US Dollar 2023 Forecast: Will Fed Hawks Aid Greenback Rally?

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

- WTI climbs to $76.00, eyes one-year high amid rising tensions in the Middle East

- How to Survive Bitcoin Winter? Will It Still Fall Below $60,000 in 2026?

Amidst the chaos of the financial markets, 2022 has been the year of the USD. The greenback rose against all currencies, and in September, it reached a 20-year high. The year started with a bullish sentiment for USD as the Federal Reserve started its' aggressive rate hikes.

Since March 2022, the Feds have raised interest rates by 425 bps (basis points). The dollar index, which tracks the performance of the USD against major peers, climbed because of the aggressive Fed hikes. In comparison, the others like EUR, GPB, JPY, CHF, CAD, AUD, and NZD didn't raise interest rates that much.

But that's not the only reason. The Russian invasion of Ukraine created chaos, creating a significant dent in the world economy. And when the situation is dire, people flock toward the good ol' greenback.

However, in the last quarter of 2022, the dollar shed more than 4%, mainly because of the surprising inflation data in November, which showed prices surged slowly in October. This led investors into a frenzy that the Feds may stop the aggressive hikes.

With the talks of global recession and geopolitical factors, will the dollar rise in 2023? We'll find out in this report.

Summary

|

Will the dollar's bullish run continue?

Although we have been seeing a decline since September, the dollar upside hasn't faded. In fact, the rally will continue but with a lower momentum than in 2022.

1. The Fed showdown

After a year of aggressive hikes, and another hike anticipated in January 2023, the Fed will most likely maintain its policy rate and study the economy to evaluate the full impact of its tightening thus far. This delay should allow the dollar's surge to take a break.

According to the Fed's evaluation of economic estimates released on December 14, policymakers expect rates to range between 4.75% and 5.75% in 2023. The conclusion is that at least one more rate rise, if not several, will occur in 2023.

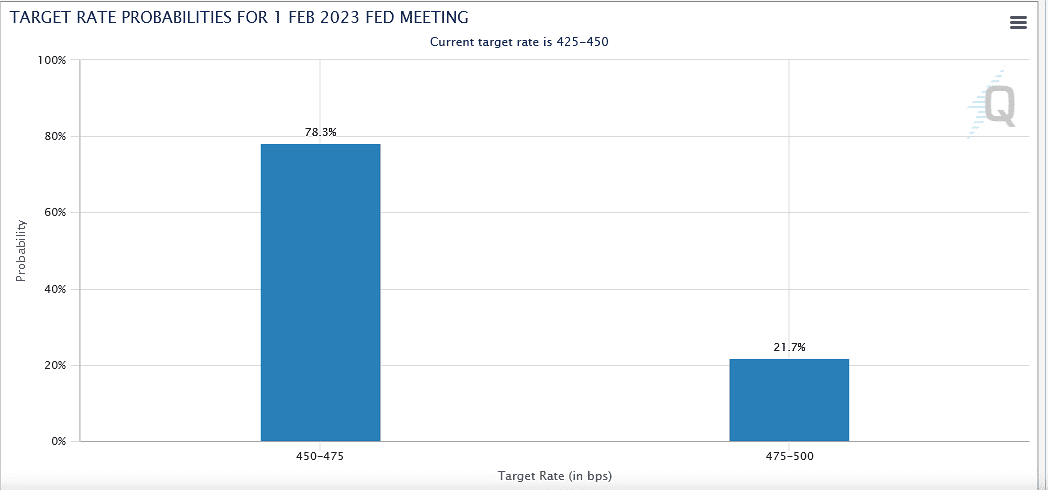

According to the CME's FedWatch, the central path is for the Fed to raise rates by 0.25 percentage points at its February 1 and March 22 meetings and then maybe keep rates stable after that.

Fed's current hike target

However, there is a potential, though it is less likely, that the Fed may go dovish, holding rates unchanged after a February 2023 rise, or hawkish, continuing to raise rates for the first half of 2023 if inflation does not trend positively.

The agreement is that the Fed is now close to the maximum level of interest rates that it intends to see, and the discussion revolves around where peak interest rates are and how long they will remain at that level. The Fed funds rate is expected to reach 5% in 2023.

Fed Chair Jerome Powell stated that no rate decreases are planned until 2023. He stated that the Fed would continue to hike rates until there is clear evidence that the path to its 2% inflation goal is achievable.

2. The recession talks

Economists agree that there will be a very moderate and brief recession in the year's first half, followed by a slower rebound. That implies the Fed keeps rates low while quickly shrinking its balance sheet.

That shows a scenario where the dollar may decline initially but remain strong throughout the year due to increasing interest rates.

The other view is that there will be no recession and that the US will get by with high job numbers and greater government spending. As a result, inflation may continue high, and the Fed may be less active in raising interest rates. This scenario assumes that the dollar would decline in the early part of the year before continuing its downward trend.

Wells Fargo views the dollar's last pushes before the downturn in its 2023 outlook.

"The greenback can experience a bout of renewed strength into early 2023. With the Fed likely to deliver more hikes than markets are priced for, a hawkish Fed should support the greenback. We believe the Fed will likely deliver more interest rate hikes than financial markets are priced for and more tightening than many other central banks."

However, by the middle of next year, the picture changes as the US economy begins to decline, putting pressure on the greenback.

According to a JP Morgan report, a Fed-less rate hike cannot cause a dollar decline. The USD's performance over the past four Fed pauses was inconsistent and dependent on the macroeconomic environment at the time. So, we can't jump to conclusions that the bullish will continue because of the hawkish Fed stance.

The Economist Intelligence published a report in November stating that they anticipate the US dollar will stay strong versus other currencies in 2023. As the Fed stops its monetary tightening in the first quarter of 2023, the dollar will begin to decline somewhat from its current high.

Bond King Jeff Gundlach says we should listen to the bond market, not the Fed. He expects the dollar to decline in 2023. He said that the dollar had peaked out.

According to him, below 5% Treasury yields are a significant signal that the US central bank would begin decreasing rates by the end of the year.

"My 40-plus years of experience in finance strongly recommends that investors should look at what the market says over what the Fed says," Gundlach said.

Other factors to look for

Besides the Fed, there are a lot of other factors that weigh in on the USD price in 2023.

Here we'll break down several factors that could increase or decrease the dollar in 2023.

1. The Euro recession

While a weaker Fed profile may be required for a bearish dollar turn, a sufficient condition requires a global economic situation attractive enough to lure capital away from the currency. Global growth predictions for 2023 are still being pulled down, primarily by the European recession.

Since the beginning of 2022, the Euro has declined rapidly against the US dollar, going below parity for the first time in 20 years in August.

2. China's reopening

Another topic to watch in 2023 is China's openness, especially as the nation lowers COVID rules and tackles an increase in cases.

The aim for China is that 2023 will be a year of normality, with the nation finally moving away from zero-COVID and practical policy assistance creating stability in the battered real estate market.

A reopening that is effective in restricting the spread of the virus and allows for growth to increase during the first half of the year will be a bearish scenario for the dollar.

However, due to COVID and many economic imbalances, there is still some speculation surrounding China's reopening. Investors may again be attracted to the US dollar for its safe-haven status if the Chinese government imposes restrictions. However, the probability of such an occurrence is low as the country is looking around economic recovery.

3. The carry trade

In addition, the carry trading environment will continue to favor the dollar. A carry trade is simply borrowing a low-yielding currency to buy a higher-yielding currency to benefit from the difference in interest rates.

The Fed's aggressive approach altered USD's carry status in 2022, with 56% of world currencies yielding less than the dollar. This incentivizes investors to acquire dollars in 2023, particularly when compared to low-yielding currencies like the JPY.

Trading Dollar online

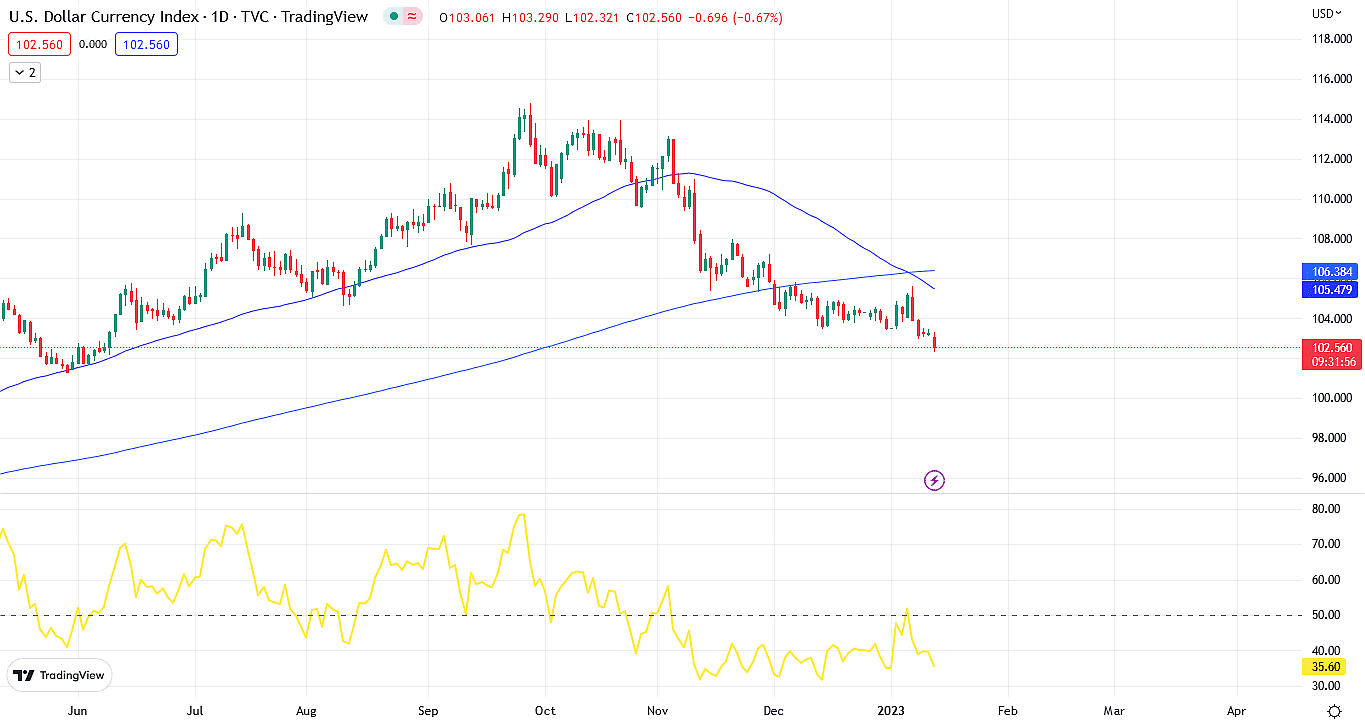

The DXY has remained in a downtrend since September. However, the bullish rally may return as it depends on many fundamental factors.

Looking at the price chart, as of January 12, the DXY is trading at 102.697, down by 8.76 in the last three months. However, it is up by 8.16% YTD.

The price has fallen below the 50 and 200-day moving averages. It also aims to produce a death cross, which occurs when the two MAs cross paths and the RSI is also in oversold territory.

DXY price chart

But that doesn't mean the situation in the FX market will not favor the greenback. The dollar rose against all its major competitors and will likely continue in 2023.

Because of Europe's recession, the EUR/USD might trade in a 0.95-1.05 zone for the majority of the year, with worries of another energy crisis in the winter of 2023 and conflict in Ukraine weighing on the currency. If the Russian-Ukraine situation de-escalates, the EUR can rise against the dollar.

Like other major currencies versus the US dollar, the pound is under pressure, falling to historic lows in September 2022 after the Truss government unveiled a series of tax cuts. Sterling should remain vulnerable in 2023 as the incoming administration strives to rebuild economic credibility.

In October 2022, the USD/JPY pair broke through 150, a 32-year low. This was primarily owing to Japan's massive trade imbalance and the BoJ's dovish attitude. The yen may stay under pressure versus the dollar in 2023 as long as the Fed and the BOJ differ. Analysts expect the yen to climb just a little versus the dollar when the Fed stops raising interest rates in mid-2023.

Fundamentally, commodity currencies appear undervalued about the US dollar. However, risk sentiment must stabilize before the gap can be closed. An improvement in China's medium-term outlook is also required for the Australian and New Zealand currencies. The Canadian dollar may surface as more appealing given its low exposure to Europe's and China's economic troubles.

USD price prediction for 2023

Some analysts say that the rise of the USD will continue in 2023; others anticipate a sideways movement, while the rest are bearish.

ING's FX strategists Chris Turner and Francesco Pesole said "FX markets are assuming that central banks can signal the all-clear on inflation and deliver gentle easing cycles to ensure soft landings in 2023. We suspect the reality will not be quite as kind to financial markets. We back a stronger dollar into early 2023."

TD Securities experts said, "USD outlook hinges on the intersection of 1) global growth, 2) terminal rate pricing, 3) terms of trade. While peak USD is here, global growth isn't strong enough to warrant a reversal. We expect consolidation in Q1 and a deeper correction afterwards."

CrossBorderCapital said, "A stronger US dollar has been a feature of the 2022 bear market in risk assets. US monetary tightness and a rush of foreign capital into US safe havens have lifted the US unit. 2023 will likely see a reversal of both drivers as policy-makers clamber to underpin fragile sovereign debt markets with liquidity and trigger a 15-20% correction in the US dollar."

ING said, "Conditions do not look to be in place for a clean dollar trend – no 'risk-on' dollar decline nor 'risk-off' dollar rally. And central banks tightening liquidity conditions through higher policy rates and shrinking balance sheets will only exacerbate the liquidity problems already present in financial markets. Volatility will stay high."

"EM equities are likely to recover as EM currencies strengthen and the US dollar weakens. We are entering 2023 with the bearish dollar position assumed in November," Tim Hayes, chief investment strategist at Ned Davis Research, expressed his forecast for the coming year.

Conclusion

There is enough uncertainty in global economic forecasts that a dollar decline in 2023 is not a done deal.

The first quarter will determine if the Fed follows through, indicating that rates will be higher than markets anticipate. The economic environment might change dramatically in the next months, changing the Fed's stance, which can lead to a weaker dollar in the last part of 2023.

Analysts share their opinions and forecasts which can be wrong. Always conduct your own research before making an investment decision. Never trade more than you can afford to lose.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.