Solana Price Forecast: SOL steadies as adoption strengthens with USDG growth and Nasdaq listing

- Solana price steadies around $207 on Monday after recovering nearly 3% in the previous week.

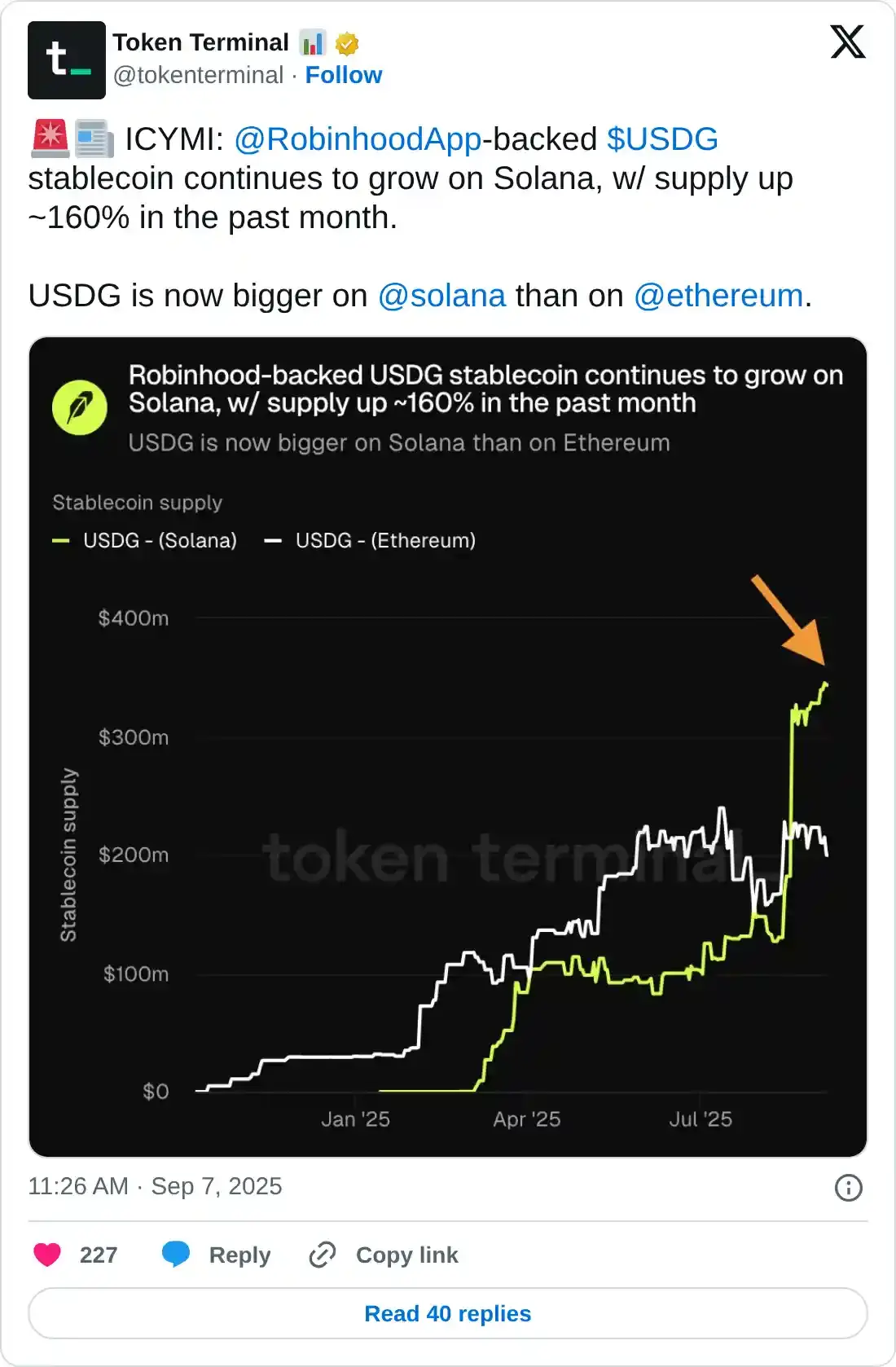

- Robinhood-backed USDG stablecoin supply on Solana has surged nearly 160% over the past month, overtaking Ethereum.

- SOL Strategies is set to become the first Solana treasury company listed on Nasdaq starting Tuesday.

Solana (SOL) price remains above $207 at the time of writing on Monday, having recovered nearly 3% last week. Robinhood-backed USDG stablecoin has seen its supply on Solana surge nearly 160% over the past month, overtaking Ethereum (ETH) and highlighting the growing adoption of the SOL network. Moreover, SOL Strategies Inc. is preparing to debut as the first Solana treasury company listed on Nasdaq, starting on Tuesday, underscoring the network’s expanding footprint.

Solana’s growing adoption and development

SOL Strategies Inc., a publicly traded Canadian company dedicated to investing in and providing infrastructure for the Solana blockchain ecosystem, announced on Friday that it has received approval to list its common shares on the Nasdaq Global Select Market.

The firm expects its common shares to begin trading on Nasdaq under the symbol “STKE” on Tuesday, as stated in its press release.

“This listing provides our shareholders with enhanced liquidity while giving us access to deeper capital markets as we continue scaling our validator operations and expanding our ecosystem investments,” said Leah Wald, Chief Executive Officer of SOL Strategies.

This listing marks a significant milestone as it becomes the first Solana treasury company to be listed on Nasdaq, which could be bullish for Solana’s native token, SOL, as it suggests growing institutional confidence and wider acceptance.

However, the announcement has yet to spark a sharp rally in SOL, which continues to hover near $207 as of Monday. Traders should watch the upcoming Nasdaq listing, as it could inject fresh liquidity into the market and increase the probability of a price upswing.

On the other hand, Token Terminal posted on its X account on Sunday that the Robinhood-backed USDG stablecoin continues to grow on the Solana blockchain, with its supply up ~160% in the past month, highlighting growing user activity and stablecoin demand, which bodes well with the Solana price. Moreover, Solana surpasses the USDG supply on the Ethereum blockchain, positioning itself as a competitive settlement layer for stablecoins.

Colosseum’s Venture Capital (VC) announced on Sunday that the fund is allocating over $2.5 million in pre-seed capital to the winners of the Solana Cypherpunk Hackathon, aiming to accelerate innovation and early-stage development within the Solana ecosystem.

Solana Price Forecast: SOL bulls target $230 mark

Solana price was rejected from the upper trendline of a parallel channel (drawn by joining multiple highs and lows since mid-April) on August 29 and declined by 8% over the next four days. However, it found support around the 50% Fibonacci retracement at $195.55 (drawn from the record high of $295.83 in January to the April low of $95.26) last week and recovered nearly 3%. At the time of writing on Monday, it continues to trade higher above $207.

If SOL continues its upward momentum, it could extend the rally toward its daily resistance at $230.

The Relative Strength Index (RSI) on the daily chart reads 56, which is above its neutral level of 50, indicating that bulls still have room for upward momentum. The Moving Average Convergence Divergence (MACD) shows decreasing red histogram bars below its neutral level, suggesting fading bearish momentum.

SOL/USDT daily chart

However, if SOL faces a correction, it could extend the decline toward the 50% Fibonacci retracement level at $195.55.