Forex Today: ECB rate decision and US data to ramp up volatility

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Thursday, June 5:

Major currency pairs fluctuate within their weekly ranges early Thursday. The European Central Bank (ECB) will announce monetary policy decisions and the US economic calendar will offer Challenger Job Cuts data for May, weekly Initial Jobless Claims reading, alongside the Goods Trade Balance figures for April. ECB President Christine Lagarde will speak on the outlook and respond to questions in the post-meeting press conference. Finally, several Federal Reserve (Fed) policymakers are scheduled to deliver speeches in the second half of the day.

US Dollar PRICE This week

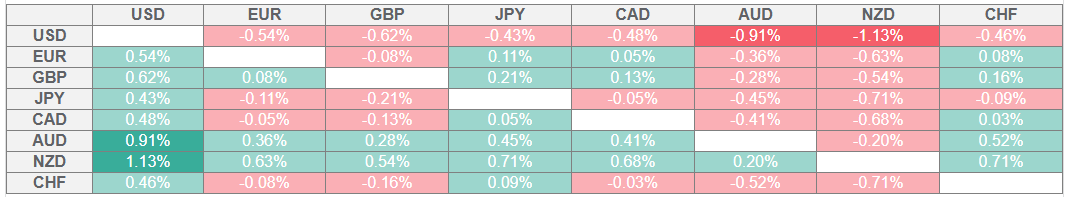

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) came under pressure following disappointing macroeconomic data releases on Wednesday. The Automatic Data Processing (ADP) reported that employment in the private sector rose by 37,000 in May, missing the market expectation of 115,000 by a wide margin. Additionally, the Institute for Supply Management's (ISM) Services Purchasing Managers Index (PMI) declined to 49.9 in May from 51.6 in April. The USD Index fell more than 0.4% on Wednesday before entering a consolidation phase at around 99.00 early Thursday. Meanwhile, US stock index futures trade marginally lower after Wall Street's main indexes closed mixed.

The data from Germany showed early Thursday that Factory Orders grew by 0.6% on a monthly basis in April. This print followed the 3.4% increase reported in March and came in better than the market expectation for a decrease of 1%. The ECB is widely expected to lower key rates by 25 basis points (bps) following the June meeting. Alongside the policy statement, the ECB will also release the updated staff projections. EUR/USD holds steady above 1.1400 in the European morning on Thursday.

GBP/USD benefited from the selling pressure surrounding the USD and closed in positive territory on Wednesday. The pair fluctuates in a narrow channel at around 1.3550 early Thursday.

USD/JPY declined sharply and lost nearly 0.9% on Wednesday. The pair corrects higher and trades above 143.00 to begin the European session.

AUD/USD holds steady at around 0.6500 after rising nearly 0.5% on Wednesday. The data from China showed earlier in the day that the Caixin Services PMI improved to 51.1 in May from 50.7 in April.

Gold continues to trade in a narrow band above $3,350 after posting small gains on Wednesday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.