Bitcoin Price Forecast: BTC recovers to $87,000 as retail optimism offsets steady ETF outflows

- Bitcoin trades above $88,000 on Tuesday after failing to hold the $90,000 level on Monday.

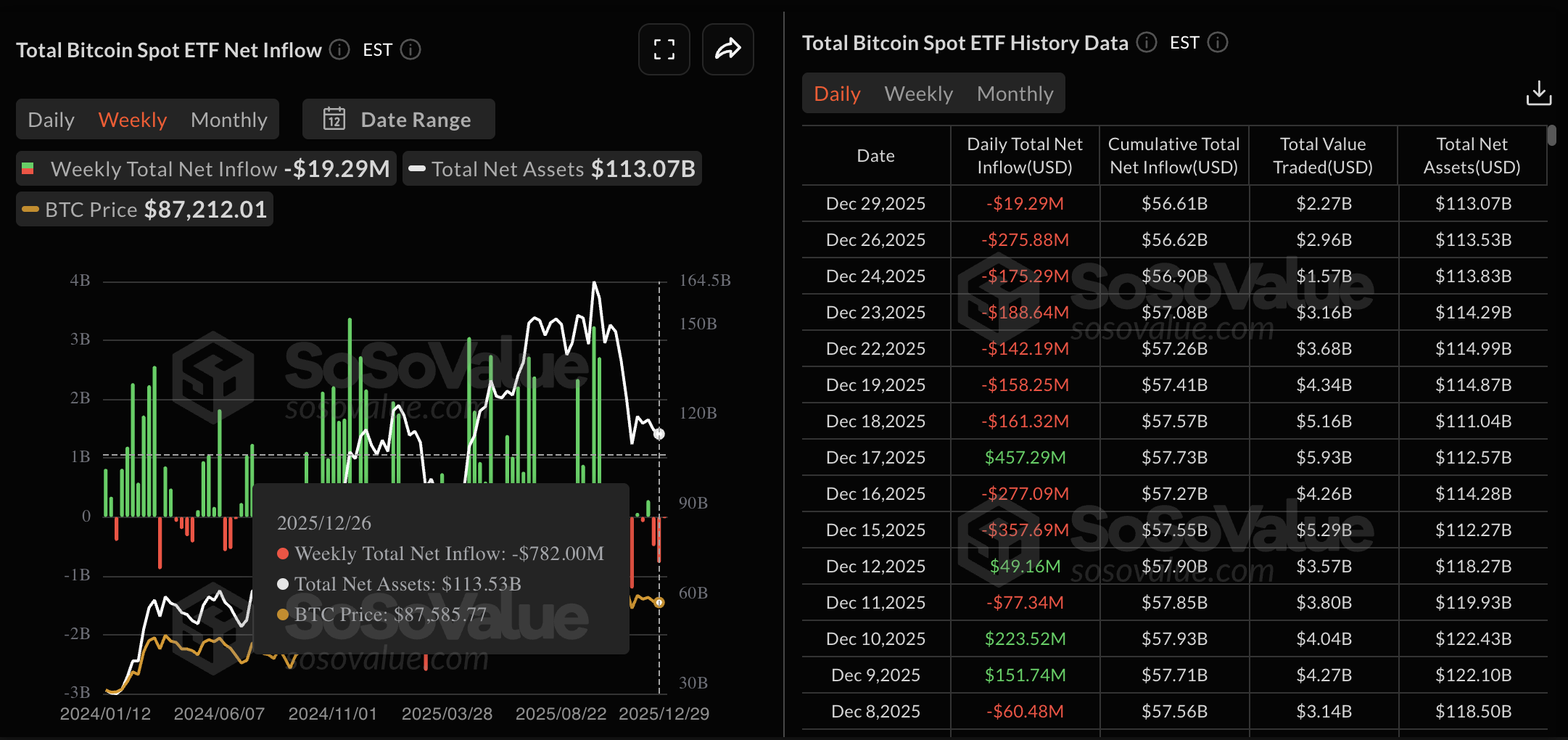

- US spot BTC ETFs recorded a daily outflow of $19.29 million on Monday, while retail traders anticipate a New Year rebound.

- Michael Saylor’s Strategy acquired more than 1,200 BTC last week, and Metaplanet bought 4,279 BTC in the previous three months.

Bitcoin (BTC) trades above $88,000 at press time on Tuesday, following a rejection at $90,000 the previous day. Institutional support remains mixed amid steady outflow from US spot BTC Exchange Traded Funds (ETFs) and Strategy Inc.’s acquisition of 1,229 BTC last week. Meanwhile, data shows that retail sentiment anticipates a New Year rebound.

Corporate and whale demand overshadow ETF outflows

Bitcoin’s institutional demand continues to decline, as evidenced by seven consecutive days of outflows from US spot BTC ETFs. Data shows $19.29 million of net outflow on Monday, adding to the $782 million of total outflow recorded last week. If institutional demand for Bitcoin continues to decline, it could fuel the selling pressure.

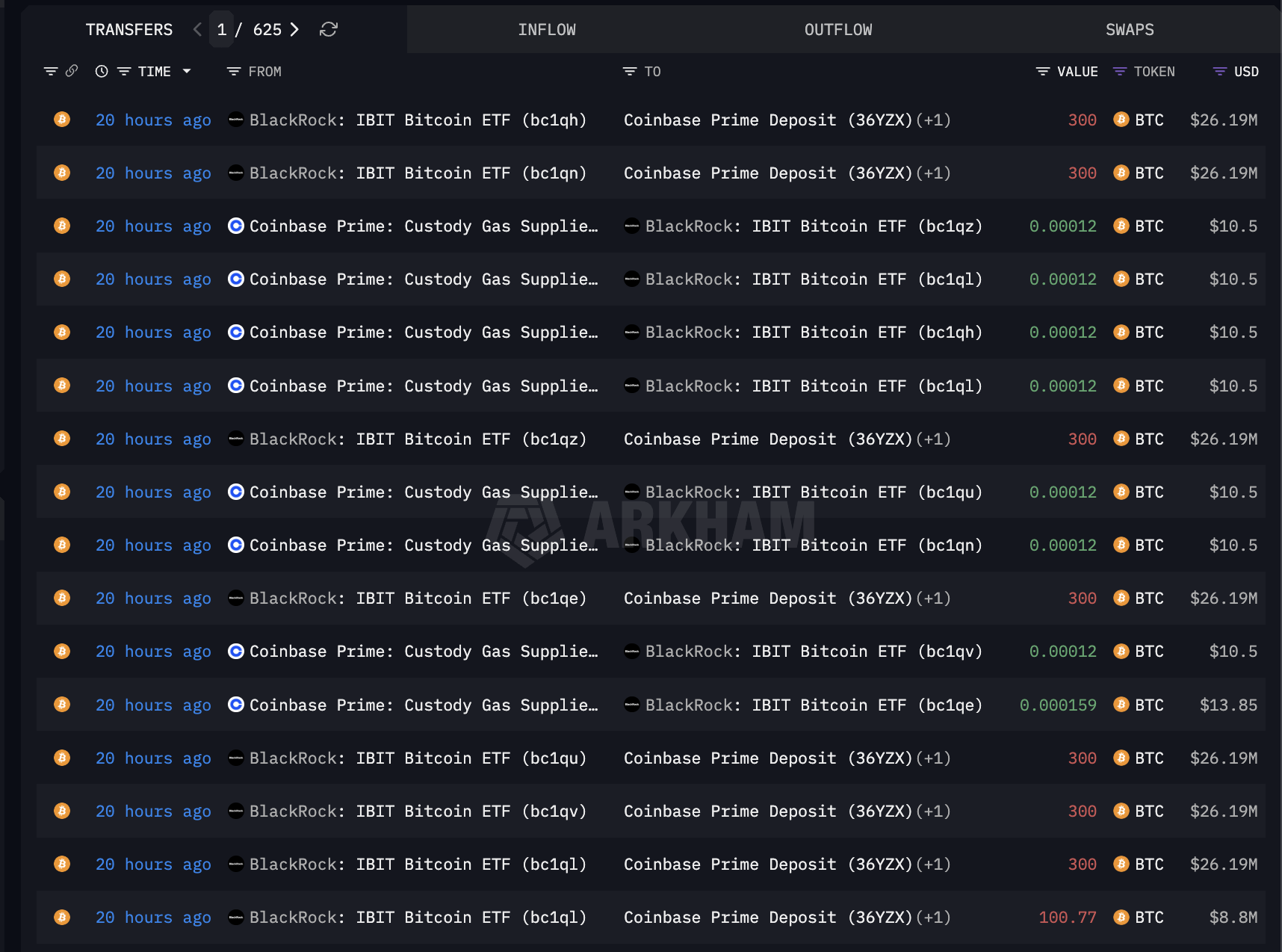

According to Arkham Intelligence, an on-chain analytics platform, BlackRock deposited over 2,200 BTC on Coinbase Prime. This trimming of the portfolio by the largest BTC ETF provider, based on assets under management (AUM), reflects a loss of confidence and could also add to selling pressure.

On the corporate side, Michael Saylor’s Strategy Inc. acquired 1,229 BTC last week, bringing total holdings to 672,497 BTC at an average price of $74,997. Additionally, Metaplanet purchased 4,279 BTC during the previous three months and currently holds 35,102 BTC at an average price of $104,679. This broadly steady corporate confidence in Bitcoin reflects a stance to buy the dip.

On a more bullish note, large wallet investors, commonly known as whales, are withdrawing Bitcoin from exchanges, suggesting fresh demand. According to Lookonchain, two newly created wallets have withdrawn 2,201 BTC from Binance, potentially betting on a New Year rebound.

Could retail optimism spark a rebound?

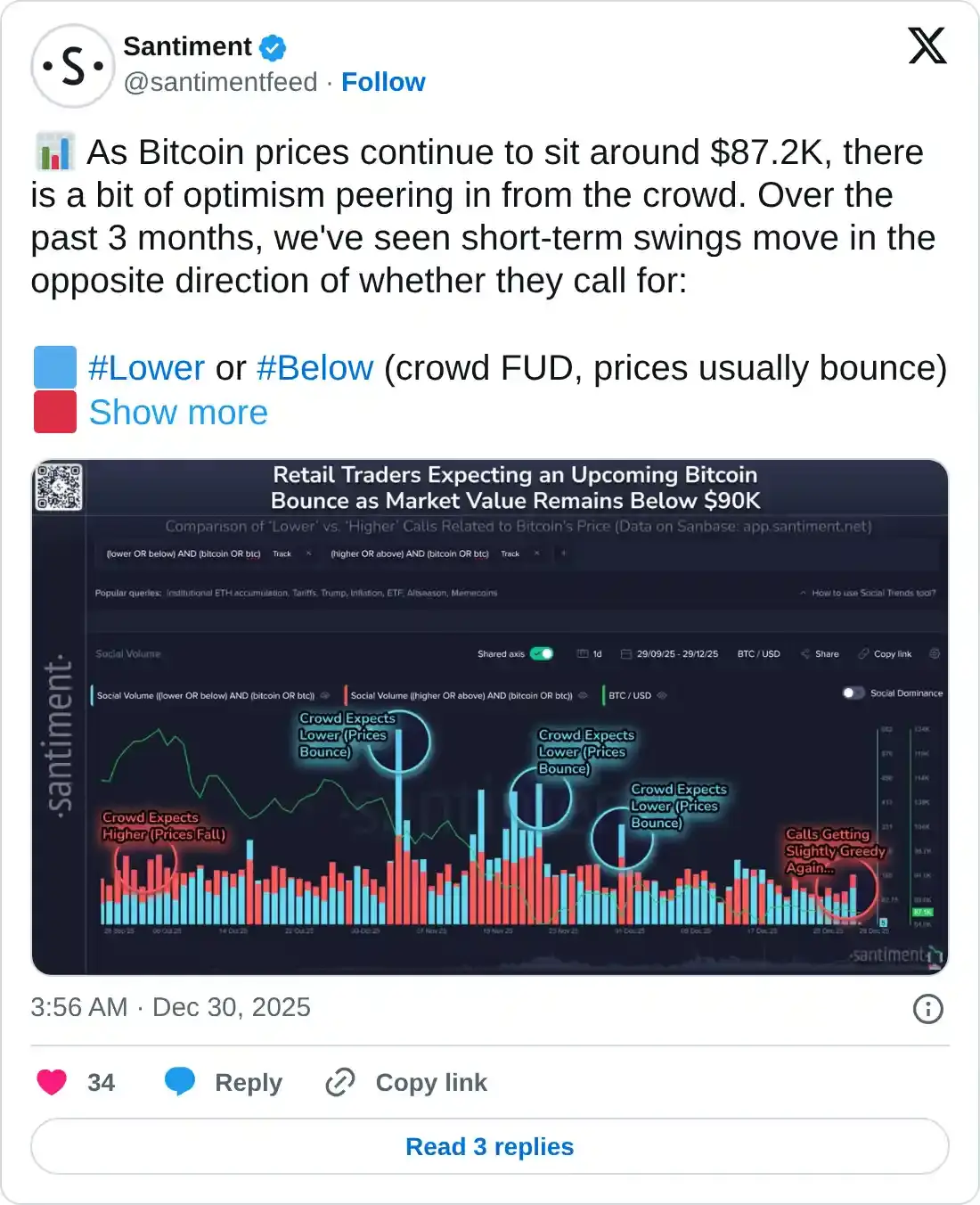

Santiment data shows that retail sentiment anticipates a Bitcoin rebound, which is typically seen near the New Year. However, the data also suggests that over the last three months, short-term BTC price swings occur in the opposite direction of retail calls. If this pattern continues, Bitcoin could record lower legs in the New Year.

Bitcoin Price Forecast: BTC risks testing support trendline near $85,000

Bitcoin failed to surpass $90,000 on Monday, triggering a nearly 1% pullback. At the time of writing, BTC is recovering above $88,000, extending a short-term sideways trend amid indecisive market sentiment.

To reinstate a bullish trend, BTC should secure a daily close above $90,588, aligning with the December 22 high. If this level is reached, the uptrend could target the 50-day Exponential Moving Average (EMA) at $91,924, followed by the November 14 low at $94,012.

The technical indicators on the daily chart remain broadly neutral. The Relative Strength Index (RSI) at 44 hovers below the halfway line. If RSI remains below this line, it would indicate persistent selling pressure, with room on the downside suggesting bearish potential.

However, the Moving Average Convergence Divergence (MACD) and the signal line continue to trend upward, targeting the zero line. Still, the close moving average lines risk a potential crossover, which would trigger renewed bearish momentum.

If BTC extends its correction, it could test the local support trendline connecting the November 22 and December 1 lows, near $85,000.