The age-old question: Trading or Investing, which is better?

The truth is, one is not above the other. While the terms are often used interchangeably, there are key differences between "trading" and "investing."

Both fundamentally seek profits through participation in the financial markets, but investing and trading adopt two very different approaches. In general, the goal of investing is to build wealth over the medium to long term, while trading aims to generate profits in the short term.

1. What is Trading

Trading

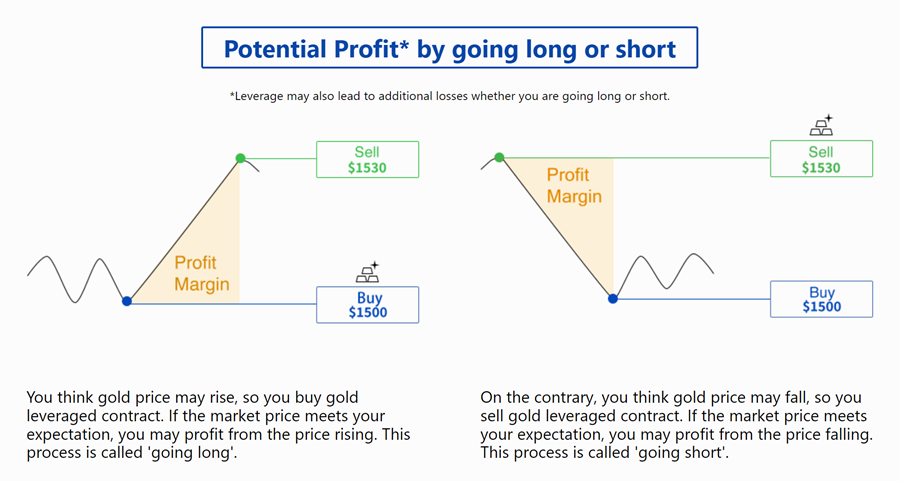

Trading involves a higher frequency of transactions, and tends to hold assets or trades for a much shorter amount of time;, it could be days, hours or even minutes. This is unlike the investors who traditionally seek price appreciation to profit in the markets. Traders can profit in both bullish trends (rising prices) and bearish trends (falling prices). Instead of focusing on an asset’s long-term growth prospects like investors, traders focus on which direction the asset’s price is likely to head next and try to profit from that price movement.

Buying (Long) and Selling (Short) are the two primary operations for pursuing profits. Buying occurs when traders anticipate that the price will increase in the short term. Conversely, selling is executed when traders expect that the price will decrease in the near future. Therefore, regardless of whether the market trend is upward or downward, traders have the opportunity to realize potential profits from the differences between buying and selling prices.

Trading can be categorized into several common types based on the time frame involved. Here are the main categories:

#Scalping

Time Frame: Seconds to a few minutes.

Description: Traders make numerous small trades throughout the day, aiming to profit from tiny price changes. Scalping requires quick decision-making and execution.

#Day Trading

Time Frame: Minutes to hours.

Description: Positions are opened and closed within the same trading day. Day traders avoid overnight risk and often use technical analysis to make quick trades.

#Swing Trading

Time Frame: Days to weeks.

Description: Traders hold positions for several days or weeks to capitalize on expected price swings. This strategy involves a mix of technical and fundamental analysis.

#Position Trading

Time Frame: Weeks to months.

Description: Long-term trading strategy where positions are held for extended periods based on fundamental analysis. Traders focus on long-term trends rather than short-term fluctuations.

Some people may also recognize investing as long-term trading, typically lasting from one year to several years. Is that saying correct? In the next section, we will continue to explore the concept and types of investing.

2. What is Investing

Investing

Investing involves purchasing and holding an asset with the expectation that its value will appreciate over time. Investors often retain these assets for years, or even decades, aiming to generate substantial profits from rising prices and any income produced by the assets, such as interest, dividends, and stock splits. While markets inevitably fluctuate, investors tend to "ride out" downturns, anticipating that prices will rebound and any losses will eventually be recovered. Typically, investors focus more on market fundamentals, including price-to-earnings ratios and management forecasts.

Investing is about pursuing long-term profits, gradually accumulating small gains over time to create a significant return. While the risk tolerance and potential returns may be lower compared to trading, investing focuses on building wealth steadily. For example, holding stocks for the long term allows investors to benefit from compounding growth, dividends, and the overall appreciation of the company’s value.

There are several investing types, including:

Value Investing: This strategy involves selecting stocks that appear to be undervalued based on fundamental analysis. Investors look for companies with strong potential for growth that are currently priced low compared to their intrinsic value.

Growth Investing: Investors in this category seek companies that exhibit signs of above-average growth, even if the stock price seems expensive relative to earnings. These stocks typically reinvest earnings to fuel further growth.

Dividend Investing: This strategy focuses on stocks that pay regular dividends. Investors benefit from both the dividend income and potential stock appreciation, making it a popular choice for those seeking a steady income stream.

Index Investing: This passive investment strategy involves buying a representative benchmark index, such as the S&P 500. It aims to match market performance rather than outperform it, often resulting in lower fees.

Environmental, Social, and Governance (ESG) Investing: This strategy incorporates non-financial factors into investment decisions. Investors seek companies that prioritize sustainability, social responsibility, and ethical governance practices.

Fixed-Income Investing: This conservative approach involves investing in bonds or other debt instruments that provide fixed interest payments. It's often chosen to preserve capital and generate stable income.

Each type of investing offers different benefits and risks, allowing investors to tailor their strategies according to their financial goals, timelines, and risk tolerance.

3. Trading vs Investing: Difference between trading and investing

Both traders and investors are market participants seeking to profit from financial markets. What separates them are their differing philosophies and methods of analysis for making financial decisions. Here are some common differences:

Aspect | Traders | Investors |

Financial Goals | Generate returns by buying and selling assets. | Build wealth through price appreciation and reinvesting dividends. |

Periods of Investments | Short periods; as brief as days, hours, or even minutes. | Longer periods; can hold assets for years, even decades. |

Risk Involved | Higher risk due to speculation on short-term market volatility, which can be highly unpredictable. | Lower risk, as decisions are not based on short-term fluctuations. |

Time & Effort | Continuous market monitoring is required due to price volatility; higher effort needed during analysis. | Lower effort is needed for monitoring and performance review; analysis requires less frequent attention. |

Type of Analysis Performed | Primarily use technical analysis, focusing on historical price movements and price charts. | Rely more on fundamental analysis, analyzing performance reports, news events, statements of accounts, and future growth prospects. |

In summary, while traders and investors have different approaches and methods of analysis for making investment decisions, this does not imply that one method is superior to the other. Trading can be more fast-paced and may yield larger gains in a shorter amount of time, but it also carries the risk of larger losses.

Ultimately, the strategy you choose will depend on your financial goals, as there is room for both trading and long-term investing in your financial journey.

4. Trading vs Investing:Which is Better?

When determining whether trading or investing is better, it largely depends on individual financial goals, risk tolerance, and time commitment. Trading offers the potential for quick gains by capitalizing on short-term market movements, appealing to those who thrive in fast-paced environments and can dedicate significant time to market analysis. However, this approach also carries higher risks and requires a deep understanding of market trends and technical indicators.

On the other hand, investing is typically a more stable, long-term strategy focused on building wealth through gradual appreciation and reinvestment of returns. Investors often adopt a buy-and-hold philosophy, which can mitigate the impact of market volatility and minimize stress. This method is ideal for those who prefer a more hands-off approach and are willing to wait for their investments to mature over time.

Ultimately, the choice between trading and investing depends on personal preferences and circumstances. Some may find success by combining both strategies, allowing for short-term gains while also building long-term wealth. Assessing your financial goals, lifestyle, and risk appetite is crucial in deciding which approach suits you best.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.