Australian Dollar loses ground following downbeat Monthly CPI

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

The Australian Dollar weakened as the Monthly Consumer Price Index rose 2.4% YoY in February, against the expected 2.5% increase.

Australian Treasurer Jim Chalmers unveiled the 2025/26 budget on Tuesday, proposing tax cuts totaling around A$17.1 billion over two rounds.

The US Dollar strengthens as market caution grows ahead of US President Donald Trump's tariff announcement on April 2.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) after Wednesday’s release of the Monthly Consumer Price Index (CPI), which rose 2.4% year-over-year in February, slightly below January’s 2.5% increase and market expectations of 2.5%.

Australian Treasurer Jim Chalmers presented the 2025/26 budget on Tuesday, outlining key economic forecasts and tax cuts totaling approximately A$17.1 billion across two rounds. The budget deficit is projected at A$27.6 billion for 2024-25 and A$42.1 billion for 2025-26. GDP growth is expected to reach 2.25% in the fiscal year 2026 and 2.5% in 2027. The tax cuts appear aimed at strengthening political support.

The AUD finds support as investors anticipate the Reserve Bank of Australia (RBA) will keep interest rates unchanged next week, following its first rate cut of 25 basis points in four years this past February. RBA Assistant Governor (Economic) Sarah Hunter reaffirmed the central bank’s cautious stance on further cuts, with February’s policy statement signaling a more conservative approach than market expectations, particularly regarding US policy decisions and their impact on Australia’s inflation outlook.

Additionally, expectations of Chinese stimulus could boost the Australian economy, given strong trade ties between the two nations. China’s Communist Party and State Council have proposed measures to "vigorously boost consumption" by raising wages and easing financial burdens—an effort to restore consumer confidence and revitalize the struggling economy.

Australian Dollar depreciates as US Dollar gains support amid market caution

The US Dollar Index (DXY), which tracks the USD against six major currencies, retraces its recent losses from the previous session and is trading around 104.30. The US Dollar gains support as market caution rises ahead of US President Donald Trump's tariff announcement on April 2. While Trump suggested that "a lot" of countries could receive exemptions, the specifics of his administration’s tariff strategy remain uncertain.

On Wednesday, the Toronto Star cited sources indicating that Canada might face lower-end tariffs in the upcoming measures. However, nothing is guaranteed. Trump is reportedly considering three escalating tariff levels, though some sources suggest this tiered approach is not officially on the table. Nonetheless, it aligns with the government’s expectations for what may unfold next week.

The S&P Global reported on Monday that the US Composite PMI climbed to 53.5 in March, up from February's 10-month low of 51.6, signaling the strongest growth since December 2024. Services PMI surged to 54.3 in March, a three-month high, from 51.0 in February. Meanwhile, the Manufacturing PMI dropped to 49.8 from 52.7, falling short of market expectations of 51.8.

Federal Reserve (Fed) Governor Adriana Kugler stated on Tuesday that the central bank’s interest rate policy remains restrictive and appropriately positioned. However, she acknowledged that progress toward the 2% inflation target has slowed since last summer and described the recent rise in goods inflation as "unhelpful."

Atlanta Fed President Raphael Bostic emphasized ongoing uncertainty on Monday, stating that inflation progress may be slower than previously projected. Bostic trimmed his 2025 rate cut expectations, citing persistent price pressure and trade-related risks.

On Monday, Australia’s Judo Bank Manufacturing PMI climbed to 52.6 in March from 50.4 in February, while the Services PMI improved to 51.2 from 50.8. The Composite PMI also increased, reaching 51.3 in March compared to 50.6 previously.

Australian Dollar pulls back from 0.6300 barrier near nine-day EMA

The AUD/USD pair is trading near 0.6280 on Wednesday, with technical indicators signaling a bearish bias as the pair consolidates within a descending channel. The 14-day Relative Strength Index (RSI) remains slightly below 50, reinforcing the persistent downward momentum.

On the downside, the AUD/USD pair could navigate the region around the lower boundary of the descending channel at 0.6210, followed by the seven-week low of 0.6187, recorded on March 5.

The nine-day Exponential Moving Average (EMA) at 0.6306, aligned with the descending channel’s upper boundary, acts as the immediate barrier. A breakout above this crucial resistance zone could weaken the bearish bias, with the pair potentially testing the monthly high at 0.6391, which reached March 18.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

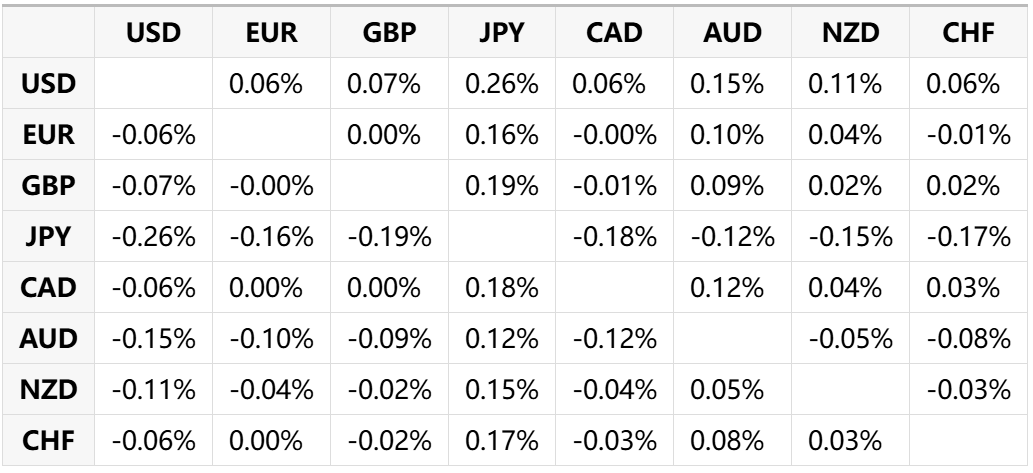

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.