EUR/JPY retraces to near 173.20 as the Japanese Yen strives to gain ground.

French PM Bayrou loses confidence vote in Parliament.

Investors expect the ECB to hold interest rates steady on Thursday.

The EUR/JPY pair trades 0.17% lower to near 173.20 during the late Asian trading session on Tuesday. The pair faces selling pressure as the Japanese Yen (JPY) bounces back against its peers, while the political crisis in Japan continues to prevail following the resignation of Prime Minister Shigeru Ishiba from his position of President in ruling Liberal Democratic Party (LDP).

Japanese Yen Price Today

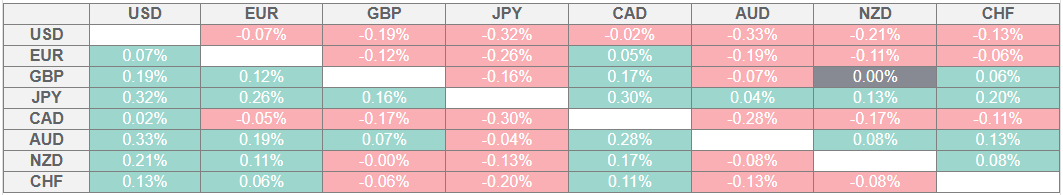

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

According to a report from NHK, Japan's PM Ishiba chose to step down to prevent a split within the party. Ishiba also stated that he will organize a leadership contest to choose his successor.

The political crisis in Japan comes at a time when the economy is facing trade war risk, and commentaries from Bank of Japan (BoJ) officials have indicated that they would struggle in hiking interest rates further.

In the Eurozone, the loss of French Prime Minister Francois Bayrou in the confidence vote after failing to gain enough support to pass the budget in Parliament has weighed on the Euro (EUR). Market experts believe that the downfall of the government for attempting to narrow the ballooning fiscal deficit will attract further credit-rating downgrades, a move that will increase borrowing costs for the administration.

This week, the major trigger for the Euro will be the announcement of the interest rate decision by the European Central Bank (ECB) on Thursday. Economists expect the ECB to hold the Deposit Facility Rate steady at 2% for the second time in a row.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.