Ripple's XRP eyes a recovery as investors switch toward accumulation

- Gold Price Forecast: XAU/USD rises to near $4,150 as Fed rate cut bets grow

- Bitcoin Price Forecast: BTC extends recovery as ETF records positive flows

- Silver Price Forecast: XAG/USD bulls remain focused on the $54.40 level

- 2025 Black Friday is coming! Which stocks may see volatility?

- Fed Officials Speak Out in Force to Back Rate Cut! December Cut Now a Done Deal? Will the FOMC Meeting Be Delayed?

- USD/JPY gathers strength to near 156.50 on mixed Fed signals

XRP investors have been accumulating following an uptrend in the Mean Coin Age metric.

However, the XRP derivatives market is yet to recover from a 30% open interest decline in the past week.

XRP eyes $2.55 but risks liquidating long positions worth over $80 million if it declines to $2.26.

Ripple's XRP is up 2% in the early Asian session on Thursday following rising accumulation among investors and a potential bottom signal in the MVRV Ratio.

XRP on-chain data indicate accumulation as derivatives trades stall

After the February 3 crypto market crash, XRP investors have largely switched towards accumulation in the past five days as buy-the-dip sentiment is becoming prevalent.

On-chain data shows that XRP has seen very minimal selling activity and more accumulation as indicated by an uptrend in Mean Coin Age metric. This metric shows the average number of days all XRP tokens remained in their current addresses. An uptrend signifies network-wide accumulation and vice versa for a downtrend.

XRP Mean Coin Age. Source: Santiment

Also, the 30-day Market Value to Realized Value (MVRV) ratio is indicating a potential bottom after hitting -17% in the past week. The last time this metric saw such low levels, XRP rallied over 60%. If history repeats itself, XRP could see a rally in the coming days.

XRP 30-day MVRV Ratio. Source: Santiment

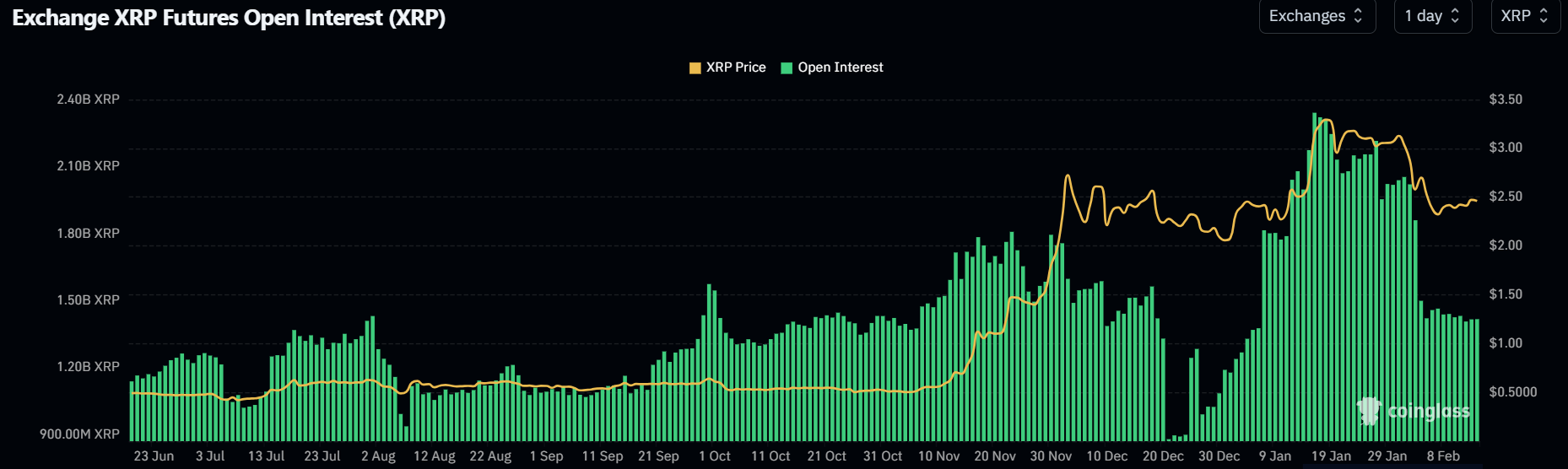

Despite signs of accumulation in the spot market, XRP's derivatives market shows traders are largely exercising caution. XRP's open interest has declined over 30% from 2.05 billion XRP to 1.42 billion XRP.

Open interest is the total amount of unsettled contracts in a derivatives market. XRP's OI needs to grow to help fuel a rally.

XRP Open Interest. Source: Coinglass

Meanwhile, the SEC acknowledged Grayscale's XRP ETF filing on Tuesday, following a 65% chance of approval placed on them by Bloomberg analysts Eric Balchunas and James Seyffart.

XRP eyes $2.55 but could spark an $80 million long squeeze if it declines toward $2.26

XRP saw $5.91 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $2.80 million and $3.11 million, respectively.

Since the February 2-3 market crash sparked by anticipation of a global trade war, XRP has been trading within a key rectangular channel marked by the $2.26 support level and the $2.55 resistance level. The current price trend signifies uncertainty among traders as the crash wiped out several long traders.

XRP/USDT 4-hour chart

However, if XRP moves above the $2.55 level and successfully overcomes the resistance near $2.72, it could incentivize a high volume of bullish bets to return to the market.

On the downside, if XRP breaches the $2.26 support, it could spark a more than $80 million long squeeze, per Coinglass data. In such a scenario, XRP could find support at $1.96.

The Relative Strength Index (RSI) and Stochastic Oscillator are above their neutral levels, indicating short-term bullish momentum.

A daily candlestick close below $1.96 will invalidate the thesis.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

[04.26.58, 13 Feb, 2025]-638750156741386753.png)

[04.26.43, 13 Feb, 2025]-638750157201606758.png)