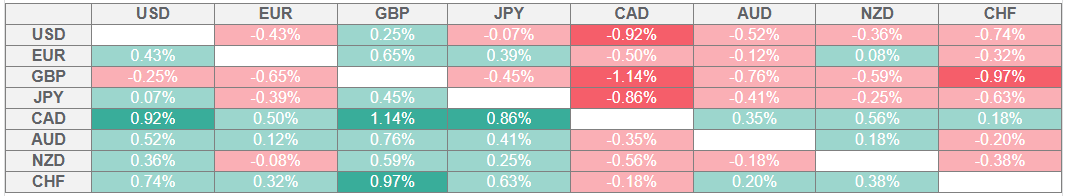

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The data published by the US Bureau of Labor Statistics showed on Thursday that Nonfarm Payrolls (NFP) in the US rose by 147,000 in June. This reading came in better than the market expectation for an increase of 110,000. In this period, the Unemployment Rate declined to 4.1% from 4.2%. The USD gathered strength with the immediate reaction to the upbeat employment data and the USD Index climbed to a six-day-high above 97.40. Early Friday, the index corrects lower and stays in negative territory below 97.00.

Late Thursday, the US House of Representative's approved US President Donald Trump's tax-cut and spending bill and sent it back to him to be signed into law. Meanwhile, Trump noted that he will begin sending letters on trade tariffs starting Friday. He added that the expects to sign a "couple more deals" and noted that countries will start paying tariffs from August 1st. Wall Street's main indexes registered strong gains on Thursday.

During the Asian session on Friday, Chinese Commerce Ministry said in a statement that China and the US are stepping up efforts to implement the outcomes of the London framework. AUD/USD showed no reaction to this headline and was last seen trading flat on the day at around 0.6570.

EUR/USD lost more than 0.3% on Thursday but managed to find a foothold early Friday. The pair was last seen trading modestly higher on the day at 1.1780. European Central Bank (ECB) president Christine Lagarde reiterated early Friday that they will do whatever they must to reach the inflation target.

Following Wednesday's sharp decline that was triggered by political jitters in the UK, GBP/USD ignored the broad-based USD strength and posted small gains on Thursday. Early Friday, the pair holds its ground and trades above 1.3650.

USD/JPY stays under bearish pressure and declines toward 144.00 after rising nearly 1% on Thursday.

Gold snapped a three-day winning streak on Thursday, losing about 1% on the day. XAU/USD holds its ground early Friday and rebounds above $3,340.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.