Forex Today: Central bank speak to garner attention in absence of data releases

Here is what you need to know on Wednesday, May 14:

Major currency pairs stay relatively quiet early Wednesday following a volatile start to the week. Since the economic calendar will not offer any high-impact data releases, investors will focus on comments from central bankers and assess the latest trade talks.

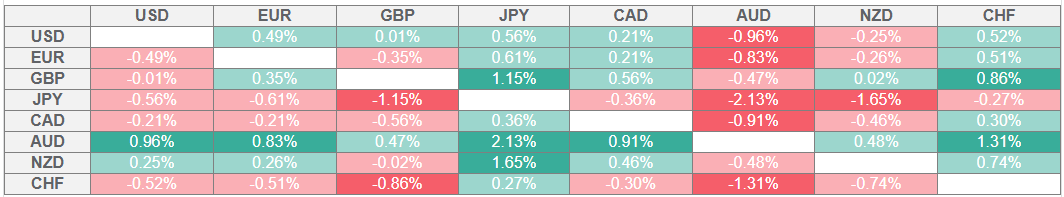

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

After outperforming its rivals on the US-China trade deal on Monday, the US Dollar (USD) came under bearish pressure on Tuesday. The data published by the Bureau of Labor Statistics showed that the Consumer Price Index (CPI) and the core CPI rose 0.2% on a monthly basis in April, coming in below the market expectation of 0.3% increase for both. The USD Index fell about 0.8% on the day and erased a majority of Monday's gains. Meanwhile, US President Donald Trump called upon the Federal Reserve to lower the interest rate again, arguing that there is no inflation.

During the Asian trading hours, the Australian Bureau of Statistics announced that the Wage Price Index rose 0.9% on a quarterly basis in the first quarter. This print followed the 0.7% increase recorded in the previous quarter and surpassed the market expectation of 0.8%. After rising about 1.5% on Tuesday, AUD/USD holds its ground in the European morning on Wednesday and trades marginally higher on the day above 0.6470. Early Thursday, April employment data from Australia will be watched closely by market participants.

EUR/USD gathered bullish momentum and gained nearly 1% on Tuesday. The pair stays calm and moves up and down in a narrow channel at around 1.1200 to begin the European session on Wednesday.

GBP/USD seems to have entered a consolidation phase near 1.3300 after rising 1% on Tuesday.

USD/JPY reversed its direction following Monday's decisive rally and lost about 0.75% on Tuesday. The pair continues to stretch lower early Wednesday and trades near 147.00.

Gold failed to benefit from the renewed USD weakness and registered small gains on Tuesday. XAU/USD stays on the back foot in the European morning and trades below $3,250.

USD/CAD closed in negative territory on Tuesday and snapped a four-day winning streak. The pair stabilizes above 1.3900 to begin the European session.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.