Forex Today: US Dollar rally loses steam as focus shifts to US data, trade talks

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Tuesday, July 29:

The US Dollar (USD) holds steady against its rivals after posting impressive gains on Monday. Consumer Confidence report for July, alongside JOLTS Job Openings and Goods Trade Balance data for June, will be featured in the US economic calendar. Additionally, market participants will pay close attention to headlines coming out of the second day of trade talks between China and the United States (US).

US Dollar PRICE This week

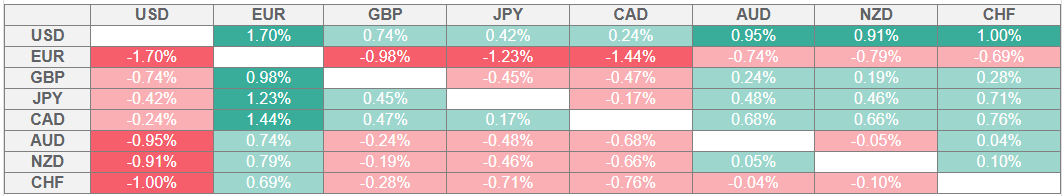

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index rose 1% on Monday and registered its largest one-day gain since May, as markets cheered the news of a trade deal between the European Union and the US. Reuters reported late Monday that US Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng worked to resolve "key trade and technology disputes, with China seeking relief from US tariffs and curbs on tech exports," during talks in Stockholm. Early Tuesday, the USD Index fluctuates in a tight channel at around 98.70, while US stock index futures trade modestly higher on the day.

USD/CAD gained about 0.3% on Monday and closed the third consecutive day in positive territory. Canadian Prime Minister Mark Carney noted on Monday that despite US President Donald Trump's claims that Canada is "difficult to deal with", trade talks are ongoing. PM Carney also noted that any offer on the table from the US is likely going to involve reactionary tariffs, making the effort to find middle ground a moot point. The pair stays in a consolidation phase in the European morning and trades slightly below 1.3750.

AUD/USD declined sharply on Monday, pressured by the broad-based USD strength. The pair stabilizes early Tuesday and fluctuates in a narrow channel above 0.6500. In the Asian session on Wednesday, the Australian Bureau of Statistics will publish Consumer Price Index (CPI) data for the second quarter.

EUR/USD fell more than 1% on Monday and erased all the gains it recorded in the previous week. The pair struggles to gain traction early Tuesday and trades below 1.1600.

GBP/USD stays on the back foot and trades below 1.3350 after losing about 0.6% on Monday. The Bank of England will publish Mortgage Approvals and New Lending to Individuals data for June later in the session.

USD/JPY corrects lower and trades below 148.50 after setting a fresh weekly-high at 148.70 during the Asian trading hours on Tuesday.

Gold started the week on a bearish noted and dropped to its lowest level in about three weeks near $3,300. XAU/USD stages a modest rebound early Tuesday and trades near $3,320.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.