What is Financial Trading and How to Trade in Financial Markets?

In today’s global economy, financial markets play a pivotal role in driving growth, facilitating investments, and shaping economic stability. Whether you’re a seasoned investor or just starting to explore the world of finance, understanding how financial markets work and the dynamics of financial trading is essential.

This article aims to break down the basics, from the structure of financial markets and the instruments traded within them to the increasingly popular world of online financial derivatives trading.

1. Understanding Financial Markets

1.1 What are Financial Markets and their main types?

Financial markets refer broadly to any marketplace where the trading of securities occurs, including the stock market, bond market, forex market, and derivatives market, among others. For example, the New York Stock Exchange (NYSE) and the , Chicago Mercantile Exchange (CME).

1.2 What are Financial Instruments?

Financial instruments are assets that can be traded, or they can also be seen as packages of capital that may be traded. Most types of financial instruments provide efficient flow and transfer of capital to all of the world’s investors.

Here are some examples of popular financial instruments that are traded today:

Types | Description | Instruments | Marketplace |

Stock Markets | Platforms for buying and selling shares of publicly traded companies. | Stock indexes(S&P 500), Stocks(AAPL), Exchange-Traded Funds (ETFs) | NYSE, Nasdaq |

Bond Markets | Markets for trading debt securities, where investors lend money for defined periods. | U.S. Treasury, municipal bonds | Various exchanges, OTC |

Forex Markets | Global decentralized markets for trading currencies. | Currency pairs (e.g., EUR/USD) | OTC Banks Forex brokers |

Derivatives Markets | Markets for contracts whose value is derived from underlying assets. | Options, futures, CFDs | Various exchanges |

Commodities Markets | Markets for trading physical goods like agricultural products and metals. | metals, energy resources, agricultural products, etc | Chicago Mercantile Exchange |

Money Markets | Markets dealing with short-term debt instruments, typically with maturities under one year. | Treasury bills, CDs | Various banks, financial institutions |

Cryptocurrency Markets | Platforms for trading digital currencies, often through decentralized exchanges. | Bitcoin, Ethereum | Cryptocurrency exchanges, including centralized exchanges (CEXs) and decentralized exchanges (DEXs) |

2. What is Financial Trading?

Financial trading involves the buying and selling of assets in financial markets. You can trade a variety of assets, including stocks, commodities, indices, foreign exchange, and more, as mentioned in section 1.

People and companies often trade financial instruments because they need the assets for themselves or their business. For example, you may be traveling from Europe to the USA and want to convert euros to dollars. To do this you would participate in the forex market.

However, most of the time financial traders don’t need the assets at all. They are speculating about the financial markets looking to make a profit from movements in the price, for example by buying low, then selling high.

3. What is online financial derivatives trading

Online financial derivatives trading involves trading financial instruments whose value is derived from underlying assets, such as stocks, commodities, or indices. One common type of derivative is the Contract for Difference (CFD).

For personal retail traders, capital is often limited, making CFDs an attractive option. CFDs allow traders to speculate on price movements in diversified markets such as Forex, stocks, gold, crude oil, and cryptocurrencies, without needing to own the underlying asset. This means you can potentially profit from both rising and falling markets.

Register and trade live with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

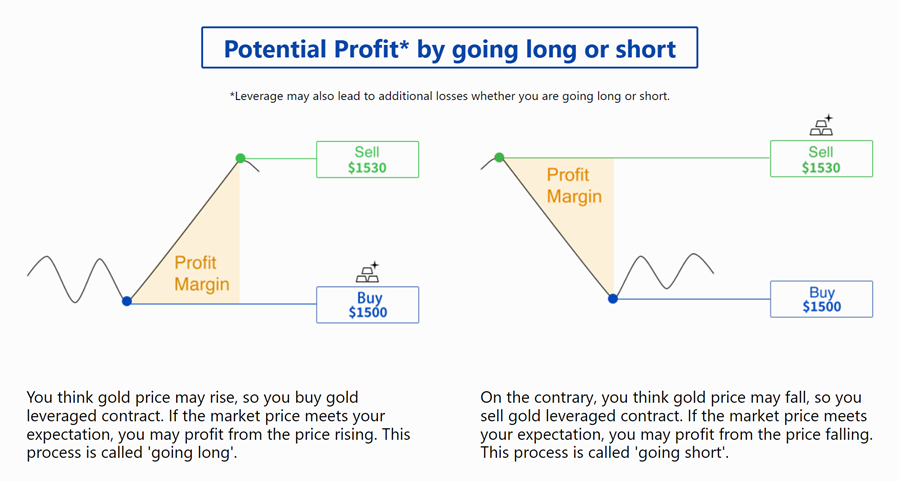

Buy (Long Position): Consider buying when you anticipate that the price of the underlying asset will rise. This is often based on technical analysis, market trends, or economic indicators.

Sell (Short Position): Consider selling when you expect the price to decline. This allows you to profit from a falling market by opening a short position.

By understanding market conditions and using effective strategies, retail traders can navigate the complexities of online financial derivatives trading.

4. Summary

Financial markets are platforms where assets such as stocks, bonds, commodities, and currencies are bought and sold. They facilitate the exchange of capital and foster economic growth. Financial trading refers to the act of buying and selling these assets to profit from price fluctuations.

Traders use various strategies, tools, and financial derivatives, such as CFDs, to maximize returns while managing risk. Understanding market dynamics and trends is essential for effective trading.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.