Privacy coins Starknet, Zcash defy market decline, record double-digit gains

- Starknet has risen 20% on Wednesday, stretching its gains to over 120% in the past two weeks.

- The Layer 2 protocol has tapped the privacy trend, growing its TVL while other L2s record outflows.

- Zcash resumed its rally, gaining 10% amid risk-off market sentiment.

Starknet (STRK) and Zcash (ZEC) jumped 20% and 10%, respectively, on Wednesday as market confidence in the privacy trend shows signs of returning.

Starknet ecosystem gains strength, eyes $0.32

Starknet returned to the limelight on Wednesday, racking up gains of over 20% over the past 24 hours and extending its two-week performance to 120%. The token has broken into the top 100 cryptocurrencies category, resuming its rally after a brief pause on Monday.

The zero-knowledge-based Ethereum L2 has tapped into the privacy trend, growing its total value locked (TVL) by $200 million in the past month. During the same period, the top L2s, including Arbitrum, Base, and Linea, have shed $1.08 billion, $650 million and $625 million, respectively.

Another key factor driving Starknet's TVL growth is the growing popularity of its Bitcoin staking feature, which allows investors to earn rewards by staking wrapped BTC tokens.

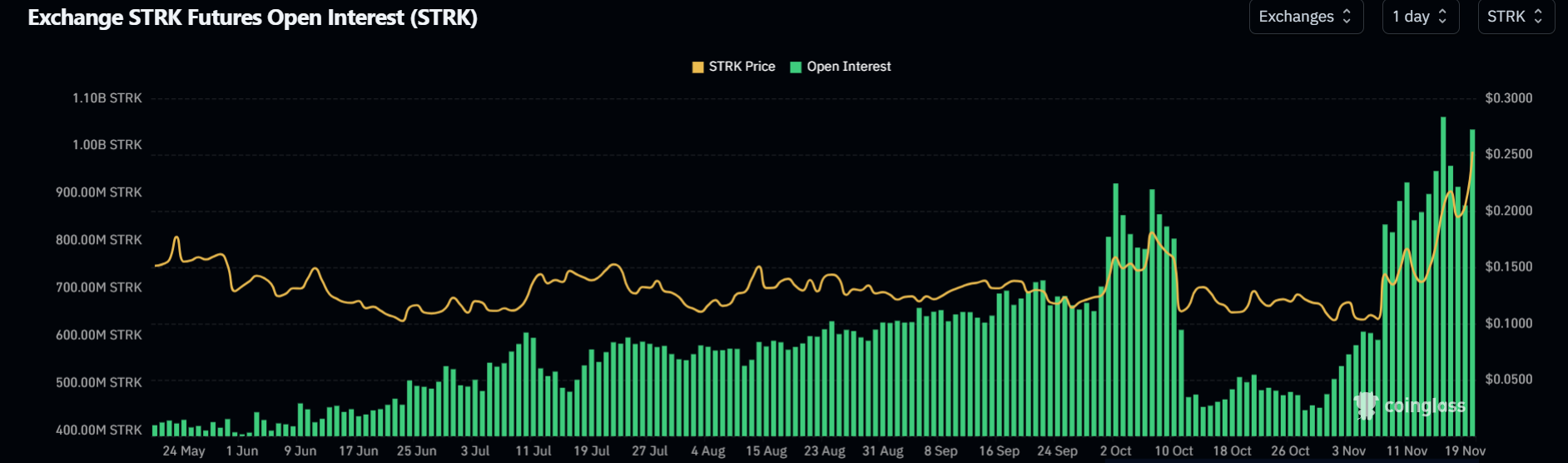

On the derivatives side, STRK's open interest has surged by over 100% to 1.04 billion STRK since the beginning of November, per Coinglass data. However, its funding rate remains conservative at 0.006%, indicating traders may be betting on a pause after a strong rally in the past few weeks.

After bouncing near its 200-day Exponential Moving Average (EMA), STRK has risen above the hurdle at $0.218 and is testing the $0.246 resistance.

If it holds the rise above $0.246, STRK could stretch its rally to $0.325. Its Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in overbought territory, signaling a dominant bullish momentum. However, sustained overbought conditions in the RSI and Stoch may lead to a short-term pullback.

Zcash could rally to $862 if it establishes a firm move above $700

Zcash's open interest has declined by 20% from its November 15 high of 2.11 million ZEC.

The privacy coin's funding rates have continued to flash negative over the past month despite its strong performance. This indicates that ZEC's price has largely been driven by momentum from traders on the spot market.

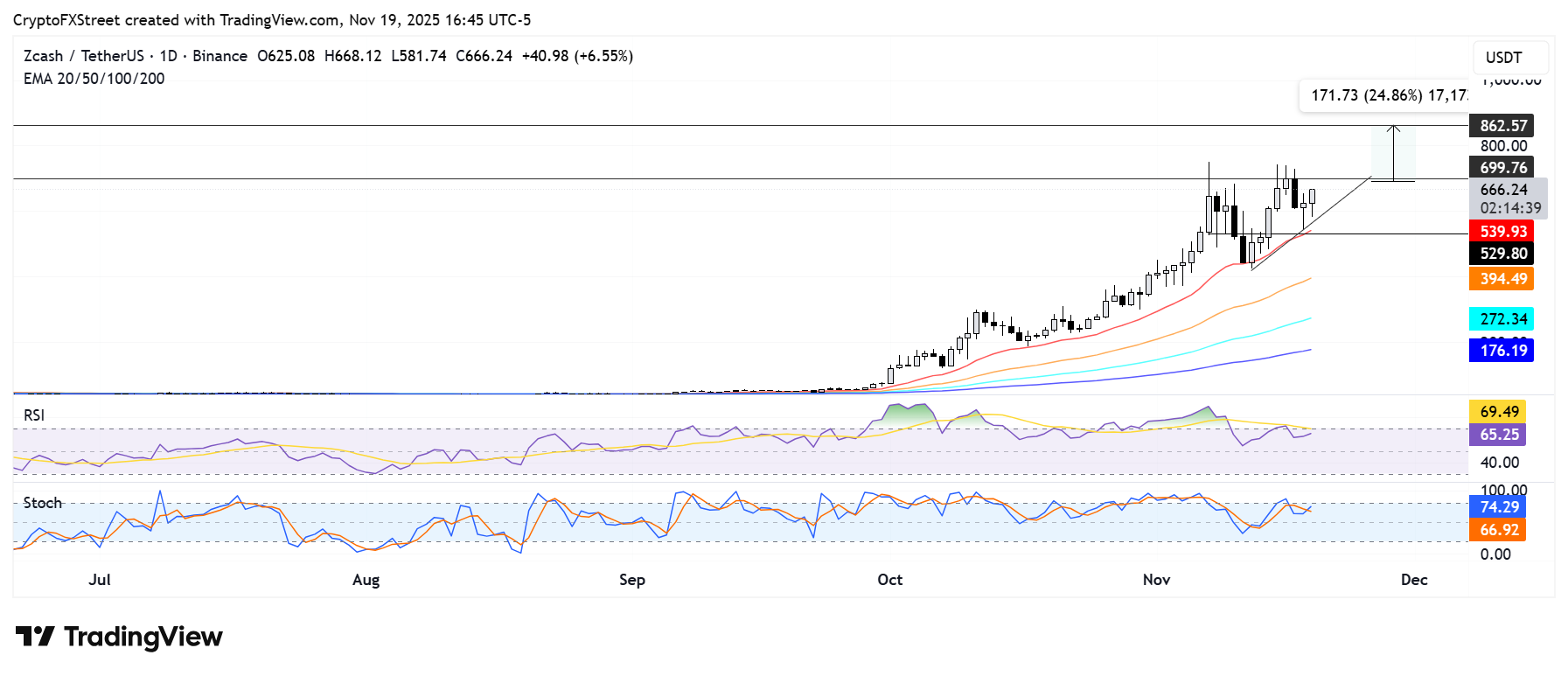

Zcash could extend its rise to the $700 resistance after bouncing off the 20-day EMA, which is just above the $529 support level.

A firm rise above $700 could push ZEC to $862, a level obtained by measuring the height of the rectangular channel and projecting it upward.

On the downside, ZEC could find support at the 20-day EMA, which has served as a key support level since the beginning of October.

ZEC's Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating a dominant bullish momentum.