- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

Gold flirts with a 1% surge on Tuesday, paring back initial losses for this week.

Headlines on German defense spending possible deal hit the US Dollar and support Gold.

Traders are bracing for the upcoming Fed meeting on March 19.

Gold’s price (XAU/USD) is popping back above the $2,900 round level and even trades above $2,910 at the time of writing on Tuesday. The move comes in a domino effect originated by the headline from the German Green coalition leaders, who said this morning to have given the green light to a deal on defense spending. That boosted confidence in the Euro (EUR) and triggered a new leg lower in the US Dollar Index (DXY), which opened the door for Bullion to surge.

Meanwhile, traders are still cautious after a tariff war is spiraling out of control outside the United States (US). Canada has hit several Chinese imports, which met with counter-tariffs from China on Canadian goods such as canola Oil. The demands from US President Donald Trump are being met for now as Canada and Mexico can see further easing on their own tariffication if they also impose levies on Chinese goods.

Daily digest market movers: Thai Baht flying

US President Donald Trump’s signals that the economy could first suffer as he reshapes trade policy with tariffs stoked concerns about a potential recession. The precious metal, a traditional haven asset, can face selling pressure during sudden market selloffs, Bloomberg reports.

Thailand’s currency, Thai Bhat (THB), has received a boost this year from a rally in Gold prices. Strategists warn though that the rally will not be enough to protect the country from tariff risks. The THB is up around 1.2% against the US Dollar this year, more than double the gain of a broad gauge of Asian currencies. A key reason is Thailand’s role as a Gold-trading hub in the region, which boosted confidence in the currency, Bloomberg reports.

The CME Fedwatch Tool sees a 95.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. However, the chances of a rate cut at the May 7 meeting increase to 47.8%.

Technical Analysis: Opening a window

For once, it is not a headline on tariffs which is boosting the precious metal. This time, it is a domino effect where a weaker US Dollar opens the door for Gold to move higher. There are not yet aspirations for a new all-time high, but it is good to see the initial weekly loss erased and Gold returning to flat on the week.

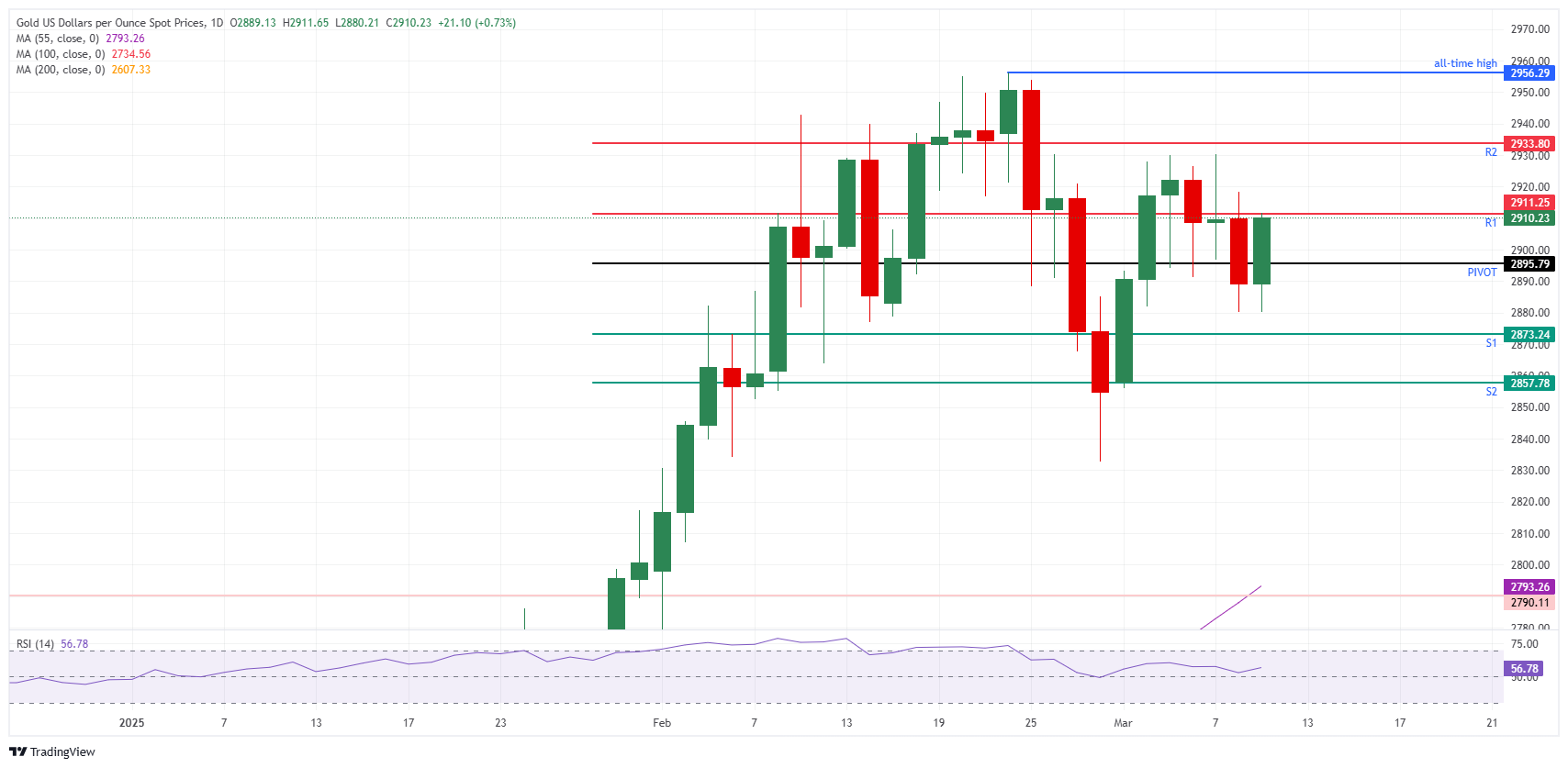

Gold is back above the $2,900 round level and, from an intraday technical perspective, it is back above the daily Pivot Point at $2,895. At the time of writing, Gold is knocking on the door of the R1 resistance near $2,910. Once through there, the intraday R2 resistance at $2,933 comes into focus on the upside, converging with last week’s highs.

On the downside, the firm support stands at $2,880, which has held Gold’s price on Monday and Tuesday. In case that level breaks, look at the S1 support around $2,873. A small leg lower could target $2,857, the convergence of the S2 support and the March 3 low.

XAU/USD: Daily Chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.