Shiba Inu hits new milestone, over $9 billion worth of SHIB tokens burnt

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Top 3 Price Prediction: BTC, ETH and XRP remain range-bound as breakdown risks rise

Shiba Inu has burned over $9 billion worth of SHIB tokens from the total supply.

SHIB holders have consistently realized losses throughout April, nearly $45 million.

SHIB is likely primed for a recovery, backed by bullish on-chain metrics.

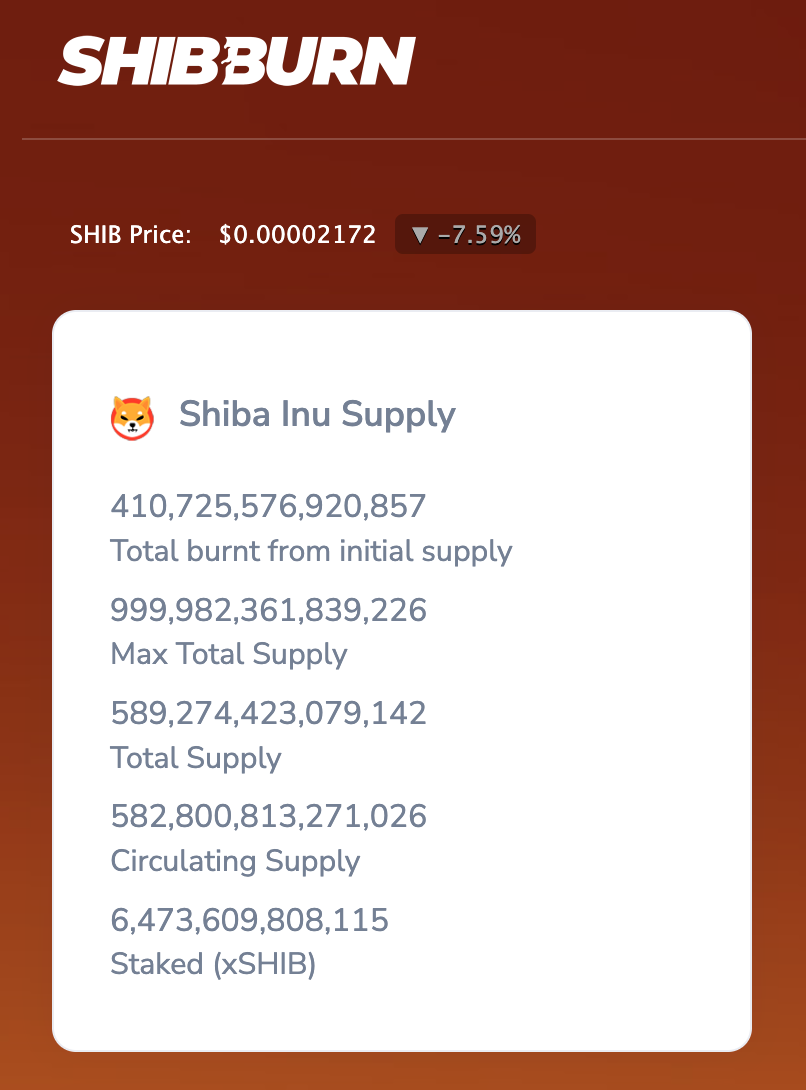

Shiba Inu (SHIB), the second-largest meme coin in the crypto ecosystem, recently hit a milestone in the volume of tokens burned. Shiba Inu has burnt over 410.72 trillion SHIB tokens since the inception of the burn mechanism in the project, worth over $9 billion.

Shiba Inu price is likely to recover, as on-chain metrics from Santiment paint a bullish picture for the meme coin.

Three factors that could catalyze Shiba Inu recovery

Three factors that could fuel a recovery in SHIB are:

Shiba Inu token burn closes in on a key milestone, elimination of over $9 billion worth of SHIB from circulation on April 16.

Market Value to Realized Value (MVRV) for SHIB is currently in the opportunity zone, in both 7-day and 30-day timeframes.

SHIB holders have consistently realized losses, amounting to $45 million throughout April, signaling the likelihood of a capitulation in the meme coin.

Data from Shibburn shows that Shiba Inu token burn removed around $9 billion worth of SHIB from the supply, reducing SHIB in circulation and typically easing the selling pressure on the meme coin.

Shiba Inu supply

Santiment data shows that when MVRV 7-day and 30-day dips in the zone marked in the chart below (between -6% and -18%), there is an increase in SHIB price in the timeframe of a week. The MVRV is back in the opportunity zone and this signals that SHIB price gains are likely.

MVRV ratio 7-day and 30-day

Data from Network Realized Profit/Loss metric (NPL) shows that SHIB holders have consistently realized losses amounting to $45 million in April until the time of writing. When NPL spikes alongside a price decline it is indicative of capitulation in the asset, typically followed by a price increase.

Network realized profit/loss

SHIB price is $0.00002232, on Binance, at the time of writing. The meme coin’s price wiped out nearly 23% of its value in the past week.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

%20[15.04.32,%2016%20Apr,%202024]-638488683576391678.png)

%20[15.01.36,%2016%20Apr,%202024]-638488683910956807.png)