Here is what you need to know on Monday, June 16:

Market participants remain cautious at the beginning of the week as tensions in the Middle East rise, with Iran and Israel exchanging missile strikes. In the second half of the day, the Federal Reserve Bank of New York will publish the Empire State Manufacturing Survey for June. Later in the American session, the US Treasury will hold a 20-year note auction.

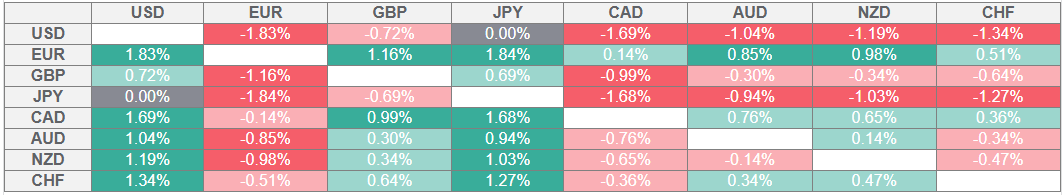

US Dollar PRICE This month

The table below shows the percentage change of US Dollar (USD) against listed major currencies this month. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The military conflict between Israel and Iran, which started early Friday, continues for the fourth consecutive day. On Sunday, Israel said that they killed the chief of Iran's armed forces intelligence unit. According to Iran's health ministry, more than 200 people have been killed in Israeli attacks. Meanwhile, several news outlets reported that Iranian missiles hit Israel’s largest oil refinery located in Haifa Bay.

Over the weekend, United States (US) President Donald Trump called upon Iran and Israel to make a deal. "We will have peace, soon, between Israel and Iran! Many calls and meetings now taking place," he added on Truth Social.

The US Dollar (USD) Index trades marginally lower on the day at around 98.00 in the European morning and US stock index futures stay in positive territory. On Wednesday, the Federal Reserve (Fed) will announce the interest rate decision and publish the revised Summary of Economic Projections (SEP), the so-called dot plot.

Gold started the week on a bullish note and climbed to its highest level in nearly two months above $3,450 before losing its traction. At the time of press, XAU/USD was down about 0.5% on the day below $3,420.

Crude oil prices shot higher on Friday and the barrel of West Texas Intermediate (WTI) rose more than 10% for the week. WTI corrects lower early Monday and trades slightly above $71.00, losing about 2% on the day.

Following Friday's decline, EUR/USD edges higher toward 1.1600 in the early European session on Monday.

The data from China showed earlier in the day that Retail Sales rose by 6.4% on a yearly basis in May. This reading came in better than the market expectation of 5%. In this period, Industrial Production expanded by 5.8%. AUD/USD holds its ground and trades in positive territory above 0.6500 on Monday.

GBP/USD ended the previous week higher despite posting daily losses on Friday. The pair clings to small daily gains and trades within a touching distance of 1.3600 in the early European morning.

USD/JPY struggles to find direction at the beginning of the week and fluctuates in a relatively tight channel above 144.00.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.