Here is what you need to know on Tuesday, September 9:

The US Dollar (USD) struggles to find demand early Tuesday after posting losses against its major rivals on Monday. Later in the day, NFIB Business Optimism Index for August will be featured in the US economic calendar. More importantly, the Bureau of Labor Statistics will publish the preliminary benchmark revisions to employment data.

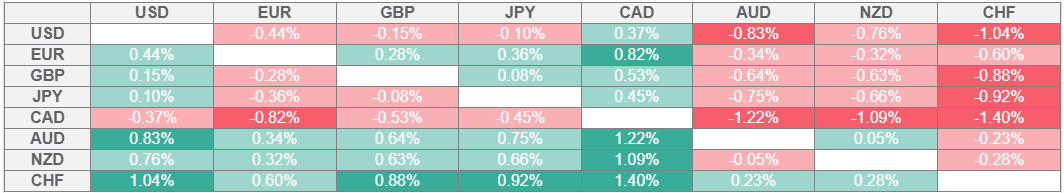

US Dollar Price Last 7 Days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Growing expectations of the Federal Reserve (Fed) opting for multiple rate cuts this year weighed on the USD at the beginning of the week, with the USD Index losing 0.3% and posting its lowest daily close since late July on Monday. Meanwhile, Wall Street's main indexes edged higher to close the day with modest gains. Early Tuesday, US stock index futures trade in positive territory.

During the Asian trading hours, the data from Australia showed that Westpac Consumer Confidence slumped to -3.1% in September from 5.7% in August. Furthermore, National Australia Bank's Business Confidence Index dropped to 4 in August from 8 in July. After rising more than 0.5% on Monday, AUD/USD seems to have entered a consolidation phase at around 0.6600 on Tuesday.

French Prime Minister François Bayrou lost the confidence vote, as anticipated, on Monday. President Emmanuel Macron is expected to announce a replacement in the coming days. Despite the political turmoil in France, EUR/USD benefited from the broad-based selling pressure surrounding the USD and closed in positive territory on Monday. In the European session on Tuesday, the pair fluctuates in a narrow range above 1.1750.

Gold extended its rally on Monday and continued to stretch higher to touch a new record-high near $3,660 on Tuesday. XAU/USD corrects lower in the European morning and trades below $3,650.

GBP/USD registered modest gains on Monday, supported by the persistent USD weakness. The pair holds its ground and trades in positive territory above 1.3550 early Tuesday.

USD/JPY remains under bearish pressure and declines toward 147.00 in the European session on Tuesday. Japan's trade negotiator Ryosei Akazawa earlier in the day that US tariffs on Japanese goods, including cars and auto parts, are set to be lowered by September 16.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.