US Dollar Index maintains position near 104.50 ahead of PCE Price Index data

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

The US Dollar Index holds gains as risk aversion increases due to concerns over potential US auto tariffs.

US bond yields dropped to 3.98% for the 2-year and 4.34% for the 10-year bond.

Traders await Friday’s US Personal Consumption Expenditures (PCE) Price Index for further insights into the Fed policy outlook.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, hovers around 104.30. The Greenback faced downward pressure as US bond yields decline—3.98% for the 2-year bond and 4.34% for the 10-year bond at the time of writing. However, Moody’s has cautioned that rising tariffs and tax cuts could significantly widen government deficits, potentially leading to a US debt rating downgrade and higher Treasury yields.

US Gross Domestic Product (GDP) expanded at an annualized rate of 2.4% in Q4 2024, surpassing the 2.3% forecast, according to Thursday’s data release. Investors now await Friday’s US Personal Consumption Expenditures (PCE) Price Index for further insights into the Federal Reserve’s (Fed) monetary policy outlook. While the Fed kept interest rates unchanged last week, it reaffirmed expectations for two rate cuts by year-end.

US President Donald Trump signed an order on Wednesday imposing a 25% tariff on auto imports and warned of further measures against the EU and Canada if they retaliate. This escalation in trade tensions is likely to strain relations with key trading partners, particularly ahead of the reciprocal tariffs set to take effect on April 2.

S&P Global warned that US policy uncertainty could hinder global economic growth, while Fitch Ratings emphasized that current tariffs may disproportionately affect smaller economies like Brazil, India, and Vietnam, making it harder for them to afford US goods.

Boston Fed President Susan Collins noted on Thursday that the central bank faces a tough choice between maintaining a restrictive stance or preemptively easing policy in response to potential economic weakness. Meanwhile, Richmond Fed President Thomas Barkin cautioned that uncertainty surrounding the Trump administration’s trade policies could push the Fed toward a more cautious, wait-and-see approach than markets anticipate.

US Dollar PRICE Today

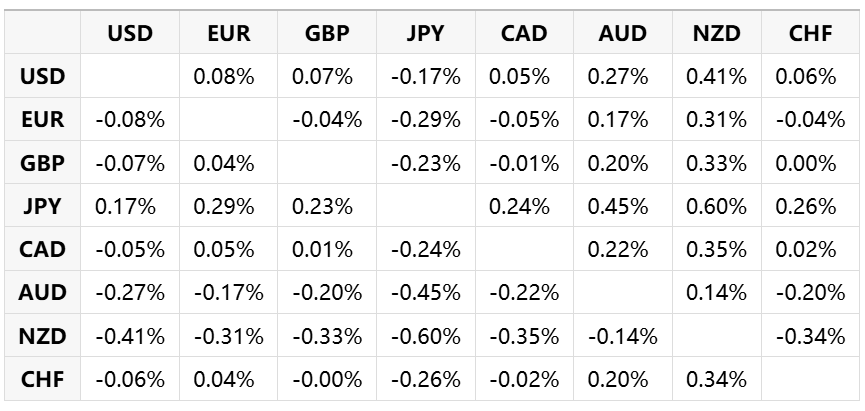

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.