Bittensor Price Forecast: TAO rallies above $240 as AI tokens rebound

- Bittensor reclaims $240 immediate support, reflecting positive sentiment in the broader crypto market.

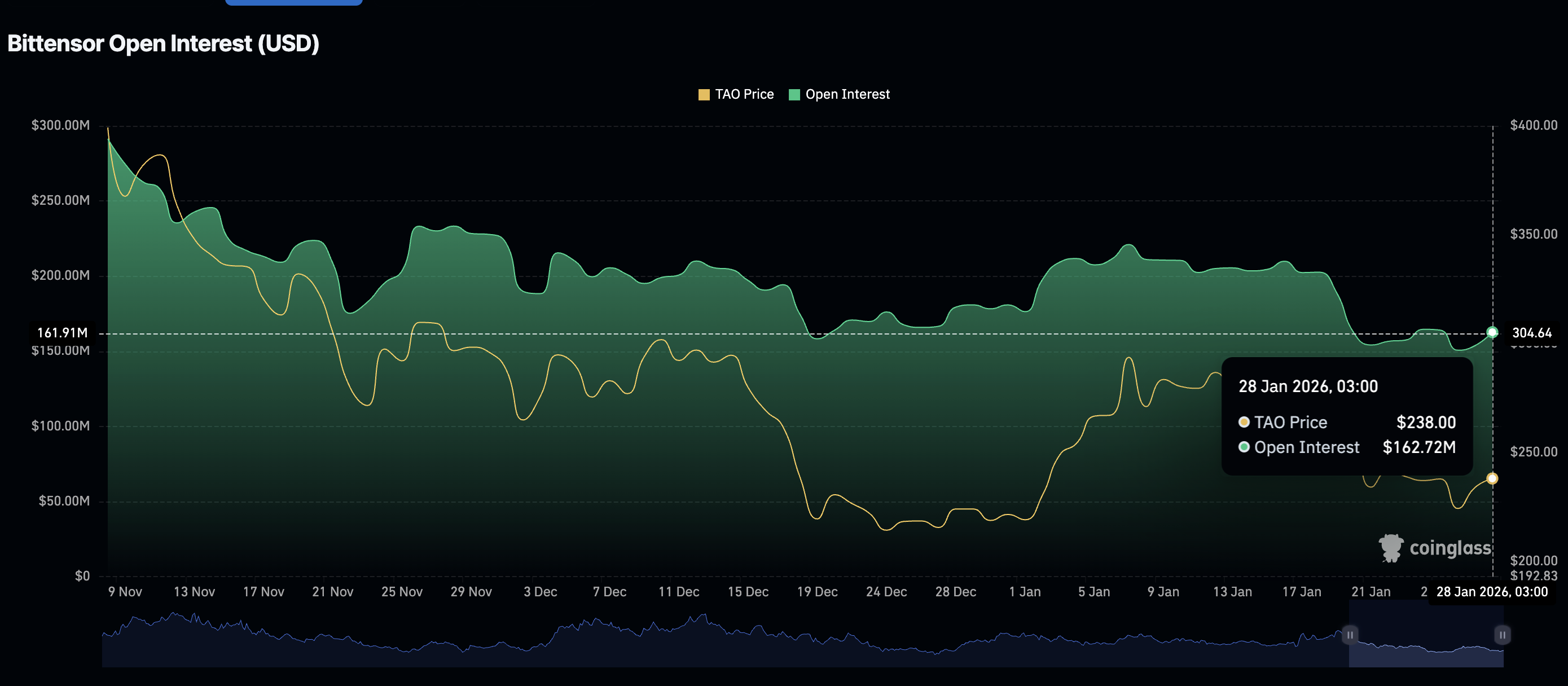

- The TAO derivatives market signals retail interest return as futures Open Interest climbs to $163 million.

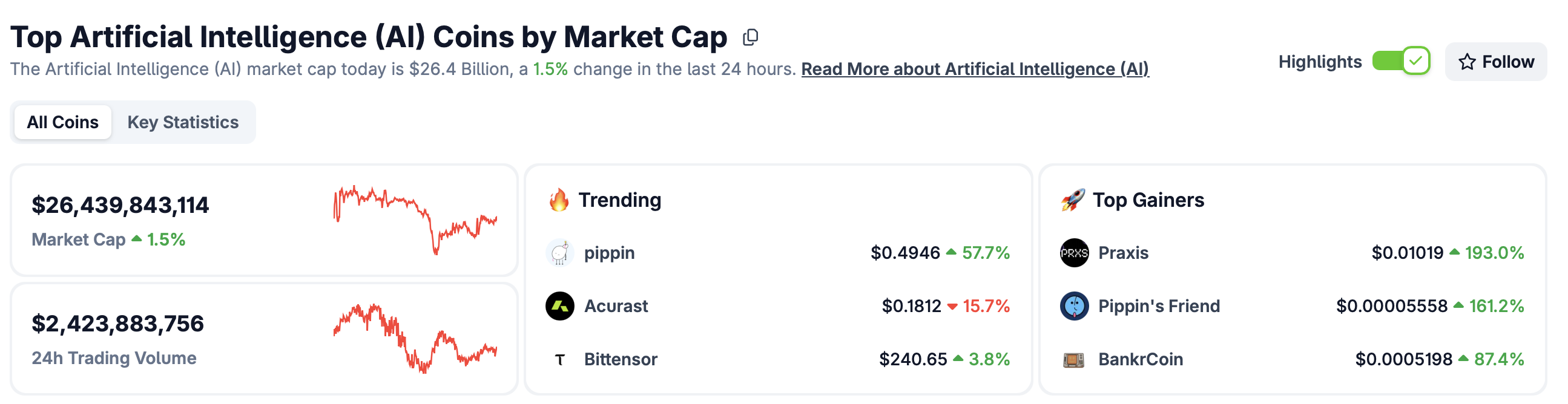

- Tokens blending AI and blockchain technologies are posting selective gains, pushing the sector’s market capitalization above $26 billion.

Bittensor (TAO) is staging a notable recovery above the $240 support level on Wednesday, reflecting renewed optimism across the Artificial Intelligence (AI) token sector as traders navigate the market ahead of the Federal Reserve’s (Fed) decision on monetary policy.

Bittensor rebounds alongside crypto AI tokens

Bittensor’s recovery comes amid a broader resurgence in AI-focused cryptocurrencies, which have expanded the sector’s total market capitalization above $26 billion.

Retail interest and positive sentiment are converging, making crypto AI tokens attractive. BankrCoin (BNKR) and Pippin (PIPPIN) have outpaced other tokens, surging by over 87% to $0.005 and 57% to $0.49, respectively, according to CoinGecko. Kite (KITE) ticked up nearly 20% to $0.15 while tokenbot (CLANKER) soared by 37% to $36.

The Bittensor derivatives market is showing relative strength, with futures Open Interest (OI) rising to $163 million on Wednesday from $154 million the previous day. A steady increase in OI indicates that confidence in the token is improving, as traders anticipate TAO extending its uptrend.

Technical outlook: Bittensor edges up above $240

Bittensor is stable above $240, marking three consecutive days of gains amid a broader price rally across the cryptocurrency market. The Relative Strength Index (RSI) is rising to 43 on the daily chart, signalling fading bearish momentum and a potential transition to a bullish phase if the indicator breaks above the midline.

The 50-day Exponential Moving Average (EMA) caps the upside at $262, posing as a threat to TAO’s rebound. A decisive break above this moving average would open the door for accelerated gains toward the 100-day EMA at $285.

However, the Moving Average Convergence Divergence (MACD) indicator remains below the signal line, cautioning traders to temper their expectations. Histogram bars below the zero line may encourage risk-off sentiment, hindering further gains. A reversal below $240 would put TAO at risk of correction toward Sunday’s low at $220.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.