Crypto Today: BTC tops $98K on US-Russia diplomacy, while NEAR and Bittensor lead AI tokens’ $30B rally

- Gold drifts higher amid growing concerns over US government shutdown

- XRP, BNB, and SOL record major losses as Bitcoin slides to $105,000

- Australian Dollar receives support following cautious remarks from RBA Hauser

- Goldman Sachs and Morgan Stanley warn of potential 20% market decline

- Gold draws support from safe-haven flows and Fed rate cut bets

- Forex Today: BoE policy announcements to set direction for Pound Sterling

The global crypto market rose 3% on Thursday, adding $45 billion to reach an aggregate market cap of $3.2 trillion.

The crypto AI sector witnessed a 15% rally, with Bittensor (TAO) and NEAR emerging as top performers on the day.

Bears dominated derivatives losses in the market, with SHORT positions closed accounting for more than 70% of $248 million total daily timeframe liquidations.

Why is Bitcoin price going up today?

Bitcoin price climbed 3% on Thursday crossing the $98,500 mark for the first time this week. Based on media reports, BTC’s latest price rally was lifted by improved macroeconomic sentiment as US and Russia agreed to resume diplomatic relations.

Bitcoin (BTC) price analysis

As Trump talks up chances of a peaceful resolution with Russia, investors pricing in a consequential drop in core inflation, as an end to the could boost Oil and Gas supply lines for production.

Bitcoin Dominance (BTC.D)

Bitcoin dominance surged throughout the day, highlighting a shift in investor sentiment. Those who had hastily exited BTC in favor of altcoins or fixed-income assets following the hotter-than-expected U.S. CPI report on February 13 are now reversing course.

With speculation mounting that a peaceful resolution to the Russia-Ukraine war could ease inflationary pressures in the coming months, capital is flowing back into risk assets.

Meanwhile, another Wall Street heavyweight Franklin Templeton has unveiled plans to launch spot ETF offerings for Bitcoin and Ethereum, further reinforcing institutional demand for BTC.

Altcoin Market Updates: LTC witnesses volatility, as Cardana and Ripple (XRP) hold gains

It was another mixed bag of outcomes for crypto altcoin traders on Thursday. While an impending end to Russia and Ukraine has triggered capital flows. Key news events within the crypto markets have impacted the allocation of the recent capital inflows.

Litecoin (LTC) price retraced 5% as investors began to book early profit on positive speculations surrounding the SEC confirmation of new ETF filings.

CANARY LITECOIN ETF ADDED TO DTCC WEBSITE, Feb 21, 2025 | Source: X.com/PhoenixNews

Litecoin (LTC) saw a 5% pullback as traders locked in profits following heightened speculation around potential SEC approval of new ETF filings. Canary Litecoin ETF (Canary Litecoin ETF SHS BEN INT) (Ticker: LTCC) has been listed on the DTCC website, with its “Create/Redeem” status marked as “D.” This designation is part of the standard process for launching a new ETF, further fueling bullish sentiment around a potential Litecoin ETF approval.

However, rather than pushing higher, many investors chose to take early profits as LTC briefly tested the $140 resistance level on Wednesday. By Friday’s session, LTC had retreated toward $128, though rising whale accumulation suggests the token could be setting up for an early rebound.

Ripple (XRP) price held firm above the $2.65 territory, having increased by another 5% over the last 24 hours.

Ethereum (ETH) price remains flatlined at $2,700 as network update controversy and insider selling from Ethereum Foundation continue to hamper short-term upside potential.

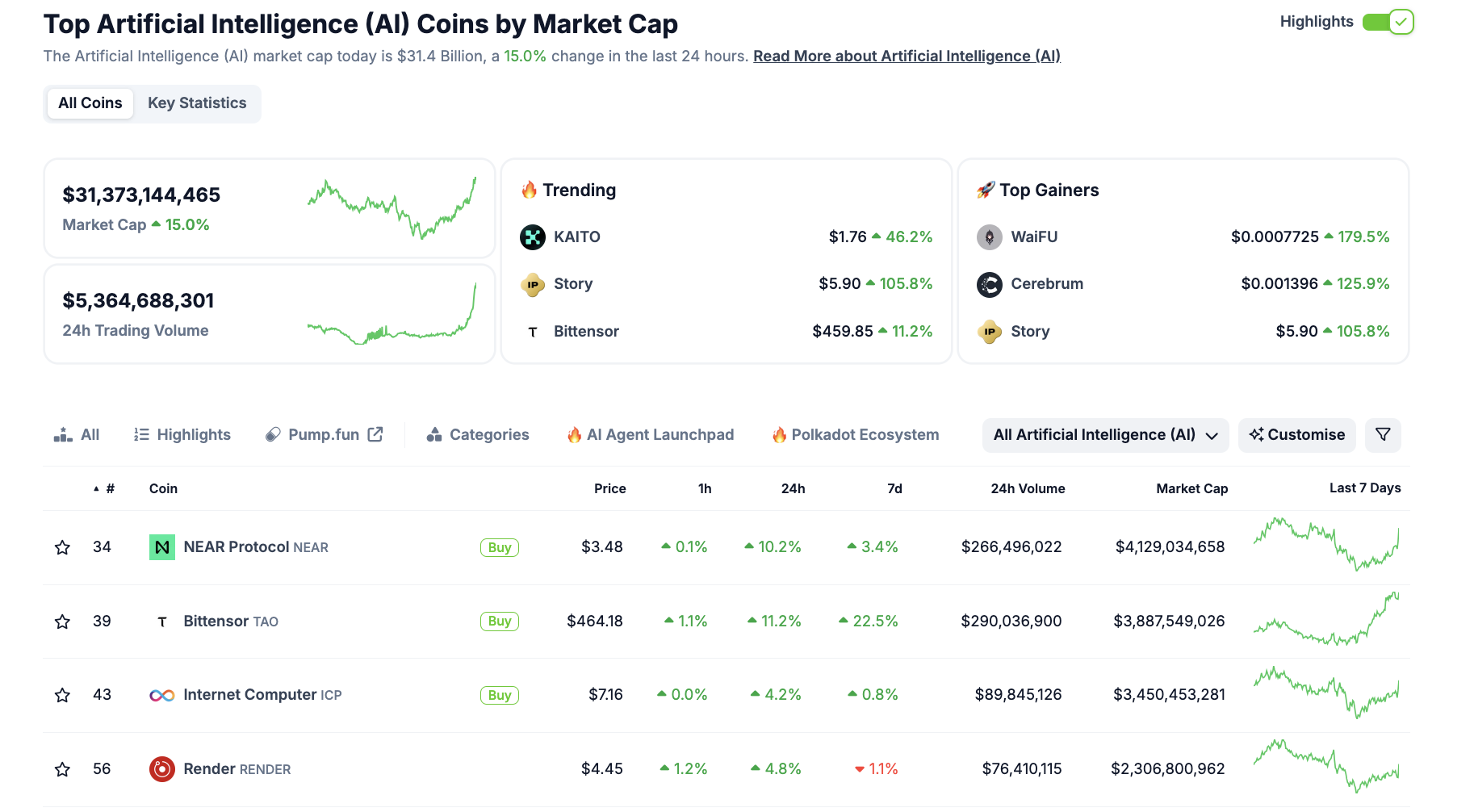

Chart of the Day: Crypto AI Tokens surge 15% as Russia energy prospects fuel Global AI rally

The crypto AI sector is charting its own course, diverging from broader digital asset trends as institutional capital intensifies bets on artificial intelligence.

This shift became evident in early February when Bittensor (TAO) posted double-digit gains following the disruptive debut of China’s Deepseek, which rattled OpenAI’s valuation and market dominance.

Now, the prospect of Russia’s reintegration into global trade is adding a fresh catalyst, boosting sentiment across energy-intensive industries—particularly AI firms and semiconductor manufacturers. NVIDIA and TSMC, the world’s largest chipmaker, both posted significant gains this week as markets adjusted to a potential realignment in energy supply chains. This momentum has extended to crypto AI tokens.

Crypto AI Sector Performance, Feb 21, 2025 | Source: Coingecko

According to Coingecko data, aggregate daily trading volumes jumped to $5.3 billion as AI-focused cryptocurrencies have surged 15% in a single day, pushing total sector capitalization beyond $31 billion.

This Crypto AI sector performance on Thursday far outpaced the broader crypto market 3% uptick —a signal that AI-driven narratives are commanding high investor interest.

Bittensor (TAO) led the way, rallying another 11% after its high-profile Coinbase listing, expanding liquidity and investor access. Meanwhile, NEAR Protocol (NEAR) also delivered double-digit gains, surging by 10.2% in 24 hours.

This affirms growing global demand for AI focused assets on the prospects that reopening Russian oil supply lines could cut energy prices and increase profit margins for investors.

Crypto News Updates:

KuCoin EU seeks MiCAR license in Austria for compliant crypto operations

KuCoin EU Exchange GmbH has initiated the process of obtaining a MiCAR license in Austria, positioning itself as a regulated crypto-asset service provider within the European Economic Area (EEA).

This move will enable the exchange to offer digital asset services compliant with the Markets in Crypto-Assets Regulation (MiCAR) framework, ensuring adherence to EU regulatory standards.

KuCoin EU plans to leverage its parent company's infrastructure to expand its product offerings while maintaining compliance with Austria’s financial authorities.

The company has selected Vienna as its headquarters, citing its regulatory clarity and skilled workforce. CEO Oliver Stauber and COO Christian Niedermueller will lead operations, focusing on integrating KuCoin’s global expertise with local compliance requirements.

If approved, KuCoin EU will gain access to 30 EEA member countries, providing services such as crypto trading, custody, and asset management under MiCAR’s regulatory framework.

SEC drops appeal in legal battle over crypto broker-dealer rule

The Securities and Exchange Commission (SEC) has formally withdrawn its appeal against a Texas court ruling that blocked the expansion of broker-dealer registration requirements.

The proposed rule would have mandated crypto liquidity providers and automated market makers with over $50 million in capital to register as dealers.

Initially introduced under former SEC Chair Gary Gensler, the rule aimed to impose Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements on decentralized finance (DeFi) participants, a move widely contested by the industry.

The SEC’s decision to drop the appeal effectively ends the legal dispute between the regulator and crypto advocacy groups, who argued that the rule was unenforceable due to the decentralized nature of crypto protocols.

The ruling represents a setback for the SEC’s broader regulatory push, signaling potential challenges in applying traditional financial oversight to decentralized digital asset markets.

Coinbase expands crypto derivatives with CFTC-regulated Solana and Hedera futures

Coinbase has introduced CFTC-regulated futures contracts for Solana (SOL) and Hedera (HBAR) through Coinbase Derivatives, LLC, marking an expansion of its crypto derivatives offerings.

The move aims to enhance institutional and retail participation in the U.S. derivatives market, providing traders with additional exposure and risk management tools.

Additionally, Coinbase Financial Markets, Inc. is increasing access to futures trading for institutional investors, reinforcing its position in the regulated derivatives sector.

As part of its broader derivatives strategy, Coinbase International Exchange, LLC has launched EURC perpetual futures, enabling leveraged trading of the Euro-backed stablecoin EURC.

This expansion supports the growth of crypto-native FX trading, offering new avenues for liquidity and risk hedging.

The introduction of these futures contracts aligns with Coinbase’s global push to integrate regulated financial instruments into the crypto ecosystem while complying with international regulatory frameworks.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.