A Reversal Signal Appears in Gold’s Long Term Upward Trend,Will Low Level Consolidation Continue this Week?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Gold may continue to a low level consolidation with upward resistance at $1977 and $2016, support at $1945 and $1913 this week. From CFTC Data and Tech bias, there was a reversal signal in the long term upward trend of gold and closely monitors should be kept.

Market Review

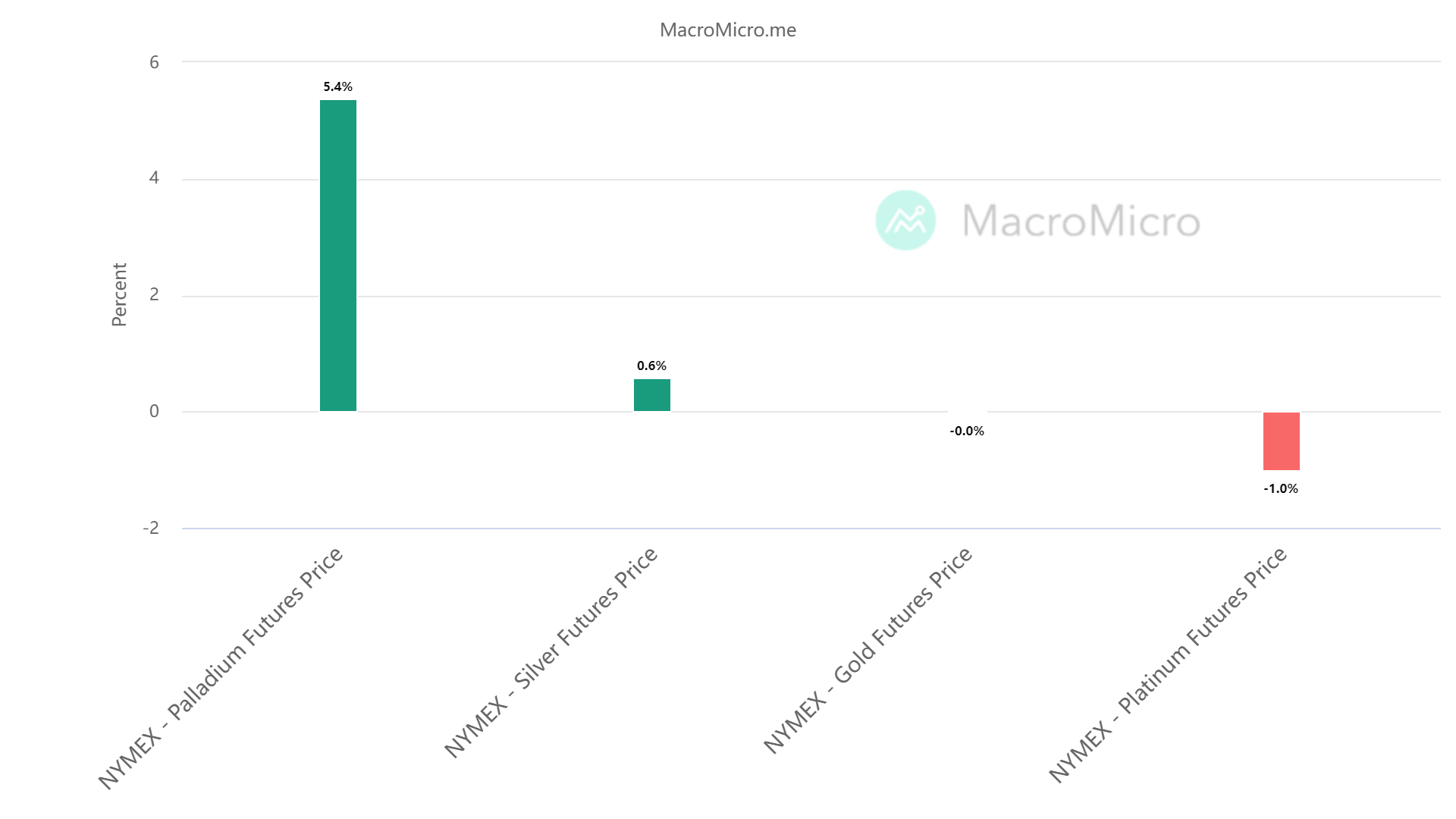

Last week (6.12-6.18), precious metals went mixed, among which, gold saw no change compared to the previous week, while silver raised 0.6%. Gold experienced a significant vol and returned to the same level as previous week.

Source: MacroMicro, The Performance of Major Precious Metals during June 12-18

Gold Found Momentum on the ECB Rate Hike

On June 13, according to the US Bureau of Labor Statistics, the US May CPI rose 4% YoY, achieving its eleventh consecutive decrease and the smallest YoY increase since March 2021, better than expected 4.1% and 4.9% previously; the CPI rose 0.1% MoM, both over expectations (0.2%) and the previous value (0.4%).

On June 15, the Fed announced its decision to keep the target range for the federal funds rate unchanged at 5.00% to 5.25%, as expected by the market, and to pause its tightening policy. However, the Fed also stated that it needs to take into account the cumulative tightening of monetary policy and the lagged effects of policy on economic activity and inflation, while maintaining its 2% inflation goal.

As a reminder, in the post-meeting "dot plot" of interest rate forecasts, most Fed officials predicted two more rate hikes this year, bringing the range to 5.5% to 5.75%. Powell's slightly hawkish comments also weighed on gold, causing it to drop from $1939 to $1928 and returning to levels near March lows.

Source: Investing.com

The European Central Bank's decision of a 25 basis point interest rate hike saved gold from its downward trend, pulling it back to around the $1953-$1960 range and achieving a strong rebound. The ECB’s 25 BP rate hike decision pushed interest rate up to the highest level since 2022 and signaled a further tightening policy.The ECB's stance on future interest rate hikes is more aggressive than that of the Fed, which providing comprehensive support for the Euro while pressuring the US dollar, and leading to a rebound in gold prices.

Mitrade Analyst

Gold fell and stood up again around $1960 with little momentum and unable to break through the nearby resistance in 1977, after Fed’s pause decision and ECB’s 25 BP rate hike. The over expected cooling of US inflation has led to a widespread belief that the US economy may not be heading into a recession as quickly as previously anticipated, and may potentially achieve a "soft landing" . A large disappearance of rate cuts expectation and growing anticipation of rate hike in July creating headwinds to gold, and the US Dollar may be strengthened. However, the US Dollar also may be pressured by the increasing expectation of ECB’s rate Hiking in July. In this case, gold will continue to low level consolidation in the short term.

Gold will be driven up and down by Powell’s congressional testimony. Looking back at his last testimony in March, his hawkish comments on continuing rate hikes were in line with market expectations. Given the current pause and projections of positive economic data, the market may anticipate Powell to further signal rate hike projection in this testimony. If so, there may be a further decline in gold.

Gold turns into Bearish in the short term?

Recently, gold speculative long positions decreased sharply. According to updated CFTC data, speculative long positions decreased by 15,432 during June 7-13; meanwhile, speculative long positions in open gold futures contracts also decreased by 10,150, while short positions increased by 5,282 from the previous period. This reflects the market investors have seen bearish in gold during the short-term.

Mitrade Analyst

In summary, due to the absence of bullish speculators from the market and some aggressive short sellers covering their positions, gold has shifted towards a bearish market in the short term and may experience a low-level vol. Caution is needed regarding the uncertain trend in the medium to long term.

Technical Analysis

Gold experienced a significant vol around 1923-1971 last week.

In terms of technical bais, the MA (60-day) long-term line remains upward, but with a reversal sign. The RSI(14-day) value of 46 on the 14th is less than 60, indicating that there is still a bearish market; meanwhile, among the MACD day line chart, the short-term line is sticking together with the long-term line which shows no obvious trend. DIFF, DEA are negative, but MACD is positive, indicating that gold is still in a low level consolidation in the near term.

Resistance: 1977、2016

Surpport:1945、1913

Source: Investing.com

Mitrade Analyst

Based on the analysis of various indicators, The reversal signal is appearing in the upward trend of gold; however, gold will continue tumbling in a low vol environment this week.

In addition, investors need to pay attention to news and economic data that may provide guidance for the future trend of gold this week, such as US Building Permits Prel in May and Fed Chair Powell Testimony, etc..

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.