Forex Today: US Dollar regains traction on renewed optimism about easing US-China tensions

Here is what you need to know on Friday, April 25:

Following Thursday's decline, the US Dollar (USD) gathers strength against its rivals early Friday as markets assess the latest headlines surrounding the US-China trade relations. Statistics Canada will release Retail Sales data for February later in the day and the University of Michigan will publish revisions to the Consumer Sentiment Index for April.

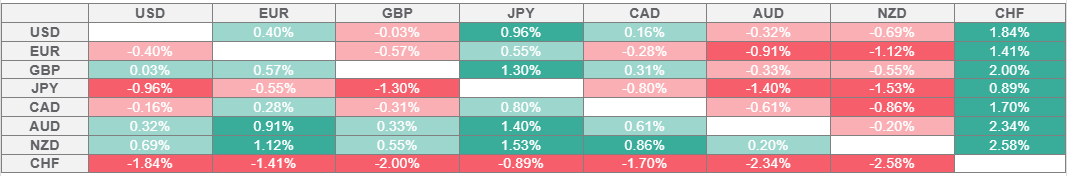

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

After losing 0.5% on Thursday, the USD Index edges higher toward 100.00 in the European morning on Friday. United States (US) President Donald Trump confirmed late Thursday that a meeting with Chinese officials took place earlier in the day. Additionally, Bloomberg reported, citing sources familiar with the matter, that China is mulling suspending its 125% tariff on some US imports including medical equipment, ethane, while discussing waiving the tariff for plane leases. US stock index futures rise between 0.1% and 0.5% in the European morning on Friday after Wall Street's main indexes registered strong gains on Thursday.

Following the Politburo meeting held early Friday, China noted that they will cut the Reserve Requirement Ratio (RRR) and interest rates in a timely manner. In the meantime, People's Bank of China (PBOC) Governor Pan Gongsheng said that they will implement a moderate and loose monetary policy to promote the development of the Chinese economy. After rising about 0.8% on Thursday, AUD/USD stays in a consolidation phase at around 0.6400 in the European morning on Friday.

Bloomberg News reported on Thursday that the European Central Bank (ECB) is preparing to revise its monetary-policy framework to allow for more agile responses to price shocks amid mounting global volatility. EUR/USD struggles to keep its footing and trades in negative territory at around 1.1350 to start the European session.

The UK's Office for National Statistics announced on Friday that Retail Sales rose by 0.4% on a monthly basis in March. This reading followed the 0.7% increase recorded in February and came in much better than the market expectation for a decrease of 0.4%. GBP/USD largely ignored these numbers and was last seen losing more than 0.2% on the day at around 1.3300.

Following a sharp two-day decline, Gold staged a rebound and gained nearly 2% on Thursday. Improving risk mood, however, caused XAU/USD to turn south once again on the last trading day of the week. At the time of press, the pair was testing $3,300, losing more than 1% on the day.

USD/JPY gains more than 0.6% on the day and trades at its highest level in 10 days near 143.50 in the European morning. Bank of Japan (BoJ) Governor Kazuo Ueda reiterated on Thursday that the Japanese central bank will continue to raise interest rates if underlying inflation converges toward its 2% inflation target as projected.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.