Bitcoin Price Forecast: BTC tests key resistance as momentum improves, ETF inflows return

- Bitcoin price tests a key resistance level at $106,455 on Tuesday, a decisive close above could pave the way for further gains.

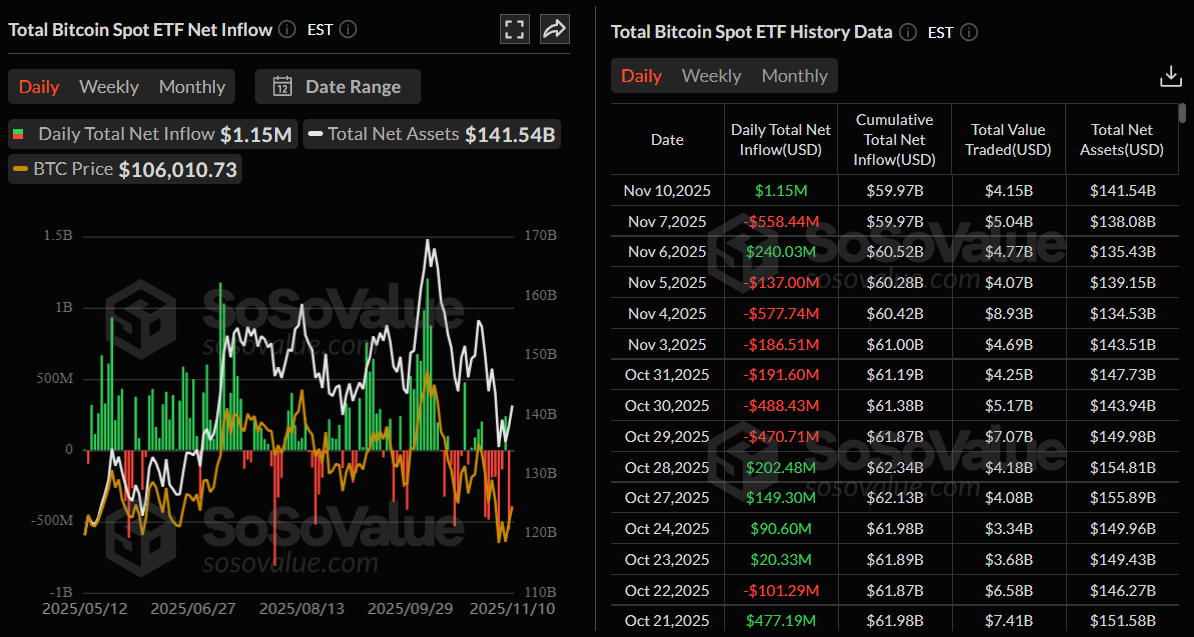

- US-listed spot Bitcoin ETFs recorded a mild inflow of $1.15 million to start the week, ending the recent streak of outflows.

- Market sentiment turns cautiously optimistic, with improving momentum, stabilizing capital flows, and signs of a potential local bottom forming around the $100,000 zone.

Bitcoin (BTC) price edges slightly lower and holds around $105,000 at the time of writing on Tuesday after testing a key resistance level. A decisive close above this crucial resistance could pave the way for further gains for the largest cryptocurrency by market capitalization. On the institutional front, a modest $1.15 million inflow into US-listed spot Bitcoin Exchange Traded Funds (ETFs) on Monday marks a positive shift after a week of heavy outflows, which could further support BTC’s recovery.

Institutional demand records mild inflows

Institutional demand for Bitcoin shows a reduction in selling pressure. According to SoSoValue data, US-listed spot Bitcoin ETFs recorded a modest inflow of $1.15 million on Monday, ending the recent streak of withdrawals totaling $1.22 billion the previous week. If this trend of inflows intensifies, it could provide the momentum needed for Bitcoin to extend its ongoing price recovery.

Some signs of optimism

Glassnode’s report on Monday highlighted that Bitcoin’s price action is beginning to stabilize, showing signs of a potential local bottom forming around the $100,000 support level.

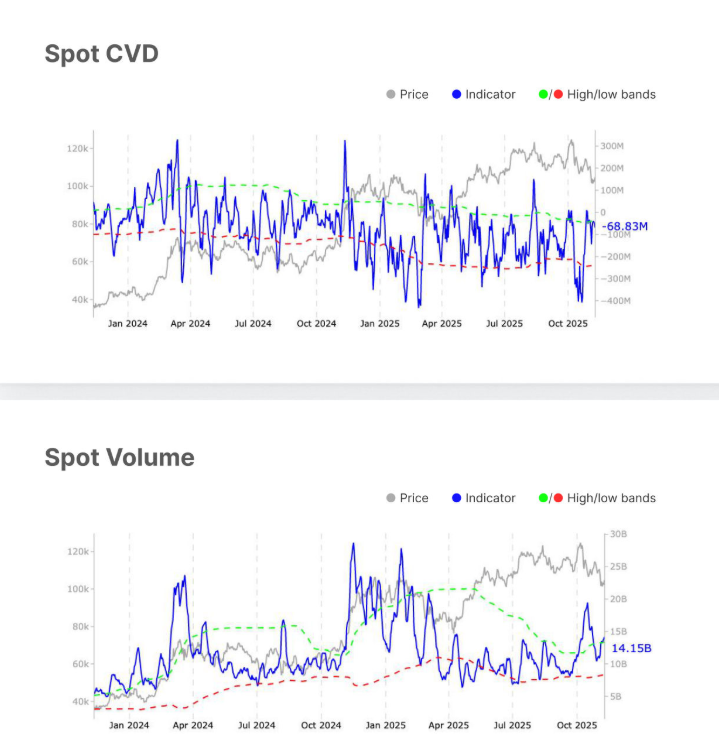

The report explained that the recovery toward $106,000 suggests early signs of buyer re-engagement, with spot trading volume surging from $11.5 billion last week to $14.1 billion on Monday, signaling strong investor participation and heightened liquidity. This aligns with a mild improvement in the cumulative volume delta, indicating a reduction in seller aggression, as shown in the chart below.

"Market conditions remain cautious yet constructive, with improving momentum, stabilizing flows, and signs of a potential local bottom forming around $100,000. This range between $100,000 and $108,000 could mark a mid-term base of support, though the broader macro downtrend in profitability continues to anchor sentiment and limit upside conviction,” concluded Glassnode’s analyst.

Bitcoin Price Forecast: BTC could extend recovery if it closes above $106,500

Bitcoin price found support around the 50% Fibonacci retracement level, drawn from the April 7 low of $74,508 to the all-time high of $126,299 set on October 6, at $100,353 on November 4, and held firm over the following four days. From Sunday to Monday, BTC rebounded by more than 3%, climbing toward a key resistance at $106,453, the 38.2% Fibonacci retracement. At the time of writing on Tuesday, it is facing slight rejection, still holding above the $105,000 mark.

If BTC closes above the 38.2% Fibonacci retracement at $106,453 on a daily basis, it could extend the recovery toward the 50-day Exponential Moving Average (EMA) at $110,041.

The Relative Strength Index (RSI) reads 44 on the daily chart, approaching the neutral 50 level and suggesting fading bearish momentum. For the recovery rally to be sustained, the RSI must move above the neutral level. Additionally, the Moving Average Convergence Divergence (MACD) lines are converging, with decreasing red histogram bars below the neutral leveland suggesting an impending bullish crossover.

On the other hand, if BTC faces a correction from $106,453, it could extend the decline toward the key support at $100,353.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.