Forex Today: Market focus shifts to US consumer sentiment data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Friday, May 16:

Markets adopt a cautious stance early Friday and the US Dollar (USD) finds it difficult to stay resilient against its major rivals. April Housing Starts and Building Permits data will be featured in the US economic calendar. Additionally, the University of Michigan will publish the preliminary Consumer Sentiment Index for May.

US Dollar PRICE This week

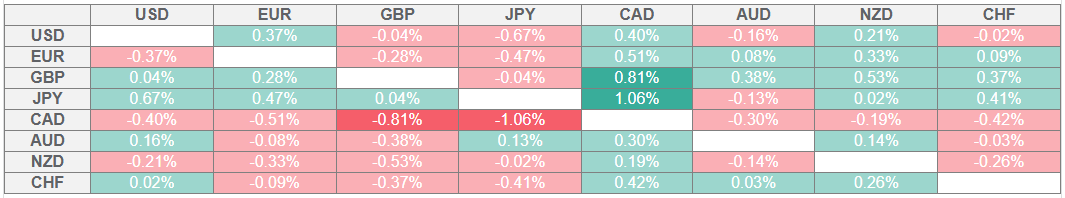

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index edged slightly lower in the American trading hours on Thursday after the Bureau of Labor Statistics reported that the Producer Price Index rose 2.4% on a yearly basis in April, compared to the 2.7% increase recorded in March. Other data from the US showed that Retail Sales increased 0.1% on a monthly basis in April, while the weekly Initial Jobless Claims came in at 229,000 to match the previous reading and the market expectation. After losing 0.2% on Thursday, the USD Index stays on the back foot and declines toward 100.50 in the European morning on Friday. In the meantime, US stock index futures trade mixed.

The data from Japan showed that the Gross Domestic Product contracted at an annual rate of 0.7% in the first quarter. This print came in worse than analysts' forecast for a 0.2% contraction. After closing in negative territory for three consecutive days, USD/JPY stays under bearish pressure and trades at a fresh weekly low slightly above 145.00.

Gold staged a decisive rebound in the second half of the day on Thursday and gained nearly 2%. XAU/USD reverses its direction on Friday and falls toward $3,200.

EUR/USD stays relatively quiet and continues to move up and down in a narrow channel near 1.1200 in the European morning on Friday. Eurostat will release Trade Balance data for March.

GBP/USD gained more than 0.3% on Thursday and erased Wednesday's losses. The pair seems to have entered a consolidation phase at around 1.3300.

The Reserve Bank of New Zealand reported that the Inflation Expectations edged higher to 2.29% for the second quarter from 2.06% in the previous quarter. NZD/USD rises more than 0.5% on Friday and trades above 0.5900.

Manufacturing Sales in Canada declined by 1.4% on a monthly basis in March, Statistics Canada reported on Thursday. USD/CAD trades marginally lower on the day near 1.3950 after posting small losses on Thursday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.