Ripple Price Forecast: XRP defends bullish structure amid RLUSD integration with BlackRock's BUIDL

- XRP's rebound from the 100-day EMA could set the stage for gains above $3.00.

- Ripple partners with Securitize, enabling BlackRock's BUIDL and VanEck's holders to swap shares for RLUSD stablecoin.

- The collaboration lays the groundwork for Securitize's integration with the XRP Ledger, enabling utility expansion in the XRPL ecosystem.

Ripple (XRP) rises above $2.88 on Wednesday, reflecting a bullish wave across the wider cryptocurrency market, which has seen Bitcoin (BTC) also climb above the $113,000 level. The cross-border money remittance token holds above a key short-term support at $2.83, increasing the chances of extending its recovery above the critical $3.00 level.

Ripple and Securitize integrate BlackRock's BUIDL and VanEck's VBILL with RLUSD

Ripple has announced a strategic partnership with Securitize, a tokenization platform, aimed at developing a smart contract that would enable holders of BlackRock's BUIDL and VanEck's VBILL funds to exchange their shares for the RLUSD stablecoin seamlessly. The smart contract expands RLUSD's utility as an additional off-ramp for BUIDL and VBILL.

BUIDL is short for BlackRock's USD Institutional Digital Liquidity Fund, while VBILL is VanEck's tokenized treasury fund. Both of these funds are issued on public blockchains.

The integration would provide holders of BUIDL and VBILL with exposure to RLUSD, without sacrificing on-chain yield and a broader range of Decentralized Finance (DeFi) strategies; thus ensuring utility expansion, flexibility and interoperability.

"Making RLUSD available as an exchange option for tokenized funds is a natural next step as we continue to bridge traditional finance and crypto," Jack McDonald, SVP of stablecoins at Ripple, stated.

Additionally, Securitize is expected to integrate its tokenisation infrastructure with the XRP Ledger (XRPL) to boost utility in the XRPL ecosystem.

"Partnering with Ripple to integrate RLUSD into our tokenization infrastructure is a major step forward in automating liquidity for tokenized assets," Carlos Domingo, the co-founder and CEO of Securitize, said.

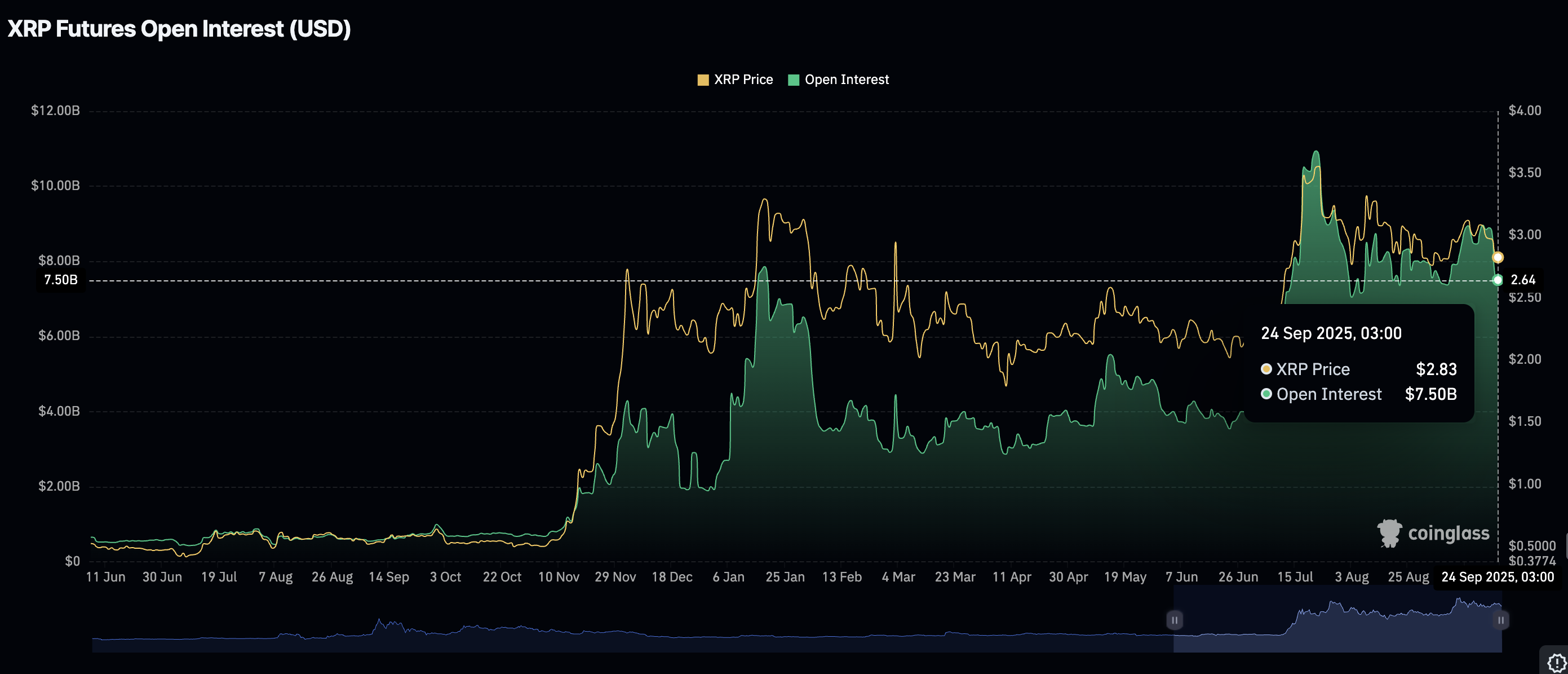

Meanwhile, retail interest in XRP has declined over the past few days, with the futures Open Interest (OI) dropping to $7.50 billion from $8.79 billion on Friday.

The drop in OI, which represents the notional value of outstanding futures contracts, indicates a lack of conviction in XRP sustaining an uptrend in the short term. If retail demand remains subdued in the coming days, bulls may struggle to sustain the uptrend, targeting highs above $3.00.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP bulls eye $3.00 breakout

XRP is extending recovery toward the $3.00 level after rebounding from support provided by the 100-day Exponential Moving Average (EMA) at $2.83. The Relative Strength Index (RSI), which has risen to 44, backs XRP's short-term bullish structure.

Key areas of interest for traders include the 50-day EMA, which marks a near-term resistance level at $2.94, and a descending trendline that has remained in place since XRP hit a new record high of $3.66 on July 18. Trading above this trendline could enhance XRP's recovery potential toward the next key hurdle, highlighted in red on the daily chart, at approximately $3.38.

XRP/USDT daily chart

Still, traders should temper their bullish expectations, considering the Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since Monday.

Suppose the blue MACD line remains below the red signal line; it will indicate persistent risk-off sentiment, which could trigger declines below the 100-day EMA support at $2.83, potentially leading to a drop toward the 200-day EMA at $2.59.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.