Coval price prediction 2025-2031: Will COVAL recover?

Key Takeaways

- Coval price prediction shows an optimistic outlook, projecting COVAL to increase to $0.0010 by the end of 2025.

- In 2028, Coval is predicted to reach a maximum price of $0.0034.

- Long-term price predictions for COVAL also present a favorable outlook, with the cryptocurrency reaching $0.0107 by 2031.

The blockchain space is not falling short of innovations. Circuits of Value combines the power of non-fungible tokens, finance, and cryptocurrencies to create a unique Coval product. Coval’s utility is interoperable across blockchains. Using the unique tool, creators can add value to their NFTs by appending digital coins and other NFTs.

COVAL previously secured the coveted Coinbase listing alongside several other cryptos, including ShapeShift FOX Token (FOX), Polkastarter (POLS), Moss Carbon Credit (MCO2), Spell Token (SPELL), and EllioTrades’ SuperFarm (SUPER). Is COVAL crypto a good investment? Let’s dig deeper and know the basis for the Coval price predictions.

Overview

| Cryptocurrency | Circuits of Value |

| Token | COVAL |

| Price | $0.000787 |

| Market Cap | $1.42M |

| Trading Volume | $86.32K |

| Circulating Supply | 1.78B COVAL |

| All-time High | $133.01, Jan 19, 2022 |

| All-time Low | $0.00001037, Mar 31, 2017 |

| 24-hour High | $0.0008258 |

| 24-hour Low | $0.0007752 |

Coval Technical Analysis

| Metric | Value |

| Price Prediction | $ 0.00082 (2.81%) |

| Volatility | 5.14% |

| 50-Day SMA | $ 0.00089 |

| 14-Day RSI | 46.95 |

| Sentiment | Bearish |

| Fear & Greed Index | 71(Greed) |

| Green Days | 14/30 (47%) |

| 200-Day SMA | $ 0.001976 |

Circuits of Value price analysis: COVAL shows bullish signs with support at $0.0007479 and resistance at $0.0008111

- The breakout confirmed that COVAL broke above $0.000780 after consolidating, signaling a bullish momentum shift.

- The key resistance in the play price is testing $0.0008111; a breakout could target $0.0008300, while rejection may lead to a pullback.

- Volume supports the move surge, which was backed by rising volume, confirming trader interest and strengthening the breakout’s validity.

On July 26th, 2025, Circuits of Value (COVAL) is currently trading at $0.0007877, reflecting a 3.81% price increase over the last 24 hours. The price action today shows signs of renewed bullish momentum after a period of consolidation. The support level stands at $0.0007479, while the resistance is positioned at $0.0008111. This recent movement indicates COVAL may be attempting a breakout from a tight trading range.

Circuits of Value 1-day price chart: COVAL bulls eye resistance breakout

On the daily chart, COVAL traded flat near $0.0007666 before dipping slightly and entering a tight consolidation range between $0.0007479 (support) and $0.000776. Bulls later gained control, triggering a breakout above $0.000780, with price peaking at $0.0008111, now acting as resistance.

The move was backed by increased buying momentum and marked a shift from the previous flat trend. Volatility picked up sharply, likely driven by speculative interest. If the price breaks above $0.0008111, the next target will be nearly $0.0008300. A failed breakout could lead to a pullback toward the $0.0007479 support. The price remains stable above the short-term moving average, supporting continued bullish bias.

Circuits of Value 4-hour price chart: COVAL volume surge signals near-term strength

The 4-hour chart reflects a prolonged consolidation zone followed by a sudden price surge, supported by volume expansion. Price stayed tightly ranged before the breakout, making the move above $0.000780 significant in the short-term market structure.

Momentum indicators are entering overbought territory, suggesting the current leg may pause or pull back before continuation. However, price remains comfortably above short-term support, and any pullback to $0.000760–$0.000770 could serve as a new base for accumulation.

COVAL technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 0.000777 | BUY |

| SMA 5 | $ 0.00081 | SELL |

| SMA 10 | $ 0.000828 | SELL |

| SMA 21 | $ 0.000823 | SELL |

| SMA 50 | $ 0.00089 | SELL |

| SMA 100 | $ 0.000881 | SELL |

| SMA 200 | $ 0.001976 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 0.000833 | SELL |

| EMA 5 | $ 0.000846 | SELL |

| EMA 10 | $ 0.000839 | SELL |

| EMA 21 | $ 0.000814 | SELL |

| EMA 50 | $ 0.00087 | SELL |

| EMA 100 | $ 0.001299 | SELL |

| EMA 200 | $ 0.002849 | SELL |

What to expect from the Coval price analysis

Circuits of Value (COVAL) is showing clear bullish intent, with price action indicating potential for further upside if momentum holds. The successful breakout above $0.000780 and ongoing test of the $0.0008111 resistance highlight a critical juncture.

If COVAL manages to close above $0.0008111, the price could advance toward $0.0008300, aligning with previous resistance levels. However, a failure to break through could result in a short-term correction back to the $0.000760–$0.000770 zone, where accumulation may resume. With price holding above the short-term moving average and supported by rising volume, bullish continuation remains the dominant scenario in the near term.

Is Coval a good investment?

COVAL shows short-term trading potential, supported by a recent breakout and rising volume. With price hovering near key resistance at $0.0008111 and support at $0.0007479, it offers opportunities for momentum-driven traders.

However, the token is still far below its all-time high of $133.01 and has a limited holder base (788 wallets), indicating low adoption and high risk. While short-term setups look promising, long-term investment remains speculative and requires further fundamental development.

Will COVAL recover?

COVAL’s recovery is uncertain, given the current bearish trend and persistent selling pressure. With technical indicators pointing to continued declines and investor sentiment remaining pessimistic, a recovery would require a significant shift in market conditions and a reversal in technical signals.

Will COVAL reach $0.005?

COVAL is expected to trade above $0.005 throughout 2029, with the maximum price projected to be $0.0051. Therefore, reaching $0.005 is highly likely in the near term.

Will COVAL reach $0.01?

Yes, COVAL is projected to exceed $0.01 by 2031. The maximum price forecast for 2031 is $0.0107, indicating that the cryptocurrency is expected to reach and surpass $0.01 within the next few years.

Does COVAL have a good long-term future?

Yes, COVAL shows a positive long-term outlook. Predictions indicate significant growth, with prices potentially reaching up to $0.0107 by 2031. This suggests a favorable long-term future, supported by projected growth and increasing market interest.

Coval price prediction July 2025

For July 2025, COVAL is predicted to have a price range between $0.000750 and $0.000844, with an average price of $0.000820. This forecast suggests a relatively stable outlook for the token, with slight fluctuations expected within this range.

| COVAL price prediction | Minimum Price | Average Price | Maximum Price |

| COVAL price prediction July 2025 | $0.000750 | $0.000820 | $0.000844 |

Coval price prediction 2025

For 2025, the COVAL price prediction suggests a trading range of $0.000948 to $0.0010, with an average price of $0.000979.

| COVAL Price Prediction | Minimum Price | Average Price | Maximum Price |

| COVAL Price Prediction 2025 | $0.000948 | $0.000979 | $0.0010 |

Coval price predictions 2026 – 2031

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $0.0013 | $0.0014 | $0.0016 |

| 2027 | $0.0019 | $0.0020 | $0.0023 |

| 2028 | $0.0028 | $0.0029 | $0.0034 |

| 2029 | $0.0043 | $0.0044 | $0.0051 |

| 2030 | $0.0061 | $0.0063 | $0.0075 |

| 2031 | $0.0086 | $0.0089 | $0.0107 |

Coval price prediction 2026

The Circuit of value prediction for 2026 suggests a notable inclination for the cryptocurrency, with its highest price expected to reach $0.0016. The lowest price of COVAL could be around $0.0013, with an average price of $0.0014.

Coval price prediction 2027

In 2027, Circuits of value price prediction suggest a maximum forecast price of $0.0023, with an average price expected to reach $0.0020 and a minimum of $0.0019.

Coval price prediction 2028

In the Circuit of Value price forecast for 2028, we foresee the cryptocurrency potentially reaching a peak of $0.0034. The average price is projected to stabilize around $0.0029, with a minimum price of $0.0028.

Coval price prediction 2029

For 2029, the price prediction Circuits of value suggests a peak value of $0.0051. The minimum trading price is expected to be $0.0043, providing a potential support level. The average market value is projected to be around $0.0044.

Coval price prediction 2030

According to the Circuits of Value price predictions for 2030, the cryptocurrency is anticipated to achieve a peak price of $0.0075. The projected minimum price is expected to be $0.0061, with an average trading price of around $0.0063.

Coval price prediction 2031

According to the Circuits of Value forecast for 2031, we foresee the cryptocurrency potentially reaching a maximum price of $0.0107. The projected minimum price is expected to be $0.0086, with an average value of around $0.0089.

Coval market price prediction: Analysts’ COVAL price forecast

| Firm | 2025 | 2026 |

| Coincodex | $ 0.000827 | $ 0.000991 |

| Digital Coin Price | $0.00175 | $0.00205 |

Cryptopolitan’s Coval (COVAL) price prediction

Cryptopolitan’s overall COVAL price prediction suggests a cautious near-term outlook, with expected prices between $0.000948 and $0.0010 in 2025. However, the long-term forecast is more optimistic, with prices projected to rise significantly. By 2028, COVAL could reach up to $0.0034; by 2031, it may attain a maximum of $0.0107.

Coval historic price sentiment

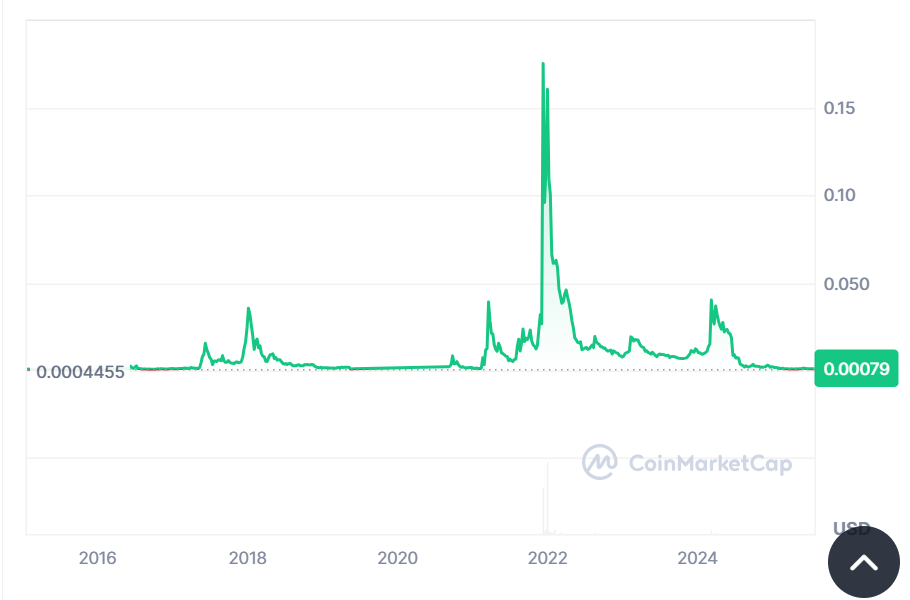

- Circuits of Value (COVAL) is a cryptocurrency that began trading in January 2015 at approximately $0.000439. In November 2015, it reached an all-time low of $0.0000453.

- The price remained relatively low until late 2021, when it experienced a significant surge, reaching an all-time high of $0.2508 on December 10, 2021. Since then, the price has declined, and as of January 2025, COVAL is trading at approximately $0.001475.

- In February, the token traded around $0.00095, gradually declining as market interest waned.

- By March, the price dipped to approximately $0.00090, and in April, it hovered near $0.00085.

- Throughout May, the price continued its slide, dropping closer to $0.00080.

- In June, it settled around $0.00078, with minimal fluctuations.

- By July 2025, Coval reached approximately $0.00079, showing no significant rebound.