Australian Dollar holds gains following Judo Bank PMI data

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises above $4,950 as US-Iran tensions boost safe-haven demand

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Silver Price Forecast: XAG/USD rises to near $78.00 on safe-haven demand

The Australian Dollar retraces its losses registered in the previous session.

Australia's Judo Bank Purchasing Managers Index indicated that private sector activity grew for the seventh straight month in April.

President Trump reassured investors that he has no intention of removing Fed’s Powell, helping ease concerns about central bank independence.

The Australian Dollar (AUD) recovered some ground on Wednesday, retracing its losses from the previous session. The AUD/USD pair stabilized following the release of preliminary data from Australia's Judo Bank Purchasing Managers Index (PMI), which showed that private sector activity expanded for the seventh consecutive month in April, driven by continued growth in both manufacturing and services output.

The Judo Bank Manufacturing PMI edged down to a two-month low of 51.7 in April, compared to 52.1 in March. While manufacturing output remained in expansion territory, the increase in new orders was modest. Meanwhile, the Services PMI dipped slightly to 51.4 from 51.6 in the previous month, and the Composite PMI also eased to 51.4 from 51.6.

The AUD/USD pair came under pressure as the US Dollar (USD) strengthened, supported by comments from US Treasury Secretary Scott Bessent, who described the ongoing tariff standoff as “unsustainable,” suggesting a potential move toward de-escalation. Market sentiment was further boosted by US President Donald Trump, who reassured investors that he has no intention of removing Federal Reserve (Fed) Chair Jerome Powell, helping ease concerns about central bank independence and policy direction.

Australian Dollar advances as Trump says that tariffs on Chinese goods wouldn’t be high

President Trump also expressed optimism about ongoing trade negotiations with China, stating that discussions were progressing well. Trump added that while tariffs on Chinese goods wouldn’t be as high as 145%, they also wouldn’t be eliminated entirely.

The White House announced on Tuesday that the Trump administration is making headway in negotiating trade deals aimed at easing the broad tariffs introduced earlier this month. According to US Press Secretary Karoline Leavitt, 18 countries have already submitted trade proposals to the US, and President Trump’s trade team is scheduled to meet with representatives from 34 nations this week to explore potential agreements.

Federal Reserve Board Governor Adriana Kugler stated on Tuesday that the unexpectedly large US import tariffs are likely to push prices higher. As reported by Reuters, Kugler emphasized that the Federal Reserve should maintain current short-term interest rates until inflationary pressures begin to ease.

The US Consumer Price Index (CPI) inflation eased to 2.4% year-over-year in March, down from 2.8% in February and below the market forecast of 2.6%. Core CPI, which excludes food and energy prices, rose 2.8% annually, compared to 3.1% previously and missing the 3.0% estimate. On a monthly basis, headline CPI dipped by 0.1%, while core CPI edged up by 0.1%.

Reserve Bank of Australia's (RBA) March 31–April 1 Meeting Minutes indicated ongoing uncertainty around the timing of the next interest rate adjustment. Although the Board considered the May meeting a suitable point to review monetary policy, it stressed that no decisions had been made in advance. The Board also pointed to both upside and downside risks facing Australia's economy and inflation trajectory.

China’s economy grew at an annual rate of 5.4% in the first quarter of 2025, matching the pace seen in Q4 2024 and surpassing market expectations of 5.1%. On a quarterly basis, GDP rose by 1.2% in Q1, following a 1.6% increase in the previous quarter, falling short of the forecasted 1.4% gain.

Australian Dollar hovers around 0.6400, nine-day EMA acts as immediate support

The AUD/USD pair is hovering near 0.6390 on Wednesday, with daily chart technicals signaling a bullish bias. The pair remains above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) holds firm above the 50 mark—both indicators pointing to continued upward momentum.

On the upside, immediate resistance lies at the recent four-month high of 0.6439, reached on April 22. A clear break above this level could open the door for a rally toward the five-month high of 0.6515.

To the downside, initial support is seen at the nine-day EMA near 0.6350, followed by stronger support around the 50-day EMA at 0.6295. A sustained move below these levels could invalidate the current bullish outlook and expose the pair to deeper losses, potentially targeting the March 2020 low near 0.5914.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

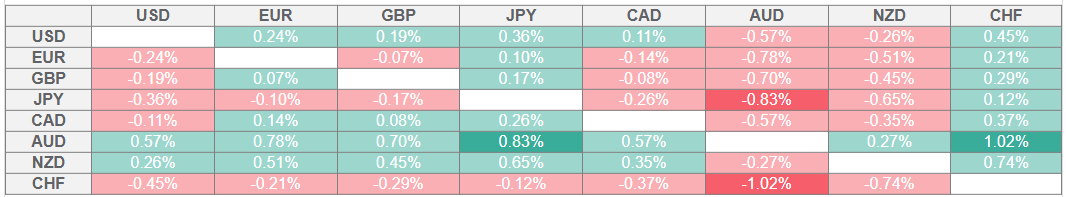

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.