Glassnode’s Bitcoin “Seller Exhaustion” Indicator Just Flashed A Signal: Bottom In?

- 270,000 People Instantly Liquidated. Crypto Earthquake, Just Because This Person Might Take Over the Fed?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Is Silver’s ‘Meme Moment’ Arriving? Surging Prices Mask Momentum Bubble Concerns

- Gold Price Forecast: XAU/USD gains momentum to near $5,050 amid geopolitical risks, Fed uncertainty

- Dollar Slumps to Four-Year Low, Trump Still Says ‘Dollar Is Doing Great’?

- Bitcoin No Longer Digital Gold? Gold and Silver Token Market Cap Hits Record $6 Billion

A Bitcoin indicator created by the on-chain analytics firm Glassnode has just given a signal that could suggest the exhaustion of selling pressure in the market.

Bitcoin Seller Exhaustion Has Just Registered A Spike

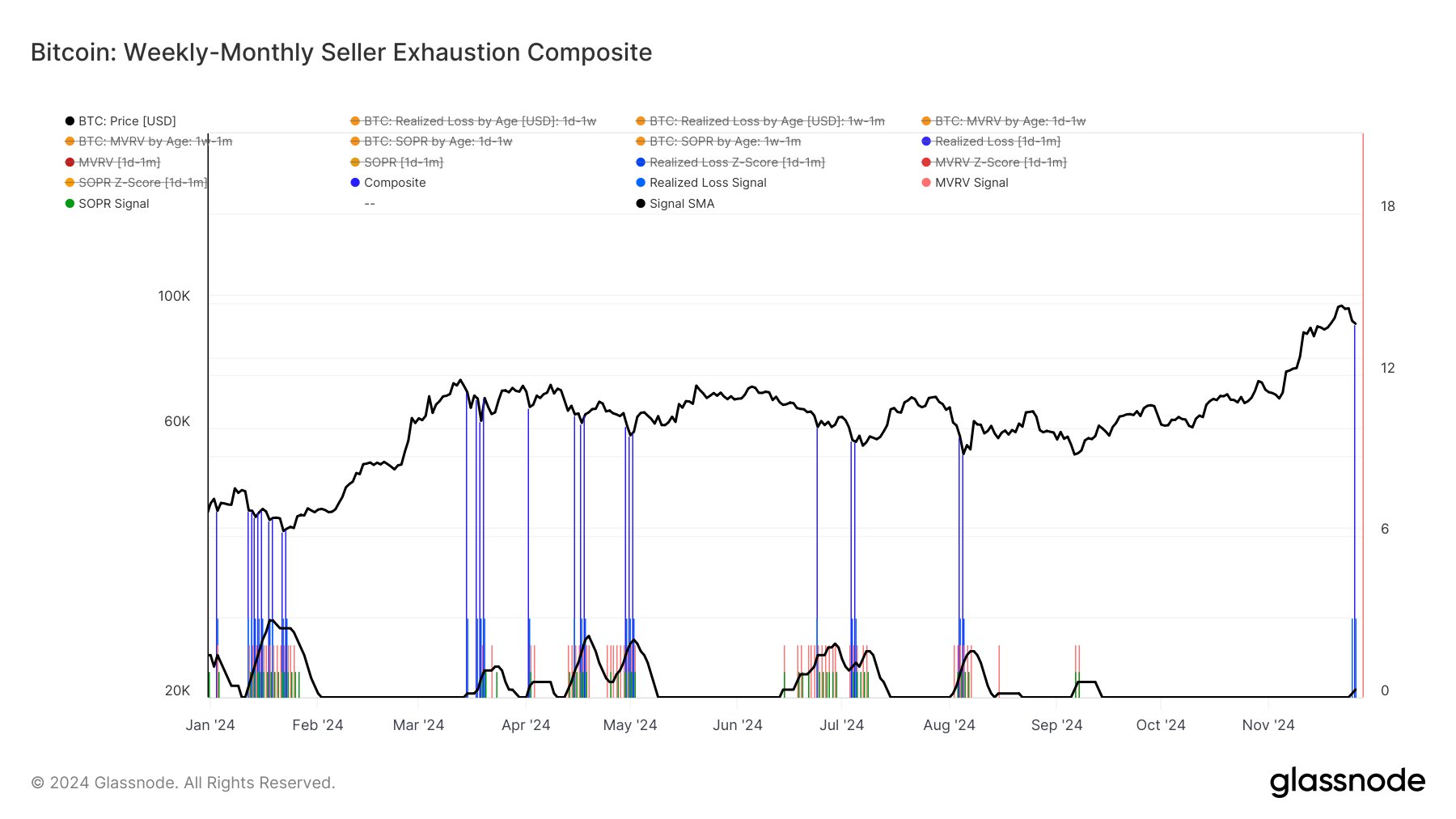

In a new post on X, Glassnode has shared an update on the Seller Exhaustion Composite for the Weekly-Monthly Bitcoin traders. The “Seller Exhaustion Composite” here refers to an indicator that basically identifies whether selling on the network has reached a state of exhaustion or not.

The metric bases itself on a few on-chain indicators, with perhaps the most notable being the Realized Loss, which measures the total amount of loss that the BTC investors are locking in.

Historically, the cryptocurrency’s price has tended to form bottoms whenever holder capitulation has reached a high. In such loss-taking events, coins transfer from the weak hands to the resolute entities, so the risk of further selling reduces, allowing for the asset to find a rebound.

In the context of the current topic, the Seller Exhaustion Composite of only the Weekly-Monthly BTC traders is of interest. These are the investors who purchased their coins between one day and one month ago. The reason Glassnode has picked this specific cohort is that there is a statistical relationship between holding time and the tendency to sell. The HODLers of the market carry their coins for long periods and, therefore, aren’t very likely to participate in selling at any point. The only times that these diamond hands are forced into capitulation are the major cyclical downturns.

On the other hand, the investors who are relatively fresh buyers can be prone to panic selling, so loss taking from them can appear in all phases of the cycle, even the bull market.

Now, here is the chart shared by the analytics firm that shows the trend in the Bitcoin Seller Exhaustion Composite for new buyers in the market:

As displayed in the above graph, the Seller Exhaustion Composite has just flashed a signal for the Bitcoin Weekly-Monthly traders. “This reflects high locked-in losses from BTC traders active in the last month,” notes Glassnode.

The latest round of capitulation from these recent buyers has come as the cryptocurrency’s price has seen a tumble after its all-time high (ATH) above the $99,000 level.

From the chart, it’s visible that the instances of high loss taking from this cohort all coincided with some sort of bottom in the price during the past year. Given this pattern, it’s possible that Bitcoin may be able to find another bottom off the back of the capitulation this time as well.

BTC Price

Bitcoin had slipped all the way down towards $90,000 a couple of days back, but the coin seems to have made some recovery as it’s now floating around $95,400.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.