- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Affected by the intensification of geopolitical tensions in the Middle East after the US air strike on Iran's nuclear facilities, the safe-haven appeal of the US dollar soared, pushing the Japanese yen to its lowest level in more than five weeks.

The US dollar became the strongest among the currencies of the Group of Eight on Monday. The US dollar index, which measures the exchange rate of the US dollar against major global trading currencies, has broken through last week's high and is currently slightly lower than the June high of 99.40.

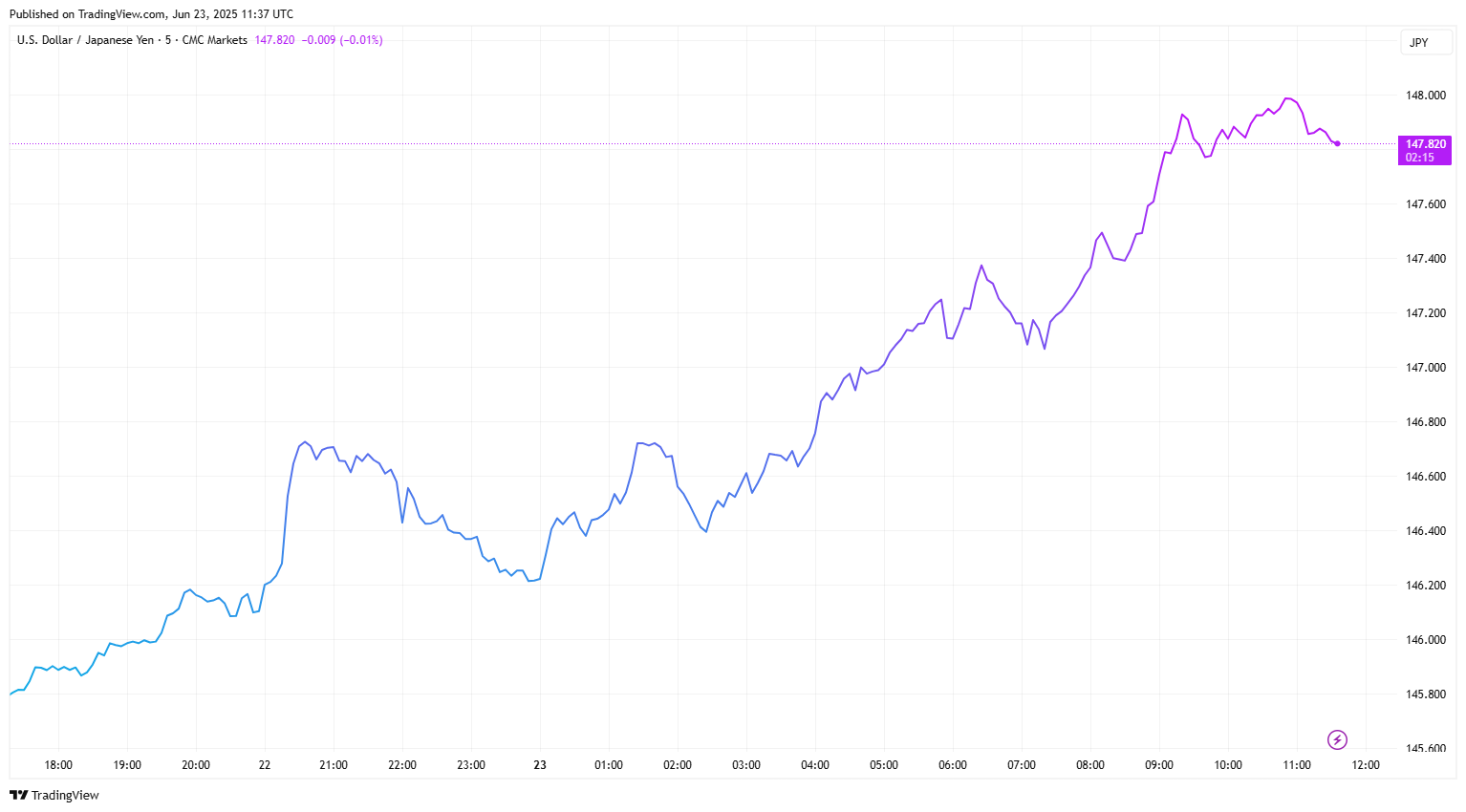

The USD/JPY soared during the European trading session. As of the time of writing this article, it was trading around 147.82, with a daily increase of more than 1.15%. The strong upward momentum of this currency pair reflects that traders are flocking to the US dollar for safe havens.

Source: TradingView

Despite the positive economic signals released by Japan, the yen failed to gain support.

Japan's composite PMI rose to 51.4 in June, the fastest increase since February. Among them, the manufacturing PMI rose from 48.6 to 51.3, exceeding the expected 49.5. The PMI of the service sector also rose slightly from 51.0 to 51.5, marking the third consecutive month of growth in the private sector.

However, these optimistic data have largely been ignored by the market because traders are focusing on the escalating conflicts among Israel, Iran, and the United States, which have intensified people's concerns about the crisis in a wider region.

The soaring global crude oil prices triggered by tensions in the Middle East have further put pressure on the Japanese yen. Japan relies heavily on energy imports. With the soaring oil prices, the country's trade imbalance problem is likely to deteriorate further. This has further weakened investors' confidence in the yen.

Citibank analysts have warned that the rise in oil prices will deteriorate Japan's trade balance and terms of trade, fundamentally weakening the yen. In a recent report, the bank reaffirmed its bearish expectation of the yen, predicting that the yen would reach 150 against the US dollar by September.

As geopolitical risks intensify and energy costs rise, the short-term outlook for the Japanese yen remains gloomy, while the US dollar's dominance is likely to persist.

Read more

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.