EUR/USD rally sponsored by US jobless claims rise, Q1 US GDP confirms contraction.

Markets now price in nearly 50 bps of Fed cuts by year-end amid weakening data.

Traders eye Core PCE data Friday; German and Italian inflation to guide Euro’s next move.

The EUR/USD rallies after hitting a weekly low of 1.1210, edging up over 0.70% on Thursday as jobs economic data from the United States (US) came in softer, weakening the US Dollar, which is also undermined by falling US yields. At the time of writing, the pair trades at 1.1376.

The US economic docket revealed that Americans filing for jobless benefits increased in the week ending May 24, as reported by the US Department of Labor. Additionally, the confirmation of a contract in Gross Domestic Product (GDP) figures for Q1 2025 pressured the Greenback and lifted the EUR/USD above the 1.1300 figure.

Following the data release, traders priced in almost two 25-basis-point (bps) interest rate cuts by the end of the year, according to the December 2025 fed funds rate futures contract.

Other data showed that Pending Home Sales in April fell by the most since September 2022.

Meanwhile, traders bought the Greenback, which, according to the US Dollar Index (DXY), is down 0.57%, at 99.30.

Across the pond, the Eurozone (EU) economic docket was quiet today. However, it would gather pace on Friday. Germany will unveil Retail Sales for April and inflation figures for May. Italy will feature inflation figures.

In the US, EUR/USD traders will take cues of the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation gauge, expected to slow moderately in April.

Euro PRICE This week

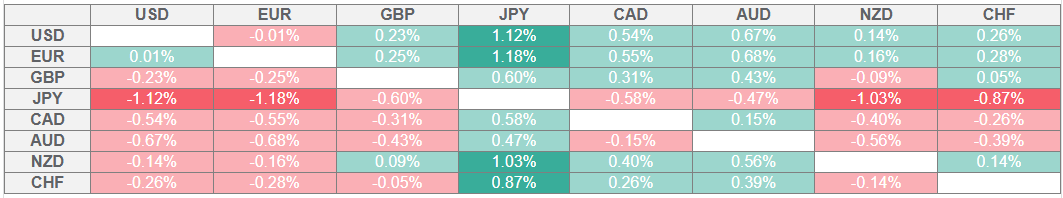

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD daily market movers: Rallies amid overall US Dollar weakness

US Initial Jobless Claims rose to 240K for the week ending May 24, up from 226K and above the 230K forecast, signaling some softening in the labor market.

The second estimate of US Q1 GDP showed a -0.2% contraction QoQ, a sharp downward revision from the previous 2.4% expansion, pointing to an economic slowdown.

The US Court of International Trade, in a ruling by a three-judge panel, declared that the Trump administration improperly used a 1977 law to justify its “Liberation Day” tariffs on dozens of countries, deeming the measures illegal.

On Wednesday, the Federal Reserve highlighted growing concern over the uncertain impact of tariffs, prompting officials to adopt a patient stance amid risks of elevated inflation and rising unemployment. Policymakers acknowledged stagflation risks, noting the Fed could face “difficult tradeoffs” if inflation remains sticky while growth and employment weaken.

Financial market players had fully priced in that the ECB would reduce its Deposit Facility Rate by 25 basis points (bps) to 2% at the monetary policy meeting next week.

EUR/USD technical outlook: Bounces off weekly lows near 1.1200, approaches 1.14

EUR/USD uptrend resumed on Thursday, with the shared currency approaching stir resistance at 1.14, as buyers bought the pullback that drove prices as low as 1.1210. However, worse-than-expected US data pushed the pair higher to hit two-day highs of 1.1384 as buyers prepared to launch an assault at 1.14. A breach of the latter will expose the April 22 high of 1.1547, ahead of the year-to-date (YTD) peak of 1.1572.

On the flip side, if EUR/USD tumbles below 1.1300, expect a test of the 20-day Simple Moving Average (SMA) at 1.1269, followed by the 50-day SMA at 1.1183.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.