NEAR Protocol Price Forecast: NEAR steadies despite OceanPal’s $120 million SovereignAI deal boosts outlook

- NEAR Protocol price hovers around $2.24 on Wednesday after being rejected around a key resistance zone earlier this week.

- OceanPal Inc. announced a $120 million PIPE deal to launch SovereignAI, a subsidiary focused on commercializing Near Protocol and building AI infrastructure.

- SovereignAI plans to implement a crypto treasury strategy, aiming to acquire up to 10% of the NEAR token supply, signaling strong institutional confidence in the ecosystem.

NEAR Protocol (NEAR) price steadies around $2.24 at the time of writing on Wednesday, after being rejected around a key resistance zone earlier this week. OceanPal Inc.(OP) announced on Tuesday a $120 million deal to launch SovereignAI, a subsidiary dedicated to building AI infrastructure and commercializing the NEAR Protocol. With plans to implement a crypto treasury strategy and acquire up to 10% of the NEAR token supply, the development underscores growing institutional confidence in NEAR’s long-term potential.

Growing institutional confidence in Near protocol

OceanPal announced on Tuesday the closing of a $120 million private investment in public equity transaction for the purchase and sale of common stock and/or pre-funded warrants to purchase shares of common stock.

The firm intends to use the net proceeds of the transaction to implement a digital asset treasury strategy through its new wholly owned subsidiary, SovereignAI Services LLC (SovereignAI), focused on commercializing the NEAR Protocol, a blockchain platform architected for Artificial Intelligence use cases.

SovereignAI will implement a crypto treasury strategy, with plans to acquire up to 10% of the NEAR token supply. The move, developed in partnership with the Near Foundation, makes OceanPal a public vehicle for exposure to the crypto protocol’s native token.

“We believe NEAR presents the greatest asymmetric upside across mature projects in the digital asset market, which we aim to capture and offer to our shareholders,” said OceanPal’s newly appointed Co-CEO, Sal Ternullo.

Ternullo continued, “This is a public company launching as an active, strategic partner with the NEAR Foundation to advance a shared vision of universal AI sovereignty by leveraging the NEAR Protocol’s vertically integrated AI products and rails, which were purpose-built for these exact use cases.”

Despite the announcement, NEAR price dipped 4.02% on Tuesday and is hovering around $2.24 at the time of writing on Wednesday. However, the development is projected as bullish for NEAR Protocol in the long term, as it highlights growing institutional involvement and confidence in the project’s underlying technology and ecosystem expansion.

NEAR’s on-chain data support a bullish bias

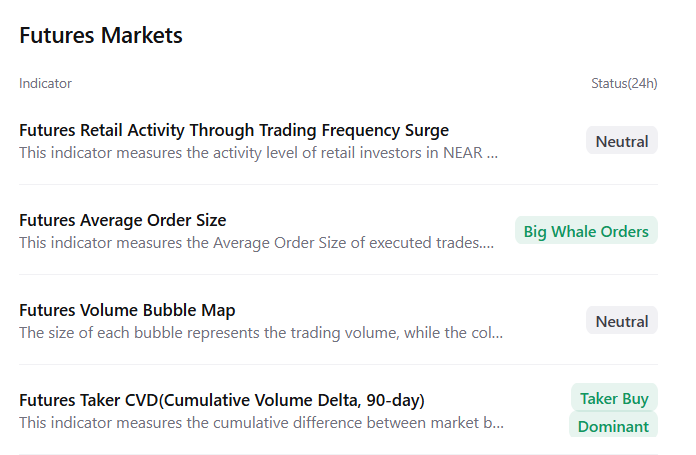

CryptoQuant’s futures market summary data for NEAR Protocol showed a bullish outlook, with large whale orders and buy dominance, signaling a potential rally ahead.

NEAR Protocol Price Forecast: NEAR faces rejection around a key level

NEAR Protocol’s price was rejected at the weekly resistance level of $2.35 on Monday and declined nearly 6% the next day. This weekly level roughly coincides with the 50-day Exponential Moving Average (EMA) at $2.51 and the 50% retracement level at $2.48 (drawn from the September 19 high of $3.34 to the October 10 low of $1.55), making this a key resistance zone. At the time of writing on Wednesday, NEAR hovers at around $2.24.

If NEAR breaks and closes above $2.51 on the daily basis, it could extend the rally toward the September 19 high at $3.34.

The Relative Strength Index (RSI) on the daily chart is 41, near the neutral 50 level, suggesting fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. However, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which still holds, supporting the bullish thesis.

NEAR/USDT daily chart

On the other hand, if NEAR continues its correction, it could extend the decline toward the daily support at $1.90.