EUR/USD Price Analysis: Oscillates in a range above 100-day SMA ahead of German CPI

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

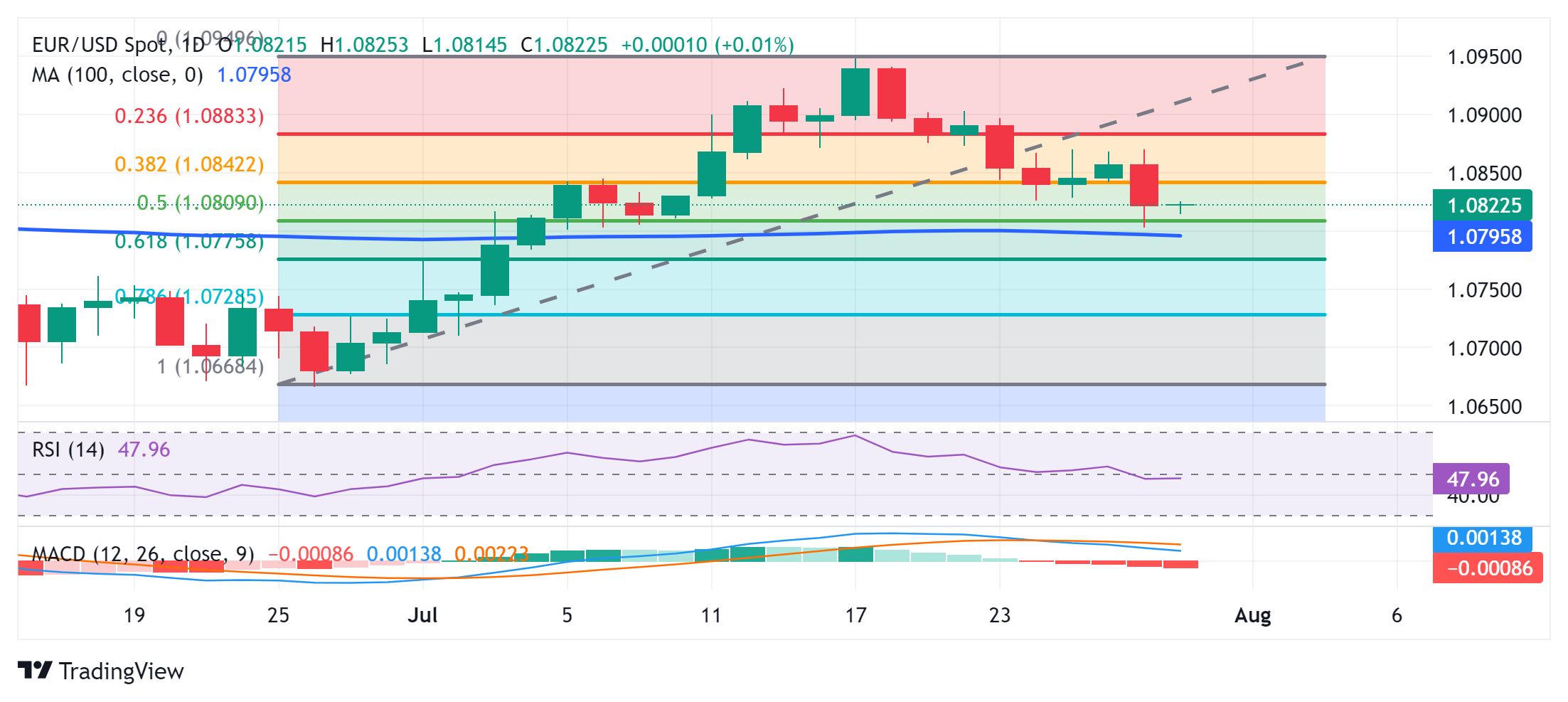

■ EUR/USD consolidates in a range above a two-and-half-week low touched on Monday.

■ September Fed rate cut bets keep the USD bulls on the defensive and act as a tailwind.

■ A sustained break below 100-day SMA is needed to support prospects for further losses.

The EUR/USD pair struggles to build on the overnight bounce from the 1.0800 neighborhood, or a two-and-half-week low and oscillates in a narrow range during the Asian session on Tuesday. Spot prices currently trade around the 1.0820-1.0825 region, nearly unchanged for the day as traders opted to wait for the release of the flash German consumer inflation figures before positioning for a firm intraday direction.

The market focus will then shift to the flash Eurozone CPI report on Wednesday, which will be followed by the outcome of a two-day FOMC monetary policy meeting. Apart from this, key US macro data scheduled at the start of a new month, including the Nonfarm Payrolls (NFP) report on Friday, will be looked for more cues about the Federal Reserve's (Fed) rate-cut path. This, in turn, will play a key role in influencing the near-term USD price dynamics and determining the next leg of a directional move for the EUR/USD pair.

From a technical perspective, spot prices showed resilience below the 50% Fibonacci retracement level of the June-July rally on Monday, though the lack of any meaningful buying warrants caution for bulls. Moreover, oscillators on the daily chart have started gaining negative traction, suggesting that the path of least resistance for the EUR/USD pair is to the downside. That said, acceptance below the 100-day SMA is needed to support prospects for an extension of the recent pullback from a four-month peak, around mid-1.0900s touched on July 17.

Spot prices might then weaken further below the 61.8% Fibo. level near the 1.0775 region and test the next relevant support near the 1.0745 horizontal zone. This is closely followed by the 78.6% Fibo. level near the 1.0730 area, below which the EUR/USD pair is likely to challenge the June monthly swing low, around the 1.0660 region, with some intermediate support near the 1.0700 round-figure mark.

On the flip side, any subsequent move up is likely to confront resistance near the 1.0840-1.0845 region or the 38.2% Fibo. level. A sustained strength beyond the latter could lift the EUR/USD pair above the 1.0865 horizontal barrier, towards the 1.0885-1.0890 region. Some follow-through buying beyond the 1.0900 mark should allow bulls to aim back towards resting the multi-month peak, around mid-1.0900s.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.