Uniswap Price Forecast: UNI holds above $6 as traders eye UNIfication vote outcome

- Uniswap price hovers around $6.06 on Tuesday after closing above the key resistance level last week.

- Market participants await UNIfication proposal, which is set to conclude on Thursday andaims to activate protocol fees and better align incentives across the ecosystem.

- The technical outlook remains constructive, with momentum indicators indicating strengthening bullish momentum.

Uniswap (UNI) price holds above $6 at the time of writing on Tuesday after closing above a key resistance zone in the previous week. Traders are focusing on the highly anticipated UNIfication proposal, which is set to conclude on Thursday, and could become a key near-term catalyst. On the technical side, momentum indicators are flashing bullish signals, hinting at an upside rally.

UNIfication proposal heading toward Christmas deadline

Uniswap’s long-running UNIfication proposal is scheduled to conclude on Thursday, bringing a pivotal governance decision across the Uniswap ecosystem and potentially serve as a near-term catalyst for the UNI token.

The ‘UNIfication’ proposal seeks to turn on protocol fees and use the revenue to burn UNI tokens, effectively introducing a deflationary mechanism to the token’s supply. These developments mark a shift for the protocol and its token holders, who have long pushed for a so-called "fee switch" that would divert a portion of the trading fees that historically accrued to liquidity providers to the Uniswap protocol's treasury or to UNI token holders.

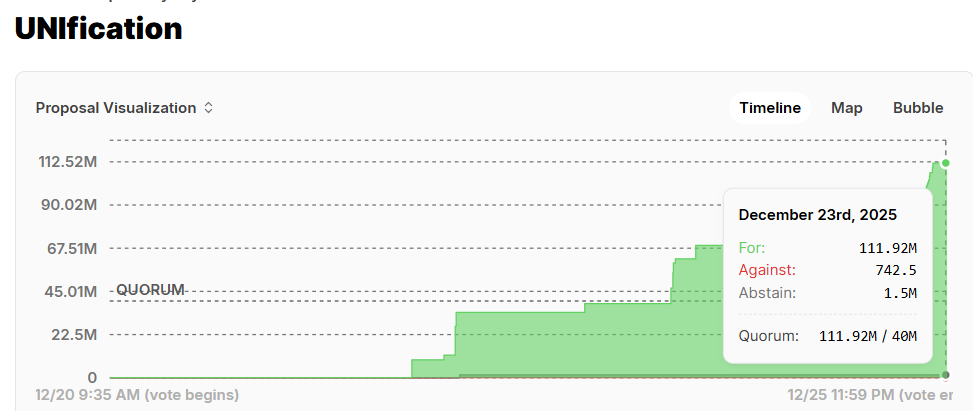

As of Tuesday, the proposal has already crossed the quorum threshold, as shown in the chart below, with more than 111 million UNI tokens voting in favor versus just 742 against, indicating strong community support. While voting remains open until Christmas, the wide margin suggests the outcome is effectively decided.

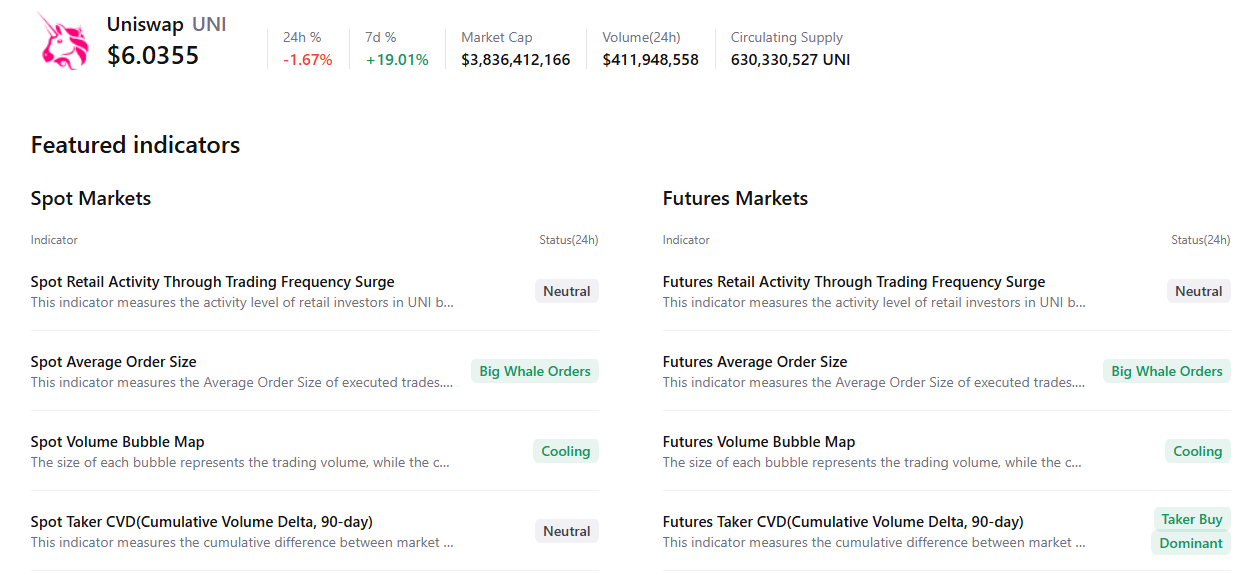

CryptoQuant summary data also supports a positive outlook for UNI, as both spot and futures markets show large whale orders, cooling conditions, and buy dominance, signaling a potential rally ahead.

Uniswap Price Forecast: UNI bulls are in control of the momentum

Uniswap price found support at the daily level at $4.77 on Thursday and rose over 27% in the following two days, closing above the daily resistance at $5.84. However, UNI declined slightly on Sunday and restested this support the next day. As of Tuesday, UNI hovers above $6.

If the $5.84 daily level continues to hold as support, UNI could extend the rally toward the next daily resistance level at $8.63.

The Relative Strength Index (RSI) on the daily chart is 54, above the neutral 50 level, indicating bullish momentum is gaining traction. Moreover, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which remains intact and further supports the positive outlook.

However, if UNI corrects, it could extend the decline toward the next daily support at $4.77.