Ripple Price Forecast: XRP downside risks persist despite Ripple’s expansion in Bahrain

- XRP remains in bearish hands as prices across the crypto market drop amid profit-taking and risk-averse sentiment.

- Ripple expands its presence in the Middle East with a strategic partnership with Bahrain Fintech Bay.

- The collaboration, which builds on Ripple’s Dubai regulatory license, contributes to Bahrain’s digital assets ecosystem.

Ripple (XRP) trades amid increasing overhead pressure on Thursday, reflecting risk-off sentiment and increasing profit-taking activities in the wider cryptocurrency market. At the time of writing, XRP trades at $2.79, down 3% for the day.

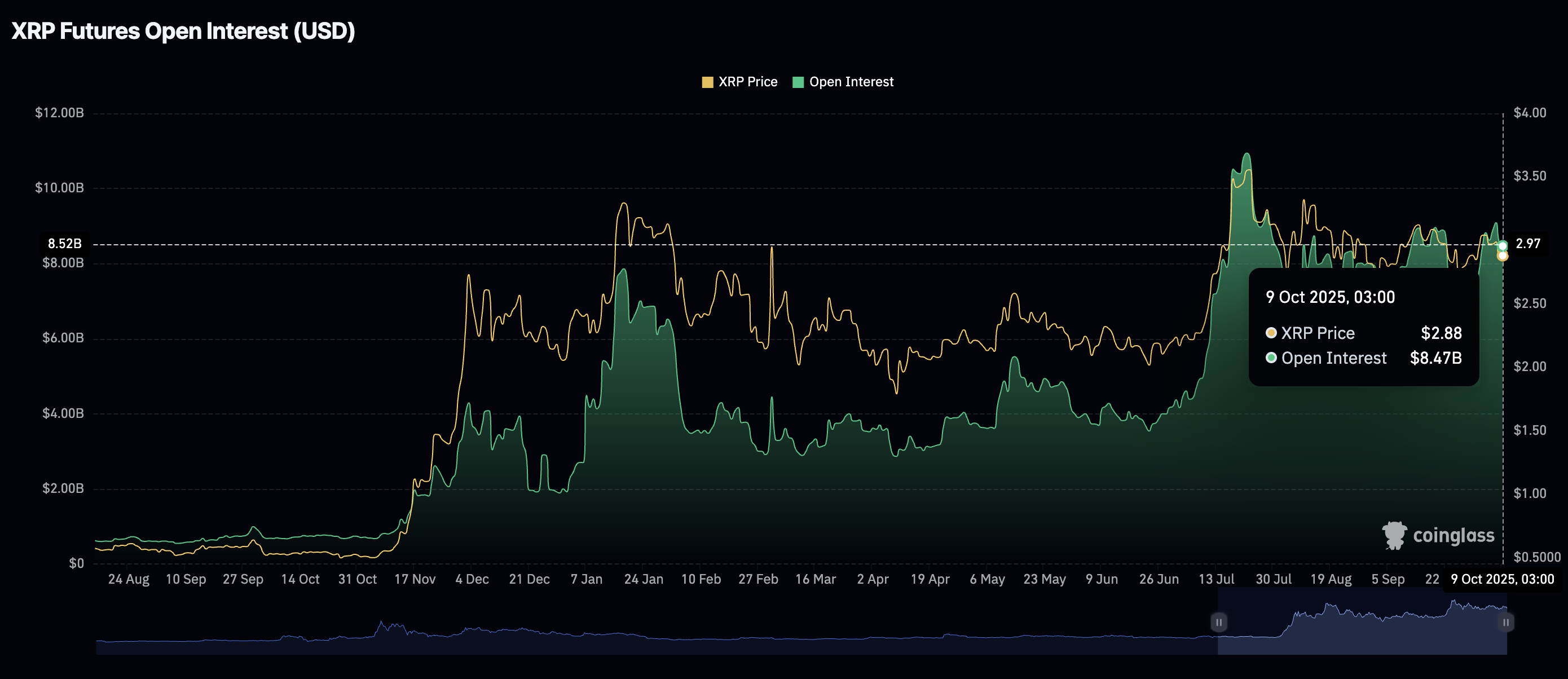

Retail interest in the cross-border money remittance token has also fallen for two consecutive days, according to the futures Open Interest (OI), which averages $8.47 billion compared to $9.09 billion on Monday.

OI is the notional value of outstanding futures contracts. Hence, a correction implies that traders could be losing confidence and conviction in XRP’s ability to sustain recovery above the pivotal $3.00 level. A steady decline in the OI often signals the potential for an extended price correction.

XRP Futures Open Interest | Source: CoinGlass

Ripple and Bahrain Fintech Bay collaborate to grow digital ecosystem

Ripple has entered into a strategic partnership with the Bahrain Fintech Bay (BFB), expanding its presence in the Middle East region. BFB is a leading fintech incubator and ecosystem builder known for partnering with the kingdom’s government agencies to accelerate digital ecosystem transformation, adoption of blockchain technology and digital assets.

The partnership with Ripple will advance Bahrain’s digital asset ecosystem through several verticals, including the development of proofs-of-concept (PoC), showcasing of blockchain-based solutions in key sectors such as cross-border payments, digital assets, stablecoins and tokenisation.

“This partnership with Ripple reflects Bahrain FinTech Bay’s commitment to bridging global innovators with the local ecosystem, creating opportunities for pilots, talent development, and cutting-edge solutions that will shape the future of finance,” Suzy Al Zeerah, the CFO at Bahrain Fintech Bay, stated.

Ripple’s collaboration with Bahrain Fintech Bay builds on its license from the Dubai Financial Services Authority (DFSA), which was granted earlier this year.

Ripple’s expansion drive to different global regions lays the foundation for seamless cross-border payments, supported by blockchain-based innovation. Demand for XRP and the protocol’s native stablecoin, RLUSD, has the potential to increase over time.

Technical outlook: XRP risks accelerating decline

XRP drops below the 100-day Exponential Moving Average (EMA), currently at $2.85, indicating that bears have the upper hand. Backing the bearish sentiment is a downward-trending Relative Strength Index (RSI) at 41 on the daily chart.

Lower RSI readings toward oversold territory imply a stronger bearish environment, potentially leading to losses extending to test support at $2.70, previously tested in late September.

A recently confirmed sell signal from the Moving Average Convergence Divergence (MACD) on the same daily chart, reinforcing the bearish grip. If the blue MACD line remains below the red signal line, investors would be inclined to reduce risk exposure, in turn, contributing to selling pressure.

XRP/USDT daily chart

The 200-day EMA at $2.64 would serve as a tentative support level if declines accelerate below the demand area marked green on the daily chart at $2.70. Still, if traders buy the dip, a reversal could follow, eyeing a breakout above the descending trendline and the psychological resistance at $3.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.