XRP gains 6% as SEC acknowledges CoinShares, Canary and WisdomTree's XRP ETF filings

SEC accelerates the XRP ETF filing process by acknowledging CoinShares, Canary and WisdomTree's applications.

The new SEC administration has yet to pause the agency's litigation against Ripple due to prioritization of cases with imminent court deadlines.

Hashdex received approval from Brazil's SEC to launch the world's first spot XRP ETF.

XRP could rally to test its seven-year high of $3.40 if it sustains a firm close above a symmetrical triangle's resistance.

Ripple's XRP saw a 6% uptick above $2.70 on Wednesday following the Securities & Exchange Commission’s (SEC) accelerated acknowledgment of XRP ETF filings. Meanwhile, asset manager Hashdex could launch the world's first spot XRP ETF in Brazil after receiving the country's SEC-equivalent authority approval.

XRP ETFs take center stage as SEC acknowledges filings

The SEC acknowledged XRP ETF filings from Nasdaq and Cboe BZX exchanges on behalf of CoinShares, Canary Capital and WisdomTree, respectively, per three separate Wednesday filings on the agency's website.

The agency is requesting comments on these filings in the next 21 days or after publishing them in its Federal Register. A 240-day window opens for the SEC to decide on approving or rejecting the filings immediately after publishing them in the Register.

This follows the SEC's acknowledgment of XRP ETF filings from Grayscale and Bitwise in the past few days.

The SEC's case against Ripple could play a major role in the agency's decision on these XRP ETF filings.

Following the SEC's pausing of several litigations the previous Gary Gensler-led administration pursued against crypto companies, including Coinbase and Binance, XRP investors have anticipated a similar action on the agency's case against Ripple.

However, the new administration under acting Chair Mark Uyeda has yet to make any comments on the SEC's appeal against Judge Analisa Torres's ruling in its case with Ripple.

A potential reason for the delay is that the SEC is "prioritising cases with imminent court deadlines [as] Ripple's next court deadline is April 16," according to Fox Business's Eleanor Terrett, citing multiple legal sources.

Meanwhile, asset manager Hashdex got the green light from Brazil's SEC to launch the world's first spot XRP ETF, ahead of its US counterparts. It's important to note that other forms of XRP investment products are already trading in other countries.

These latest developments could boost investor interest in XRP as it aims to recover from the market downturn on February 3.

XRP could stage a rally to $3.40 if it surpasses symmetrical triangle resistance

XRP saw $8.10 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $1.81 million and $6.29 million, respectively.

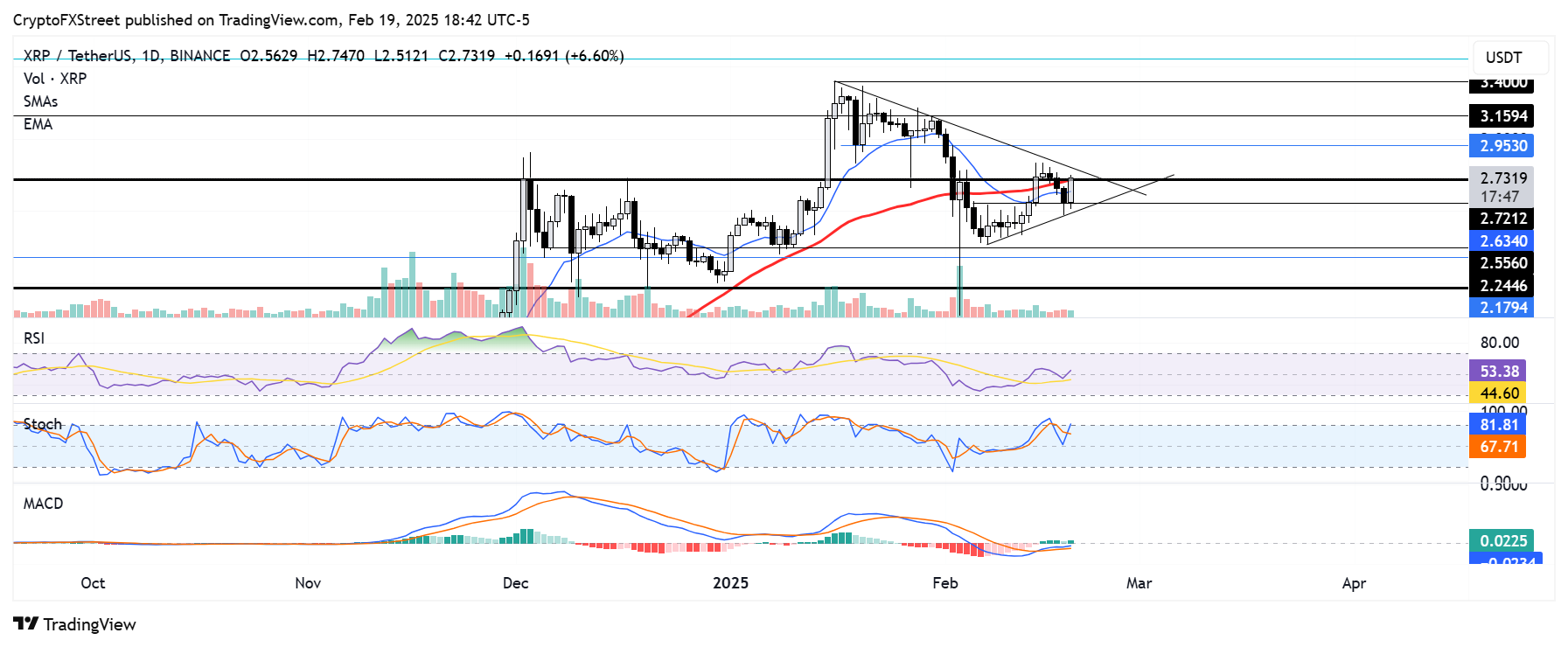

After bouncing off the lower boundary line of a symmetrical triangle, XRP recovered the $2.55 support level with a 6% rise in the past 24 hours.

XRP/USDT daily chart

The remittance-based token is testing the $2.72 resistance, strengthened by the 50-day Simple Moving Average (SMA). If XRP fails to see a rejection at this level and breaks the symmetrical triangle upper boundary resistance with a high volume, it could rally to test its seven-year high of $3.40.

A rejection at $2.72 could send XRP back to the triangle's lower boundary line if the $2.55 support level fails.

The Relative Strength Index (RSI), Stochastic Oscillator (Stoch) and Moving Average Convergence Divergence (MACD) are above their neutral levels, indicating dominant bullish momentum.

A daily candlestick close below $2.24 will invalidate the thesis and could send XRP to find support near the $1.96 level.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.